The Reserve Bank of India cut the repo rate by 25 basis points on Friday. Coupled with the recent tax rate cuts announced in the Union Budget 2025, this move provides a dual advantage for salaried individuals and the middle class, helping them combat inflation and boost household savings.

Impact on Home Loan Borrowers

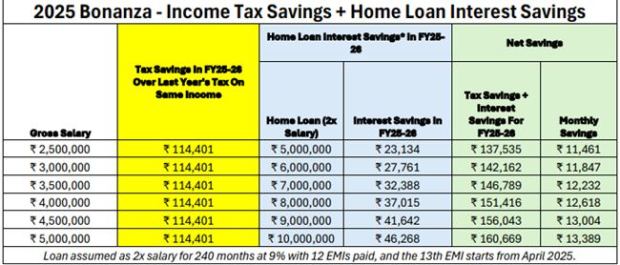

For home loan borrowers, the rate cut translates into significant savings. For instance, someone earning a gross salary of Rs 25 lakh, the tax savings are likely to be Rs 1.14 lakh for FY2025-26, and with a Rs 50 lakh home loan taken at 9% interest rate for 20 years (with 19 years left before the rate cut), the interest savings would be approximately Rs 23,000. This gives us total savings of Rs 1.37 lakh for FY2025-26, or Rs 11,461 a month. This will be through a combination of interest savings on the home loan rate reduction of 25 bps and the tax savings from higher tax slabs from April 1, according to Bankbazaar.

BankBazaar suggests that borrowers with strong credit scores explore more aggressive payment options, such as refinancing to a rate that is 50 bps or lower. For example, refinancing to an 8.25% rate while keeping the EMI constant could lead to per-lakh savings of Rs 14,480 over the remaining loan tenure, translating to nearly 15% savings per lakh—a substantial benefit.

Additionally, if the rate cut takes effect from April 1, borrowers can expect per-lakh interest savings of Rs 3,002 for the remainder of the year. On a Rs 50 lakh loan, this means savings of Rs 1.50 lakh in the second year alone.