How to check Income Tax Return processing and ITR refund status for AY 2023-24? While more than 1.5 crore taxpayers have filed their Income Tax Returns (ITRs) for Assessment Year 2023-24, many of them are awaiting faster processing of their returns and refunds.

As per the latest data shared by the Income Tax Department, as many as 1,89,56,358 ITRs for AY 2023-24 were filed till July 9, 2023. Of these, over 1.74 crore returns have been verified by taxpayers while the Income Tax Department has processed over 46 lakh verified returns till July 9. This article explains how to check your ITR status and Income Tax Refund Status.

How to check ITR status

To know whether you have successfully filed your ITR or not, you can visit the e-filing website and click on the link saying “Income Tax Return (ITR) Status”. Once you click on the link, it will take you to a new page where you can provide your ITR Acknowledgement Number and Mobile Number. Further, you need to verify the mobile number by submitting the OTP sent to your number and then click on “Continue”. This will show you the status of your return. If you have successfully filed ITR earlier, the status will show as “Filed”.

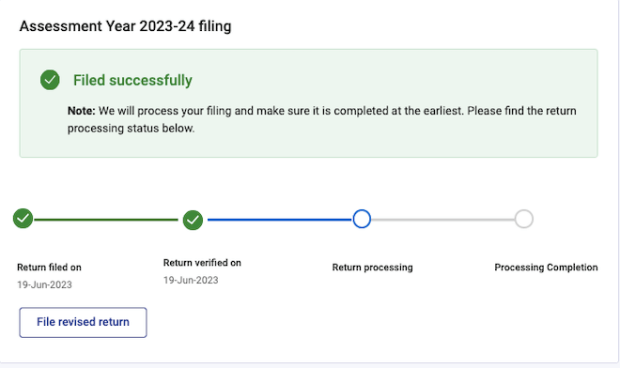

Alternatively, you can also log in to the e-filing website, which will show you the status of your return as shown in the image below.

How to know ITR refund status

You can log in to the e-filing portal. The dashboard will show you when your return was filed and verified and the status of the return processing (as shown in the image above).

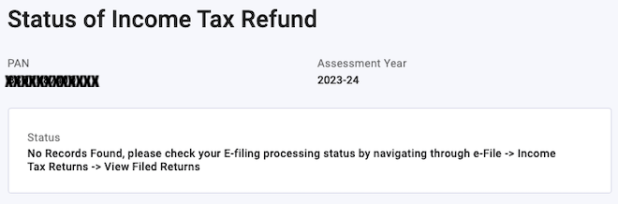

Alternatively, to know the refund status, you can visit the Income tax e-filing website and click on the link saying “Know Your Refund Status”. The link is available at the bottom of the left panel on the home page of the e-filing website.

Once you click on the above link, it will take you to a new page where you need to provide your PAN/TAN, Assessment Year and Mobile Number for OTP verification. After submitting the OTP, the website will show you the status of your refund.

For those who have filed their returns recently, the status may show as “No Records Found, please check your E-filing processing status by navigating through e-File -> Income Tax Returns -> View Filed Returns”.

The due date to file ITR for AY 2023-24 is July 31, 2023 for taxpayers whose accounts don’t need to be audited. If you haven’t filed returns yet, do it soon to avoid late fees and other consequences of not filing an ITR.