Public sector stocks are back on the FII radar.

After a long period of under-ownership and scepticism, foreign investors are gradually warming up to select PSU names.

In the past few quarters, FII shareholding has moved up meaningfully in companies where earnings visibility is strong, capex plans are credible, and the balance sheet is clean.

In the June quarter, FIIs increased exposure to government-backed companies across defence, oil and gas, shipbuilding, and industrial finance.

The common thread is earnings traction, scale and clarity on capital allocation. With several PSU stocks still trading below their private peers on valuations, institutional interest could have more room to run.

Here are 5 PSUs stocks with rise in FII ownership over the past few quarters.

#1 Bharat Electronics

First on our list is the Bharat Electronics.

India’s top defense electronics manufacturer, Bharat Electronics (BEL), is a vital supplier to the country’s military.

From communications and avionics to radars and electronic warfare, it develops and produces vital systems.

Between December 2024 and June 2025, the ownership of BEL by foreign institutional investors increased by 1.2%.

That may not seem like much, but for a state-owned enterprise that already commands a leadership position, it signals growing confidence from global funds.

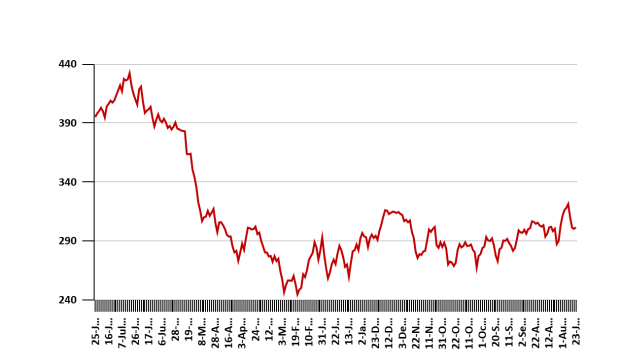

Bharat Electronics Share Price – 1 Year

FY25 was a year of steady execution for the defence major. The revenue rose 15% year on year (YoY) to Rs 204 billion (bn), while net profit grew 20%. Operating margins held firm at 23%.

The company added over Rs 350 bn in new orders during the year. As a result, its order book rose from Rs 653 bn in FY24 to Rs 760 bn in FY25, a 16% increase, providing revenue visibility over the medium term.

BEL has stepped up investment in newer domains such as software-defined radios, electro-optics and artificial intelligence (AI) based surveillance.

The PSU is also building a homeland security portfolio and deepening its export pipeline. Defence exports crossed Rs 4 bn in FY25.

The company remains debt-free and has a strong return profile.

#2 Mazagon Dock Shipbuilders

Next on our list is Mazagon Dock Shipbuilders.

Mazagon Dock Shipbuilders (MDL) is India’s premier defence shipyard for submarines and frontline warships.

It has delivered Scorpene-class submarines and destroyers for the Indian Navy and plays a central role in India’s naval modernisation drive.

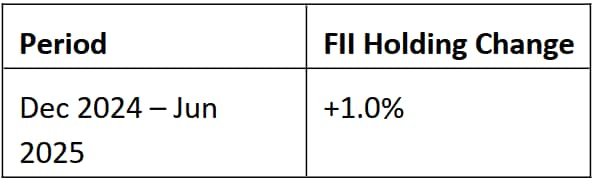

FII ownership in the stock rose by 1% between December 2024 and June 2025.

This reflects growing interest as the country steps up capital defence allocation.

