India is gearing up to become a global defence powerhouse. From once being the world’s second-largest importer of arms, it is now focusing on becoming a leading exporter and manufacturer. According to a report by Nuvama Institutional Equities, India is targeting a defence production value of Rs 3 lakh crore by FY29, a sharp rise from Rs 1.3 lakh crore in FY24. Defence exports are also projected to more than double, reaching Rs 50,000 crore by the same period.

Nomura sees massive opportunity ahead

Nuvama estimates that India’s defence sector could unlock a Rs 10.8 lakh crore opportunity over the next five years, with the Air Force and Navy expected to be key drivers of demand. Major projects include the Light Combat Aircraft (LCA) Mark 1A and 2, Advanced Medium Combat Aircraft (AMCA), and submarines under Project 75-I. These projects make up a big portion of the Defence Public Sector Units’ (DPSUs) total project pipeline, which is worth around Rs 8.7 lakh crore.

Higher defence spending, but GDP share dips

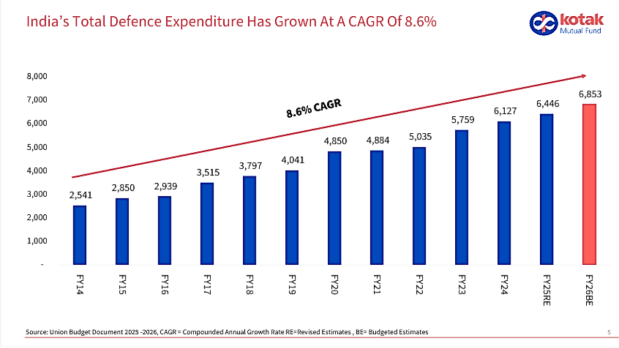

In pursuit of self-reliance in military manufacturing, India has also increased its defence spending. According to a reportby Kotak Institutional Equities, India was the 5th largest defence spender in 2024 from being the 9th largest in 2000.

India’s total defence expenditure has grown at a compounded annual rate (CAGR) of 8.6 per cent over the last decade. The Indian government has allocated over Rs 6.8 lakh crore for defence this financial year, with capital expenditure expected to reach Rs 1.9 lakh crore. This marks a significant increase from Rs 80,200 crore in FY14.

However, contrary to the growth, India’s defence budget as a share of GDP has seen a steady decline. The defence budget as a share of GDP was around 2.3 per cent in FY17; it peaked at approximately 2.45 per cent in FY21. However, it has since then dropped sharply to just over 2.1 per cent in FY22 and is projected to decline further to 1.9 per cent by FY26, according to Budget Estimates. Analysts argue that there is an urgent need to accelerate spending to meet modern military demands.

India produces defence equipment worth Rs 1 trillion in FY24

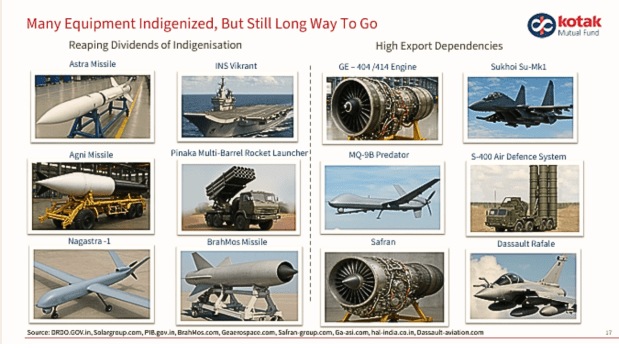

The Kotak Institutional Equities report also highlights India’s progress toward Atmanirbhar Bharat in the defence sector. According to data from the Stockholm International Peace Research Institute (SIPRI), India was the world’s largest arms importer in 2010, accounting for 11 per cent of global imports. By 2024, it had dropped to fourth position, with a reduced share of 4 per cent.

As per the report, the government has banned the import of 209 defence items and identified over 2,000 components for domestic production within set timelines to encourage local manufacturing. As a result, state-run companies produced equipment worth Rs 1 trillion in FY24 alone, and defence exports have also surged. Exports have grown 30 times since 2015, with the private sector contributing nearly 65 per cent.

Defence manufacturing: Private sector leads the charge

Nuvama projects private defence firms to grow their earnings by 25 – 40 per cent, outpacing Defence Public Sector Units (DPSUs). However, Bharat Electronics (BEL) and Hindustan Aeronautics (HAL) are also expected to grow at 15 to 18 per cent, driven by joint ventures and technology partnerships with foreign firms, helping to resolve supply bottlenecks and expand local production.

Private defence firm Data Patterns and DPSU Bharat Electronics are Nuvama’s top picks for their strong R\&D and execution capabilities.

Export potential rises as Europe boosts defence budgets

India’s export potential is rising as European countries rush to rebuild their defence capabilities. NATO nations are expected to spend EUR 800 billion over the next three to four years, especially as US support wanes under the Trump administration. With Europe’s defence manufacturing seen as weak and slow, Indian companies have an opportunity to step in and supply critical components and systems. Nuvama reports that India’s defence exports have already grown 30 times since 2015, with private firms contributing up to 65 per cent.

‘Make in India’ gains momentum

India has reduced its dependence on imports from 70 per cent to 35–40 per cent, highlighting progress towards Atmanirbhar Bharat. Experts highlighted four key factors driving this change: import restrictions, rising exports, fleet modernisation, and homegrown R\&D.

Government initiatives such as allowing 74 per cent FDI under the automatic route, establishing defence corridors in Uttar Pradesh and Tamil Nadu, and launching the iDEX programme to support startups are bolstering the sector.

Challenges remain, but outlook is optimistic

Despite the progress, challenges remain for the India defence sector. These include delays in aircraft delivery, supply chain constraints, and a shortage of skilled manpower. Nuvama warns that execution delays in key projects like the LCA Mk-IA and AMCA could hurt momentum.

Still, the outlook remains optimistic. “2025 is expected to be a turning point, with major orders likely to be placed,” the report by Nuvama notes.

Electronics, innovation, and startups driving the next phase

With an increasing focus on modern warfare, India is investing in high-tech platforms like drones, anti-drone systems, loitering munitions, and electronic warfare. The Defence Research and Development Organisation (DRDO) has boosted its share of the capital outlay for R\&D to over 8 per cent in FY26.

The defence electronics segment, including radar systems, communication technologies, and command platforms, is expected to grow at 1.5 to 2 times the pace of overall defence capital expenditure.

Experts say electronics now play a critical role in avionics, weapons systems, and command infrastructure, making it a key driver of future defence growth.

Defence IPOs signal investor confidence

The defence sector is entering a high-growth phase, and investors are showing strong confidence. Defence sector stocks have seen a significant rise over the past few months. The increase in IPOs by private defence companies is another clear sign of growing investor confidence.

Firms like Mazagon Dock, Paras Defence, and Azad Engineering are raising capital through IPOs and qualified institutional placements, using these funds to expand manufacturing and invest in R&D.

With a capital outlay of Rs 1.8 lakh crore planned for FY26, growing export demand, and robust government support, India’s defence sector is poised for rapid transformation.