India’s aerospace and defence sector is seeing massive growth fuelled by strategic policies, increasing defence expenditure and the “Atmanirbhar Bharat” initiative.

With a growing urgency for the modernization of armed forces and the strengthening of national security, the Indian government is heavily prioritizing the development of indigenous capabilities in missiles, aircraft production, and other high-tech defence equipment.

Substantial FDI inflow, joint ventures and technology transfers with international defence manufacturers have pushed India to the forefront of the global landscape for aerospace and defence innovation.

Since the onset of the “Make in India” initiative, India’s defence sector production reached a worth of INR 1.27 lakh crore in FY 2024. For FY 2025, the country’s defence exports reached an all-time high of INR 23,622 crore from INR 686 crore in FY 2014, a surge of 34 times. India’s defence budget has also soared 2.6 times from INR 2.53 lakh crore in FY 2014 to INR 6.81 lakh crore in FY 2026.

Now, before we deep dive into 3 stocks in this space that deserve attention, let’s take a look at the trajectory of recent defence contracts.

Recent defence contracts

In FY 2025, the Ministry of Defence has signed deals to procure 193 contracts, worth INR 2.09 lakh crore. 92% of these contracts have been handed out to the domestic defence manufacturing sector. This amounts to 81% of total contract value or INR 1.68 lakh crore.

In early 2025, Mumbai-based Godrej & Boyce’s aerospace division inked a Memorandum of Understanding (MoU) with the Ministry’s Aeronautical Development Agency (ADA) to design and manufacture Flight Control Actuators for the Advanced Medium Combat Aircraft (AMCA). Through this partnership, Godrej will showcase its expertise in producing components for flight-critical DDV-based servo actuators.

Under the Innovations for Defence Excellence (iDEX) initiative, as of February 2025, a total of 619 startups and MSMEs have been awarded 413 contracts. The program is designed to promote defence technology by giving grants to MSMEs, startups, R&D institutes and the academic community.

Key milestones

With 9 government sector undertakings, 41 ordinance factories, exclusive research organizations and more than 300 private companies, India has established a robust manufacturing base of aerospace and defence (A&D). With the adoption of cutting-edge innovation techniques and state-of-the-art manufacturing facilities, many Indian companies in the sector are delivering first-time correct quality (FTCQ) at par with international standards.

One beaming example of India’s fast-growing domestic manufacturing capabilities is Hindustan Aeronautics Limited (HAL) exhibiting its indigenously developed Light Utility Helicopter (LUH) at the Aero India 2025 show. Innovations like the 4G/LTE TAC-LAN, Quantum Key Distribution (QKD) system, Smart Compressed Breathing Apparatus, and Advanced Autonomous Systems for the Armed Forces reflect India’s prowess in manufacturing AI-driven, next-generation surveillance systems and counter-drone measures.

DRDO has partnered with Bharat Forge and Tata Advanced Systems to manufacture the Advanced Towed Artillery Gun System (ATAGS). It is equipped with a range capacity of over 40 km, advanced fire control, precision targeting, automated loading, and recoil management.

Here we take a look at 3 major Indian A&D manufacturing companies with significantly low EV/EBITDA ratios which indicate the long-term growth potential of these stocks.

#ideaForge Technology Ltd.

Valued at a market cap of INR 2,283 crore, ideaForge Technology stock has declined approximately 23.9% in the past one year.

Founded in 2007, the Mumbai-headquartered company specializes in the manufacturing of Unmanned Aircraft Systems (UAS). With a 50% share in India’s UAV market, it became the first company to manufacture vertical take-off and landing (VTOL) hybrid UAVs and high-altitude drones.

For FY 2025, the company’s defence portfolio clocked in 59% of total revenues. The portfolio consists of high-performance drones like Q4i, Q6, NETRA V4 Pro, and SWITCH. These are equipped for high-altitude missions and designed with a range capacity upto 15 km and flight times upto 2 hours.

Its civil portfolio, which reported 41% of total revenues for the reported fiscal, comprises lightweight drones like NINJA and RYNO, designed for day and night functioning, with ranges up to 4 km.

In February 2025, the company inked a strategic investment deal with California-based Vantage Robotics, Inc. a high-tech nano and micro UAV provider. The collaboration will not only cement the Indian firm’s presence in North America but also upgrade its large drone ecosystem.

