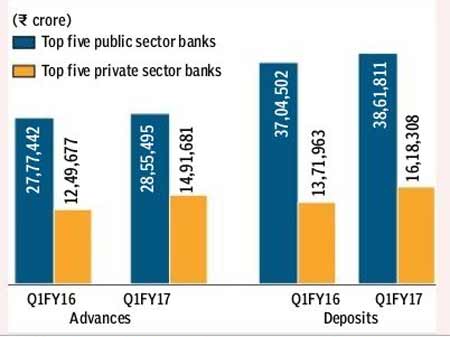

The growth in the loan books of a clutch of top five private sector banks outpaced the same for the top five public sector banks (PSBs) by over three times in the quarter ended June. The private sector players lent Rs 2.4 lakh crore in Q1FY17, taking their loan books to nearly Rs 15 lakh crore. On the other hand, state-owned banks lent just around Rs 80,000 crore in the reviewed quarter and their combined loans stood at Rs 28.6 lakh crore.

Analysts believe the private sector players will continue to outperform in the short to medium term. HSBC Global Research wrote recently that while PSBs continue to consolidate their loan books, private sector banks will continue to expand. “We expect a 5% loan growth for PSUs, compared with 21% growth for private banks, implying that incrementally, private banks will continue to gain significant loan market share,” HSBC Global said.

Karthik Srinivasan, senior vice-president of ICRA, believes that sluggish credit demand from corporates will ensure single-digit growth in the loan books of PSBs in FY17. “Given that the corporate book of PSBs is much bigger than their retail books, we expect their loan books to grow in single digit in the current fiscal year. On the other hand, a significantly higher proportion of retail loans will ensure a 14-16% growth in the loan books of private sector banks this year,” Srinivasan said.

While not putting out estimates, analysts at Kotak Institutional Equities are of the opinion that PSBs’ loan growth will continue to remain sluggish as long as the capital expenditure cycle in the country doesn’t turn. “Our study of private capex does not suggest an improvement in corporate loan growth as fresh capex is still elusive as the focus is on de-leveraging the balance sheet at this point in time. This implies weak revenue growth for the sector, especially public sector banks,” they observed.

At Bank of Baroda (BoB), the loan book contracted 11.2% Y-o-Y with deposits too coming off by 3.1% Y-o-Y. The bank’s top management attributed the contraction in its loan book to a conscious running down of certain assets, primarily in its international business, and the drop in deposits to running down of high-cost deposits, which it said also helped expand the net interest margin (NIM).

At the same time, the bank continues to be confident of achieving 8-10% growth in the loan book in FY17. “We have a reasonable pipeline. Additional requests are coming to us from the port sector. We expect to see growth in fertiliser. We are also getting a few transactions in the oil and natural gas segment. Renewable energy too continues to grow, along with the retail and SME segments,” PS Jayakumar, the bank’s MD & CEO, said at the post-results press conference.

YES Bank’s advances grew 33% Y-o-Y in the June quarter on a small base, while those at ICICI Bank grew at 12.4% Y-o-Y. HDFC Bank too added meaningfully to its loan book, but Kotak Mahindra Bank appeared to have been cautious, with loans under its business banking segment barely growing since last year.

The bank’s management, however, attributed the slowdown to integration issues arising out of its merger with ING Vysya Bank. “Now, both the banks as you know were on different technology pieces. Kotak bank was on Finacle which is Infosys, ING Vysya was on a system of FIS which is Profile. So, Profile moved into Finacle. That integration happened in the middle of May. So, it was for the first time during the June quarter that organisational integration and technology integration of the retail and SME pieces got completed,” Uday Kotak, Kotak Mahindra Bank’s executive vice-chairman & MD, said. Private lenders appear to be more confident than their public sector peers about the credit growth this year. ICICI Bank, for instance, has guided that its loan book will grow by 18% in FY17.

“As far as credit growth is concerned, we had said that we will continue to probably see a target of 18% for our domestic loan book, which will be mainly driven by growth in the retail segment,” Chanda Kochhar, MD & CEO, observed after the bank’s Q1 results.

State Bank of India, on the other hand, has guided for just a 12-13% growth in it loan book in FY17. “At the start of the year, I had said that loan growth will be 12-13% and I have not been anticipating more, chairman Arundhati Bhattacharya told FE last month.

Other PSBs appear to be cautious.At Bank of India, advances fell 5.4% Y-o-Y. Melwyn Rego, MD & CEO, expects the loan book to rise by just 6% in FY17. The bank’s Mission Star One initiative, which along with better NPA management and current accounts saving accounts deposits augmentation, is aimed at re-balancing the loan portfolio in favour of the retail segment, and it has already started showing results and should help meet the full-year loan growth target, Rego said.

At Canara Bank, advances shrank almost 1% Y-o-Y.

Meanwhile, the deposit growth at state-owned banks also lagged that of the top five private lenders by close to Rs 90,000 crore. The spread between the yield and the interest on deposits has shrunk.