The cost of a piece of property plays a significant role in ascertaining whether you are financially ready to buy a house or must wait some more time to collect enough funds before taking such a big financial decision. Often, only the purchase price of the property is considered to be the real cost of owning a home.

However, that is not true especially if you are planning to take a home loan. The actual cost of owning a home involves many hidden expenses beyond the monthly mortgage payments. It is essential to factor in all these costs to avoid financial stress. Also, the cost varies across cities and the type of property you are buying. Let’s shed light on the key factors involved in estimating the true cost of home ownership.

Property cost and down payment

The first step in estimating the actual cost is determining the property’s purchase price. This amount is based on various factors, including the location, size, amenities, and market conditions. Once the property cost is established, prospective homebuyers need to consider the down payment.

Financial institutions typically require a down payment of 10%-20% of the property cost. It is important to have the necessary funds set aside to meet this requirement.

Home loan amount and interest rate

Buying a house is a significant financial decision that requires careful planning and consideration, especially when it comes to a home loan. Understanding the actual cost of purchasing a property with a home loan is crucial. It gives you an idea how much money you need now and what will be your requirements in the future when you start repaying the loan.

The loan amount depends on the property cost and the down payment made. “It’s essential to research and compare loan options offered by different lenders to secure the most favourable interest rates. The interest rate is the percentage charged by the lender on the borrowed amount and varies based on factors like loan tenure and the borrower’s creditworthiness,” says Adhil Shetty, CEO, Bankbazaar.com.

Loan tenure and EMI

The loan tenure refers to the duration over which the borrower repays the home loan. In India, loan tenures can range from 5 to 30 years, depending on the borrower’s eligibility and the terms offered by the lender. While longer tenures result in lower EMIs, they also increase the total interest paid over time. It is crucial to strike a balance between affordable monthly payments and minimising interest costs.

Additional costs

Apart from the property cost and the home loan, there are several other expenses to consider when estimating the actual cost of homeownership. These include:

Processing fees: Banks charge a processing fee for loan application processing, which is typically a percentage of the loan amount.

Legal and documentation charges: Legal fees and charges for document verification and registration are part of the total costs.

Stamp duty and registration charges: These charges are levied by the government and vary across states. It is important to factor them into the overall cost.

Insurance: Home insurance and mortgage insurance are important to protect the property and the loan.

It’s important to consider additional costs such as processing fees, legal and documentation charges, stamp duty and registration charges, electricity, water, parking & maintenance cost, apart from insurance (optional) & amenities, among others. These costs can vary depending on the location and specific requirements.

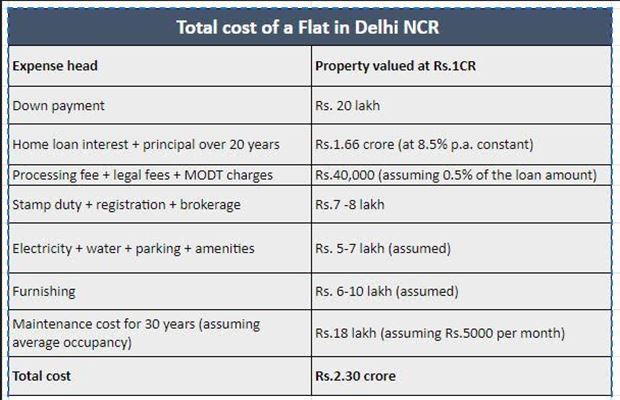

By considering the above costs (See Table), which may typically be more than double the purchase price of a piece of property during its lifetime depending on your requirements, you can estimate the actual cost of buying a house in India. It’s recommended to consult with financial institutions or professionals for accurate calculations based on specific loan terms and conditions.

Prospective homebuyers must carefully evaluate their financial capabilities, research loan options, and factor in additional costs to arrive at an accurate estimation of the total expenditure. With careful planning, a prospective homebuyer can make informed decisions and embark on homeownership journey with confidence.