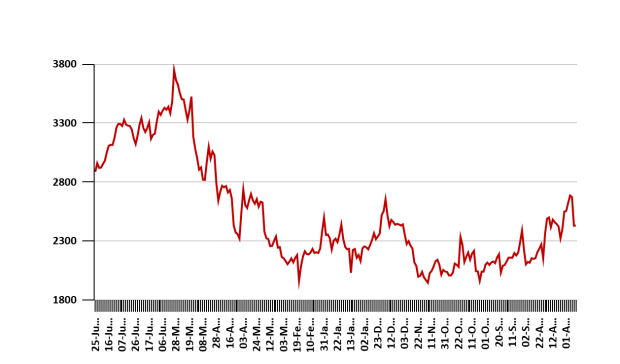

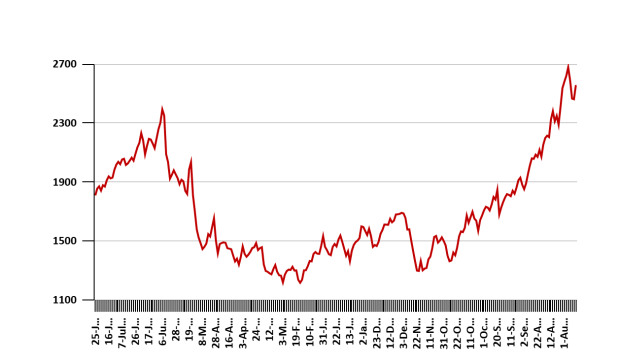

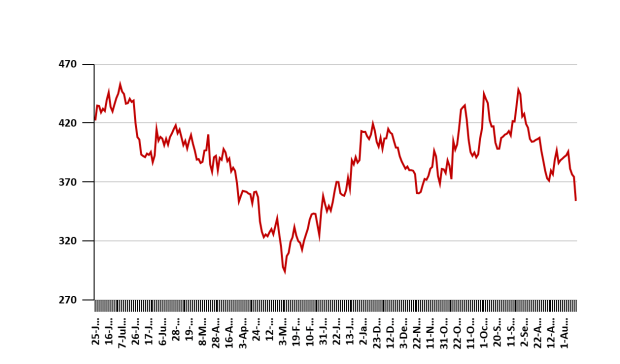

Mazagon Dock Shipbuilders Share Price – 1 Year

In FY25, the company’s revenue grew 2% YoY to Rs 114.3 bn. Net profit was up marginally at Rs 23.2 bn. With revenue down 14% year over year and profit before taxes down 16%, the Q4FY25 numbers showed little momentum.

This was partially due to execution lags and cost pressures, even after the delivery pipeline was steady.

Although core profitability was unaffected, margins were also impacted by a one-time provision pertaining to older contracts.

MDL had a Rs 320 billion order book at the end of FY25. The bigger story lies ahead. Two mega submarine contracts, including Project-75 (additional) and Project-75(I), could push the order book past Rs 1.2 trillion in FY26 if awarded.

The company is also in the race for large surface ship contracts and mine countermeasure vessels.

The company’s capacity upgrades include expanded dry docks and the development of its newly acquired land at Nhava, aimed at scaling operations.

Around Rs 40 bn in capex is planned. For now, growth hinges less on what has been built and more on what comes next. Execution and fresh orders will be the real trigger.

#3 Cochin Shipyard

Third on our list is Cochin Shipyard.

Cochin Shipyard is India’s largest public sector shipbuilder. Apart from being a defence-focused behemoth it is pivoting into a multi-cylinder engine offering repair, exports, green technology, and global partnerships.

Foreign institutional ownership in the stock rose by 1% between December 2024 and June 2025, reflecting rising global interest in what was once seen as a sleepy defence PSU.

Operationally, the company’s standalone revenue grew 24% YoY to Rs 45 bn, while PAT increased 4% to Rs 8.4 bn in FY25. The margin shrank slightly, from 31% to 26%, dragged by provisions. But the quality of revenue improved.

Ship repair is now more profitable than shipbuilding. It jumped to Rs 18.6 bn, outpacing the shipbuilding segment, indicating Cochin Shipyard’s expanding capabilities.

Looking ahead, the commissioning of two large facilities, including an international ship repair hub and a new dry dock, worth over Rs 21 bn, should help unlock more upside in FY26.

Cochin Shipyard Share Price – 1 Year

The company’s order momentum remains healthy.

Cochin Shipyard bagged a fresh contract from Polestar Maritime for two high-powered tugs and another for luxury river cruise vessels via its subsidiary Hooghly Cochin Shipyard.

It’s also making the right noises globally. In recent months, it tied up with Drydocks World to co-develop ship repair clusters and with Korea’s HD KSOE for technical collaboration and capacity improvement.

The company has no long-term debt and pays regular dividends.