In 2025, it raised a capital of INR 114.5 crore through its latest funding round. The company is committed to strengthening its indigenous drone manufacturing through the innovation of high-tech platforms equipped with advanced features like long-endurance flight, thermal imaging, AI-enabled analytics, and GPS-denied navigation.

As of FY 2025, the company registered an order book of INR 13.6 crore. It unveiled two new products NETRA 5 and SWITCH V2, while also launching concept models for the Tactical ZOLT drone and the Logistics YETI drone in the same fiscal.

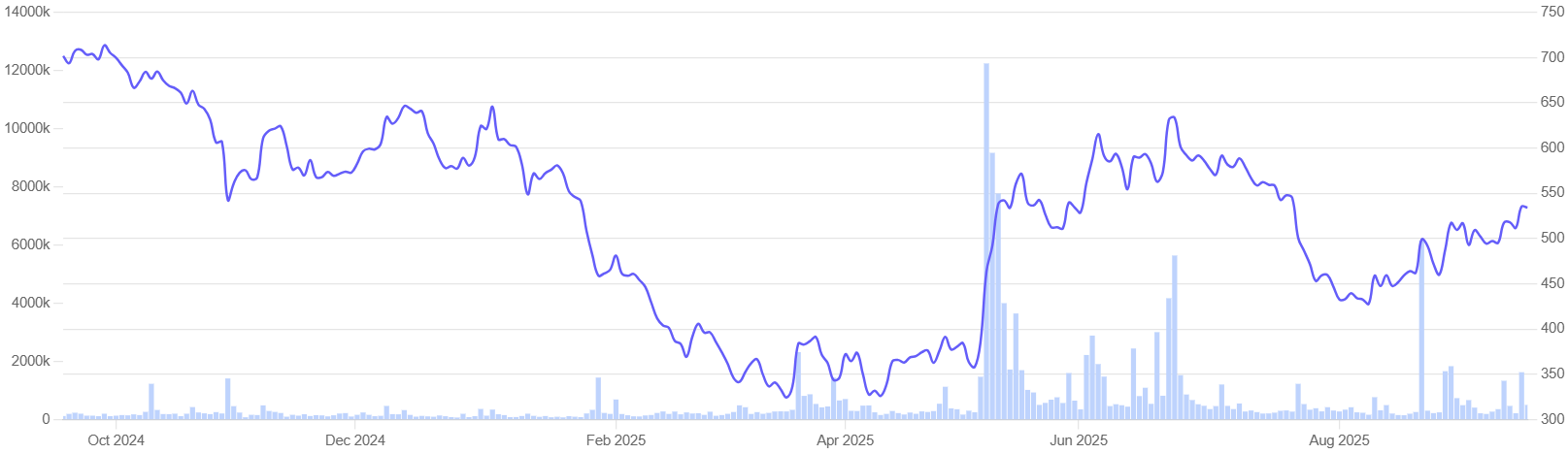

ideaForge Technology share price return: 1 Year

The company reported an operating loss and hence valuing it on the EV/EBITDA metric is not meaningful.

Sales growth at ideaForge have grown at a 5-year CAGR of 63.0%.

#Hindustan Aeronautics

Valued at a market cap of INR 3,24,791 crore, Hindustan Aeronautics stock has returned 15.84% approximately to shareholders in the past one year.

The state-owned company, one of the oldest in the world, specializes in the manufacture, repair and maintenance of aircraft and helicopters.

In August 2025, Hindustan Aeronautics Limited (HAL) secured a pivotal contract worth INR 62,000 crore for 97 Tejas Mk-1A fighter jets. The deal will be a combination of the usage of domestic innovation capabilities and partnership with GE/Israel.

In March 2025, the Ministry of Defence handed out two contracts to HAL for 156 LCH Prachand helicopters valued at INR 62,700 crore (excluding taxes).

In February, HAL and Safran Aircraft Engines signed a long-term deal for the procurement of turbine forged parts for LEAP engines, giving a major boost to the “Make in India” policy.

Around the same time, American aviation technology company, Collins Aerospace partnered with HAL to establish a maintenance, repair and overhaul (MRO) facility at HAL’s accessories complex located in Lucknow. Post the commencement of operations, the MRO facility will provide infrastructural support to all indigenously manufactured LCA (Light Combat Aircraft) Tejas Mk-1 used by the Indian Air Force (IAF).

