Imagine you invested ₹1 lakh each in two listed companies five years ago, and now the amount has grown to over ₹50 lakh at a massive compound annual growth rate of 118%. Companies that turnaround their operations or operate in a sector with massive tailwinds often generate these kinds of returns in a short period.

However, it is challenging to identify them initially and even harder to hold on to them amid all the volatility. So, here are two stocks that have risen more than 50 times in the last five years. Let’s take a look..

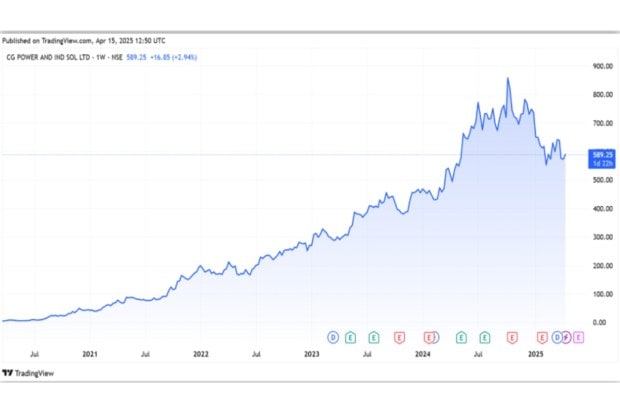

#1 CG Power and Industrial Solutions

CG Power is an 86-year-old engineering group and a leader in the electrical engineering industry. The company has two business lines: Industrial systems and power systems. It manufactures traction motors, propulsion systems, signalling relays, etc., for Indian Railways.

In addition, it produces a wide range of induction motors, drives, transformers, switchgear and other related products for the industrial and power sectors. The company has also recently ventured into the business of consumer appliances such as fans, pumps and water heaters.

Its financial performance began to deteriorate a decade ago, as its revenue fell from ₹121 billion in FY13 to ₹29.6 billion in FY21. The company was later found to be involved in accounting irregularities.

Later, in 2020, the Murugappa Group took over CG Power, infused ₹7 billion, and appointed directors to its board. The group company Tube Investments of India (TII) holds a 57.9% controlling stake in the company.

The company subsequently turned around, and its revenue grew 2.7x from ₹29.6 billion in FY21 to ₹80 billion in FY24. Of the ₹80 billion revenue, 67% came from the industrial sectors, while the remaining 33% came from the power system.

In contrast, its profit initially declined to Rs 9.1 billion in FY22 (from Rs 12.8 billion the previous year) due to restructuring and then grew 56% to Rs 14 billion in FY24. In FY24, profit rose 48%, driven by an 83% jump in earnings before interest & tax (EBIT).

Consolidated earnings before interest, tax, depreciation, and amortisation (EBITDA) also increased to ₹11.3 billion in FY24 (from ₹9.9 billion in FY23), while the EBIDTA margin remained flat at 14.0%.

The power segment margin improved to 17% (from 12.8% in FY23), owing to higher realisation, better product mix, cost efficiencies, and higher-margin export orders. However, the industrial segment margin dipped from 160 basis points to 15.5% due to pricing pressure in the low-tension motor business.

The company maintained the growth momentum in 9MFY25 as well. Its revenue rose 22% to ₹71.6 billion. However, net profit declined 40% to ₹7.0 billion, primarily due to a one-time profit of ₹5.5 billion in Q3FY24.

Looking ahead, CG Power aims to maintain a robust growth rate supported by a strong order book, which provides revenue growth visibility. As of Q3FY25, the industrial segment had an order backlog of ₹29.7 billion (+50% from last year). Meanwhile, the power segment had an order backlog of ₹58.8 billion (+67% year-on-year).

The company is expected to benefit from the expanding power transformer market. To this end, it is investing ₹7.1 billion to set up a 45,000 mega volt ampere transformer manufacturing unit. With this expansion, CG Power aims to cater to growing domestic and export demand, further strengthening its market position.

It also plans to enhance export capabilities to improve its international revenue share, especially in power systems. In addition, it is developing Electric vehicle motors and controllers to expand into electric mobility and energy-efficiency technology solutions.

The company trades at a price-to-equity (P/E) multiple of 93x, 24% higher than its 10-year average of 74x. This premium could be due to re-rating, strong promoter group, and financial performance.

CG Power Share Price is up 72x in the last 5 years.

#2 Bombay Stock Exchange

BSE, established in 1875, is the first stock exchange in India and the oldest in Asia. It is also the Fastest Stock Exchange in the world, with a speed of 6 microseconds, and is one of India’s leading exchange groups.

BSE has a diversified revenue stream linked to capital market activity. Transaction fees lead, contributing 42% of its ₹13,901 million revenue, followed by services to corporates with 25%. The rest comes from treasury income and other securities services, which contribute 13% each, and 7% from other operating income.

The company’s transaction fees more than doubled to Rs 5,827 million in FY24 from Rs 2,412 million in the previous year, driven by record volumes amid a surge in investors.

BSE is the leader in mutual fund distribution through its BSE STAR distribution platform, holding an 85% market share (by transactions) among exchange-based platforms in FY24. StAR has been a big beneficiary of the increasing financialisation of savings. Its revenue grew 63% to ₹1,281 million, led by a 55% increase in orders.

In addition, services to the corporates segment, which earn revenue from annual listing fees and other charges, reported a 20% rise to ₹2,904 million. The growth was supported by higher listing activity and an uptick in corporate actions such as bonuses, stock splits, and other related events.

BSE’s total revenue rose 70% year-on-year to ₹16,180 million in FY24, driven by strong growth across segments, while net profit doubled to ₹4,109 million. In 9MFY25, the momentum continues, with 118% revenue growth and 173% profit growth.

Looking ahead, the company aims to increase market share across all segments as BSE plans to leverage the growing number of registered investors and turnover. It lists rising disposable household income and preference for financial savings as an advantage.

The company also wants to aggressively expand BSE StAR as it offers cost savings and convenience. Apart from this, it aims to expand its services from the existing e-platforms, such as book-building and buy/sell offers for IPOs.

In addition, BSE is poised to benefit from co-location services, which provide racks with trading forms to house their servers. This enables low-latency access to the exchange infrastructure, enabling faster trade execution.

BSE had 100 racks, but all were already working at full capacity. Thus, it aims to create more racks, thereby increasing trading volumes. In addition, BSE has bought a 50% stake in Asia Index (AIPL) from S&P Dow Jones Indices (S&P DJI).

AIPL–a joint venture between BSE and S&P DJI, is best known for managing the Sensex Index–has become a BSE subsidiary. APIL launched four new indices as benchmarks for passive investment and other financial products. Thus, APIL is seeing increased demand for data subscriptions for various indices.

BSE operates in a highly regulated environment, which can affect its operations. Frequent policy changes have added to volatility, while a slowdown in capital markets, as seen in the past six months, may weigh on growth.

BSE trades at a P/E of 86, significantly higher than the 10-year median multiple of 29. The valuation has seen a strong re-rating over the past 5-years driven by strong financial performance. Hence, it leaves no margin of safety, and stock price depends on earnings growth.

BSE Share Price Up 45x in last 5 years

Conclusion

Both CG Power and BSE have delivered exceptional returns over the last five years, driven by strong turnarounds and favourable industry trends. While their past performance has been remarkable, current valuations suggest much of the optimism is already priced in. Going forward, sustained earnings growth and execution on future plans will be key to justifying their elevated valuations.

Disclaimer

Note: We have relied on data from http://www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.