Mutual fund investors seeking diversification across market capitalisation of underlying securities have the option of picking from two major baskets — flexi-cap and multi-cap funds — today. But finding the right fit between the two could pose a challenge to the uninitiated.

Until a little over two years ago, multi-cap fund was the only category with the flexibility to invest across market capitalisation of stocks basis the fund manager’s view on trends and opportunities in the underlying market, subject to a minimum of 65% in equities.

Then, in December 2020, the Securities and Exchange Board of India (SEBI) revised the definition of muti-cap funds, making it mandatory for these to invest at least 75% of their total assets in equities, with a minimum of 25% exposure to each market capitalisation category — large-cap, mid-cap, and small-cap.

SEBI also introduced a new category called flexi-cap funds. In a role reversal of sorts, this category was allowed to do what multi-cap could do till then — invest dynamically across large-cap, mid-cap, and small-cap stocks subject to a minimum of 65% in equity and equity-related securities.

Also Read: Decoding Equity Savings Funds: Are They Right For You?

Following the changes, which became applicable from January 2021, the mutual fund industry reclassified the original multi-cap funds as flexi-cap to avoid changing the underlying fund structure.

Today, flexi-cap funds are among the largest open-ended equity mutual fund category in India, with assets of Rs 2.63 lakh crore as of May 2023, compared with Rs 0.74 lakh crore of multi-cap funds.

How the portfolios differ

A look at the portfolio construct of multi-cap funds prior to the SEBI amendment reveals they leaned towards large caps. Between 2018 and 2020, their exposure to large caps stood at more than 60% on average.

After the new regulation became effective, the exposure of multi-cap funds to blue chips has fallen to around 40%.

On the other hand, flexi-cap funds have more than 60% exposure to large caps.

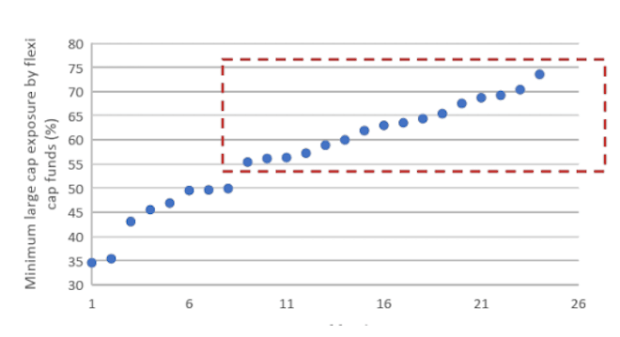

As of May 2023, there were 35 flexi-cap funds in India, of which 25 have been in existence since January 2021. Of these 25, only eight had reduced their exposure to large caps to below 50% over January 2021-May 2023. All others have consistently held more than 50% in large-cap stocks.

Also Read: Go for systematic withdrawals now

Exposure of flexi-cap funds to large-caps

How the two stack up in terms of performance

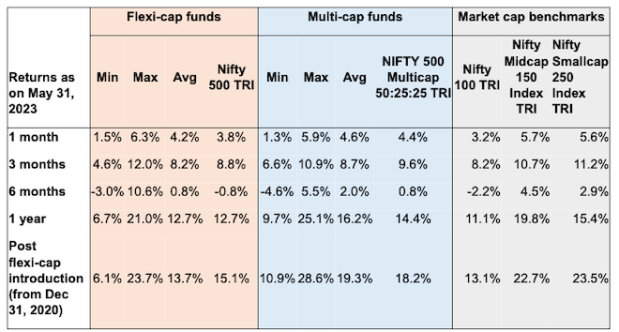

For the purpose of this analysis, we have taken the period since December 31, 2020, when flexi-cap category was introduced. The analysis shows that multi-cap funds have on average delivered better returns than flexi-cap funds.

A similar trend is visible in their respective benchmarks as well with the Nifty 500 Multicap index outperforming the Nifty 500 index during the periods under review.

This could be because mid-caps and small-caps generated much better returns than large-caps during the periods.

Takeaways for investors

As the above analysis shows, the portfolios of flexi-cap funds have been skewed towards large-cap stocks.

That has meant lower returns for the category compared with multi-cap funds, which have more uniform investments across capitalisation.

To reiterate, the portfolios of flexi-cap funds are constructed based on the fund managers’ discretion, or their judgement of the market environment and opportunities to invest across market capitalisation. Thus, although flexi-cap funds do have a dynamic investment strategy covering the three market capitalisation categories, their performance will depend on the allocation calls of fund managers.

Investors should keep these crucial differences in mind while selecting schemes in the two categories.

The column has been written by Piyush Gupta, Director – Funds Research, CRISIL Market Intelligence and Analytics

Disclaimer: The views expressed in this article are that of the respective authors. The facts and opinions expressed here do not reflect the views of www.financialexpress.com. Please consult your financial advisor before investing in mutual funds.