Credit cards have become a go-to payment option in metro cities for different types of purchases, from groceries to big-ticket items like electronics and home décor. And during festive seasons like Diwali, this trend takes off, with many people swiping their cards to make the most of seasonal sales and offers.

But a recent report by BankBazaar has highlighted an interesting shift: non-metro cities are now using credit cards more frequently for everyday expenses, even surpassing their metro counterparts in certain ways.

Non-Metros Leading the Charge

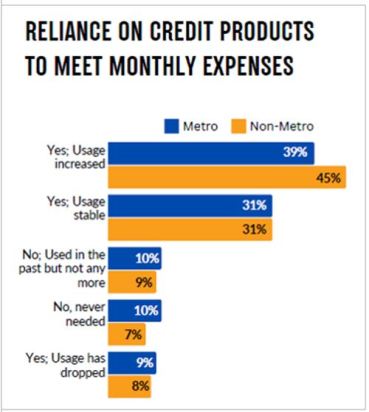

The study shows that credit cards are not just being used for occasional purchases, but they are increasingly being relied upon for monthly expenses, highlighting a shift in usage priorities between metro and non-metro residents. Around 45% of people in non-metros use credit cards to cover monthly costs, compared to 39% in metro areas. This difference highlights the growing financial reliance on credit for routine expenses outside major urban centres. This shows a growing trend where residents in smaller cities are turning to credit for regular expenses, reflecting a shift in spending habits.

Financial Strain in Non-Metros

While credit cards can be convenient, there’s also the risk of accumulating debt if payments aren’t managed properly. The study reveals that people in non-metros are finding it a bit tougher to keep up with their credit card bills than those in metro cities. Around 22% of non-metro residents reported difficulties in repaying their loans, compared to just 18% in metro areas. The financial strain could be linked to slower income growth and fewer financial options in smaller cities.

Also Read: Top 10 Lifetime Free Credit Cards in India in 2024

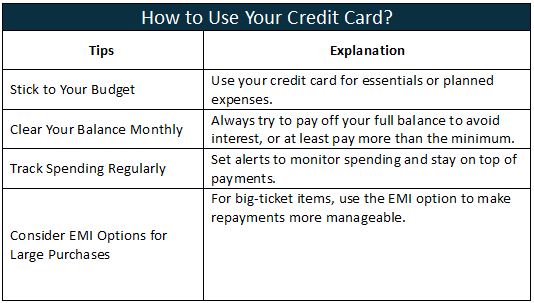

Tips for Managing Your Credit Card

Credit cards users must use their credit limit responsibly and remember to clear their monthly bills on time to avoid penalties. Spending on credit cards help you earn reward points which can be helpful in saving money while you spend. Here are some key tips to consider while using your credit cards.

Aspiring for Debt-Free Future

Debt continues to be a significant concern for many individuals, which explains why a considerable proportion of residents in major urban areas aspire to achieve a debt-free status in the near future. Nonetheless, the management of debt is a priority for individuals in both metropolitan and non-metropolitan regions. Notably, approximately 44% of respondents from metropolitan areas and 36% from non-metropolitan areas express a desire to eliminate their debt within the next year, indicating a robust aspiration for financial stability.

High Expenses but Slower Income

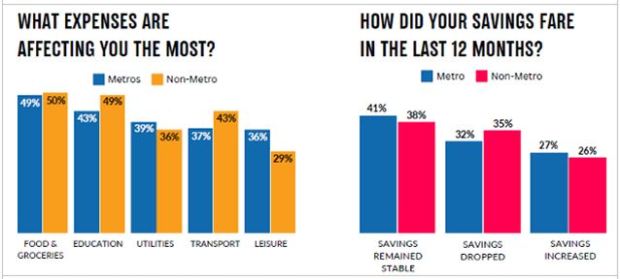

Despite a neutral stance from the Reserve Bank of India on interest rates, rising cost is a concern. The report highlights that 54% of people across India saw their expenses increase by Rs 10,000 to Rs 50,000 per month, while only 43% saw a similar increase in income. Additionally, 15% saw little to no income growth. This gap between rising expenses and income is one of the main reasons why many, particularly in non-metros, are turning to credit cards to help cover daily expenses.

Saving Challenges in Non-Metros

When it comes to savings, metros are seeing a bit more growth. Around 28% of metro residents reported an increase in savings, while only 26% in non-metros could say the same. In fact, a significant portion of non-metro residents (35%) reported a drop in savings over the past year. With slower growth in savings, credit cards become an easy way to bridge financial gaps, but this could also mean more debt in the long run.

Food Expenses Increasing

The cost of food is rising across the country for people, and it’s having a big impact on household budgets in both metro and non-metro areas. This has led to increased credit card use for monthly budgets, especially for essential purchases rather than luxury items.

In conclusion, credit cards are gaining popularity not just as a festive shopping tool, but as a staple for managing everyday expenses, especially in non-metro areas. For everything from groceries to big shopping events like festivals and weddings, credit cards offer convenience and flexibility—but they come with the responsibility to manage payments wisely.