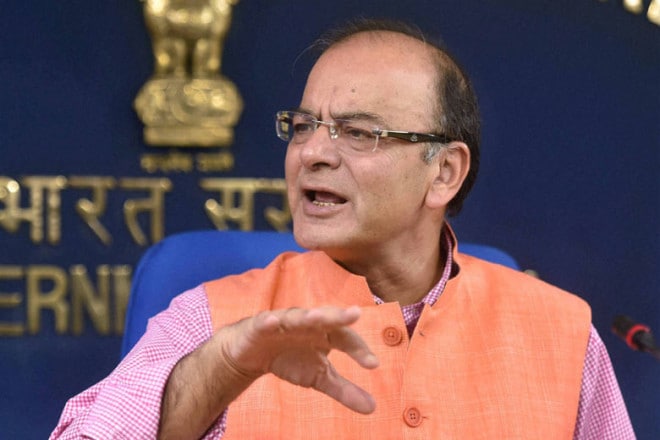

After reviewing the steps Public Sector Banks (PSBs) are taking to expedite the recovery of bad loans, Finance Minister Arun Jaitley acknowledged that there’s challenge to credit growth as well as the need for a speedy resolution for all pending NPA cases. Jaitley is reported to have discussed NPA resolution, finances of banks, review of financial inclusion with heads of public banks.

“There is a challenge with regard to credit growth. Already about 81 cases filed under Bankruptcy Code. Also, RBI is at advanced stage of preparing list of debtors where resolution required,” Jaitley said.

Jaitley met with the heads of Public Sector Banks (PSBs) today to discuss how to tackle the growing menace of NPAs. The rampant adverse effect of NPAs is evident from a fact disclosed by Jaitley himself, that the PSBs made stable operating profit of Rs 1.50 lakh crore in 2016-17, but only a paltry net profit of Rs 574 crore after provisioning for their NPAs.

Nifty PSU Bank index, which was under pressure since the beginning of trade today, slipped further after this meeting and recorded its biggest intraday percent loss of 1.72% since May 29, while the Nifty Bank index slipped as much as 0.82%. At 1:55 p.m., was down over 1.62% at 3,461.95 points with all the constituent scrips trading lower, while the Nifty Bank index was down 0.74% at 23,516.20 points.

Among public sector banks, Oriental Bank of Commerce was down over 4% at Rs 146.00, Union Bank of India was down over 3.6% at Rs 152.20, Canara Bank was down over 3.4% at Rs 348.15, Bank of Baroda was down 3.20% at Rs 168.15, Bank of India was down over 3% at Rs 138.95 and Punjab National Bank was down 2.7% at Rs 148.00.

You may also like to watch:

[jwplayer LLcNKlSO]

Today’s meeting was the first after last month’s promulgation of the ordinance amending the Banking Regulation Act, 1949, which gave RBI enhanced powers to deal with NPA by directing banks to start insolvency proceedings against defaulters.

Jaitley had said the ordinance empowered the Reserve Bank to issue “directions to any banking company or banking companies to initiate insolvency resolution process in respect of a default under the provisions of the Insolvency and Bankruptcy Code (IBC), 2016”, the report had added.

On the sensitive issue of farm loan waivers, Jaitley said that states offering such waivers ‘must generate funds from their own resources’, the report added. Jaitley’s comment comes after the Maharashtra government announced a total loan waiver for farmers in the state.

In RBI’s recent Monetary Policy Review, RBI Governor Urjit Patel had said that farm loan waiver is a path that needs to be tread carefully, while RBI’s policy statement said that farm loan waivers have raised the risk of fiscal slippages.

According to reports, the Maharashtra government will have to make provisions for Rs 1.14 lakh crore to waive off entire loan burden of all 1.36 crore farmers in the state. However, if the Maharashtra government decides to waive off the loan of marginal and small farmers only, then the burden it will have to bear would amount to Rs 30,000 crore only.