If you are already in your 40s, then you know that time is ticking for you to build a substantial corpus for a comfortable retirement. Compared to someone in his or her 20s, who has the luxury of making lower monthly investments to reach the goal, or even adjusting investment portfolio later, a 40-year-old obviously needs to allocate a higher amount to reach the same level.

The significance of the starting age in retirement planning cannot be overstated due to the compound interest phenomenon. Starting at the age of 20, individuals benefit immensely from the power of compounding, enabling the accumulation of a significant corpus with modest monthly investments even at a return rate of 10%.

Monthly investment for a 20-year-old to achieve a Rs 10 crore retirement fund

If someone is 20 years old and has a portfolio consisting of investment instruments like PPF and fixed deposits, yielding returns of 7% to 8%, alongside mutual funds providing an average return of around 12% over the next 40 years, the individual would need to invest a monthly sum of roughly around Rs 16,000.

Monthly investment for a 40-year-old to achieve a Rs 10 crore retirement fund

If a person is 40 years old and earning an average return of 10% on investments, he or she would need to invest Rs 1,31,688 monthly for the next 20 years to build a corpus of Rs 10 crore.

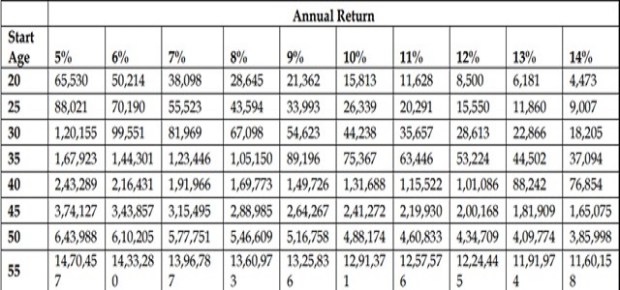

Here is the data compiled in a table by the Pension Fund Regulatory and Development Authority (PFRDA), showing the required monthly investments and average returns needed for individuals in different age groups to reach a retirement corpus of Rs 10 crore. The age groups shown in the table range from 20-year-olds to 55-year-olds, with the return on investment ranging from 5% to 14%.

Riskier investments with higher returns cut monthly contributions further

Conversely, for those willing to embrace more risk, aggressive investment strategies targeting 15% to 25% return rates can greatly diminish the required monthly contribution.

This approach is particularly beneficial for late starters, aged 40 to 55 years, as it assists in accelerating the buildup of their retirement corpus, though it’s crucial to be cognizant of the heightened risks associated with such high-return investments, according to the PFRDA.