#4 Garden Reach Shipbuilders & Engineers

Fourth on our list is Garden Reach Shipbuilders & Engineers.

Garden Reach Shipbuilders & Engineers (GRSE) is a defence PSU that builds warships, patrol vessels, and ferries for the Indian Navy and Coast Guard.

FY25 was a good year as revenue jumped 41% to Rs 50.75 bn and net profit shot up 46%. Operating profit more than doubled and GRSE crossed the Rs 50 bn revenue mark for the first time.

Foreign institutional investors have started taking note. FII holding rose from 3.9% in March 2025 to 5.3% in June 2025.

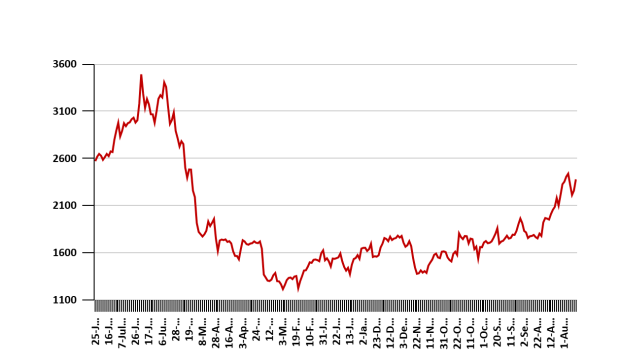

Garden Reach Shipbuilders & Engineers Share Price – 1 Year

Looking ahead, the future pipeline is rich. GRSE is eyeing orders from the Next-Gen Corvette, Large Survey Vessels, and Fast Patrol Vessel projects. Large bids like P-17 Bravo (Rs 700 bn) and Mine Countermeasure Vessels (Rs 320 bn) are also in the works.

The company has expanded its yard capacity from 20 to 24 ships, with a target of 28 by FY26.

It’s also exploring greenfield facilities and partnerships on the western coast. Apart from this, new technologies, including autonomous and green vessels, are on the radar.

#5 Hindustan Petroleum Corporation

Last on the list is Hindustan Petroleum Corporation (HPCL).

HPCL is one of India’s largest oil marketing companies. It covers refining, marketing, and natural gas, with growing investments in petrochemicals and green energy.

FII ownership in the stock rose by 1% between December 2024 and June 2025.

The increase is modest, but it coincides with the completion of HPCL’s aggressive capex cycle and the start of a better earnings trajectory.

HPCL Share Price – 1 Year

In FY25, HPCL reported standalone revenue of Rs 4.3 trillion and a net profit of Rs 73.7 bn. The full-year performance masked a sharp turnaround in the second half.

Quarterly profit rose from just Rs 9.87 bn in H1 to Rs 33.55 bn in Q4FY25, aided by better refining margins and higher marketing volumes. The company’s GRMs improved to over US$ 12 per barrel.

The company is entering the monetisation phase of its multi-year projects. The 15 m tonnes Vizag refinery expansion is fully operational and the Mumbai unit is nearing peak throughput.

HPCL is preparing to commission its Rs 440 bn Barmer refinery by October 2025, followed by a petrochemical unit in early 2026. It has also commissioned a new gas terminal and expects to scale up its LNG play.

The company has guided for a capex of Rs 130–140 bn in FY26. With the peak capex behind it, HPCL is now focused on sweating its assets and improving returns. Free cash flow visibility is beginning to emerge.

Conclusion

When foreign investors start buying, it often pays to pay attention.

FIIs bring with them deep research, long-term discipline and a global lens that retail investors can learn from. Tracking where this smart money is flowing can offer conviction.

Conviction can be obtained by monitoring the flow of this smart money. However, blind faith should never be mistaken for conviction.

Even businesses supported by well-known investors have risks of their own, whether they be rich valuations, unexpected regulations, or execution delays. Knowing not only who is purchasing, but also why, is crucial.

As always, the real opportunity lies in finding quality businesses where capital allocation, governance and long-term strategy align.

A rise in FII holding is a useful signal, but it is only a starting point. Use it to filter ideas, then dig deeper. That’s where your real edge lies in investing.

Be a thoughtful investor.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.