In September 2024, the PSU secured a new contract worth INR 26,000 crore from the Ministry of Defence for the supply of 240 aero-engines for Su-30 MKI aircraft used by the Indian Air Force.

As of FY 2025, the company’s order book amounted to INR 1,84,000 crores, up from INR 94,129 crore in the previous fiscal.

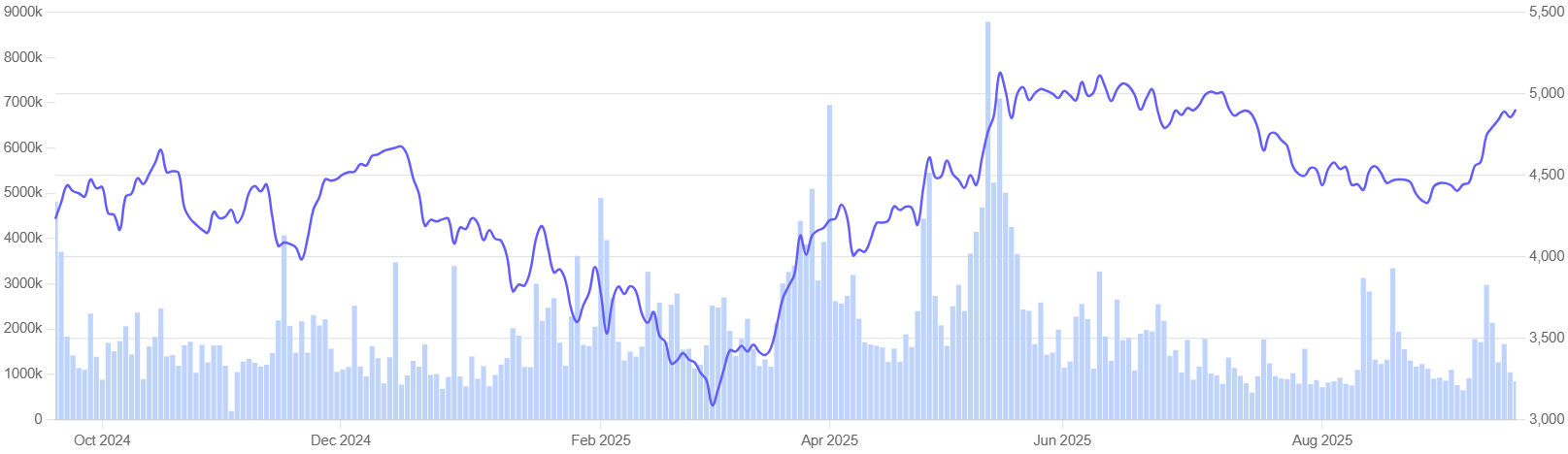

Hindustan Aeronautics Limited share price return: 1 Year

The stock currently has an EV/EBITDA ratio of 23.2 as compared to the 10-year median of 7.3. The current industry median is 37 times.

HAL’s sales have grown at a 5-year CAGR of 7.6%. and profits have compounded 24% over this same period.

#DCX Systems

Valued at a market cap of INR 3,093 crore, DCX Systems stock has declined approximately 19% in the past one year.

Founded in 2011, the company is an active player in the domain of system integration, cable and wire harness manufacturing, and kitting services for the aerospace and defence sectors. It has emerged as a foremost Indian Offset Partner (IOP) for global original equipment manufacturers, particularly serving the Indian defence market by manufacturing electronic sub-systems and cable & wire harness assemblies.

In February 2025, the company established two new manufacturing facilities in Bengaluru under the Domestic Tariff Area (DTA). These units located in the KIADB Industrial Area, will bolster the company’s operations in system integration, cable and wire harness assemblies, printed circuit board assemblies, and electronic sub-assemblies.

One of the biggest strength areas of the company is that its new contract orders bring in higher profit margins due to its backward integration strategy. This entails in-house production of key components, thereby enhancing the cost efficiency of the manufacturing process.

For FY 2025, the consolidated order book of the company stood at INR 2,855 crores, an increase of 3.5 times from the previous fiscal. Some of its biggest clients are Lockheed Martin (USA) with orders worth INR 460 crore for electronic assemblies and ELTA Systems (Israel) with orders worth INR 483 crore for CIWS Module Assemblies.

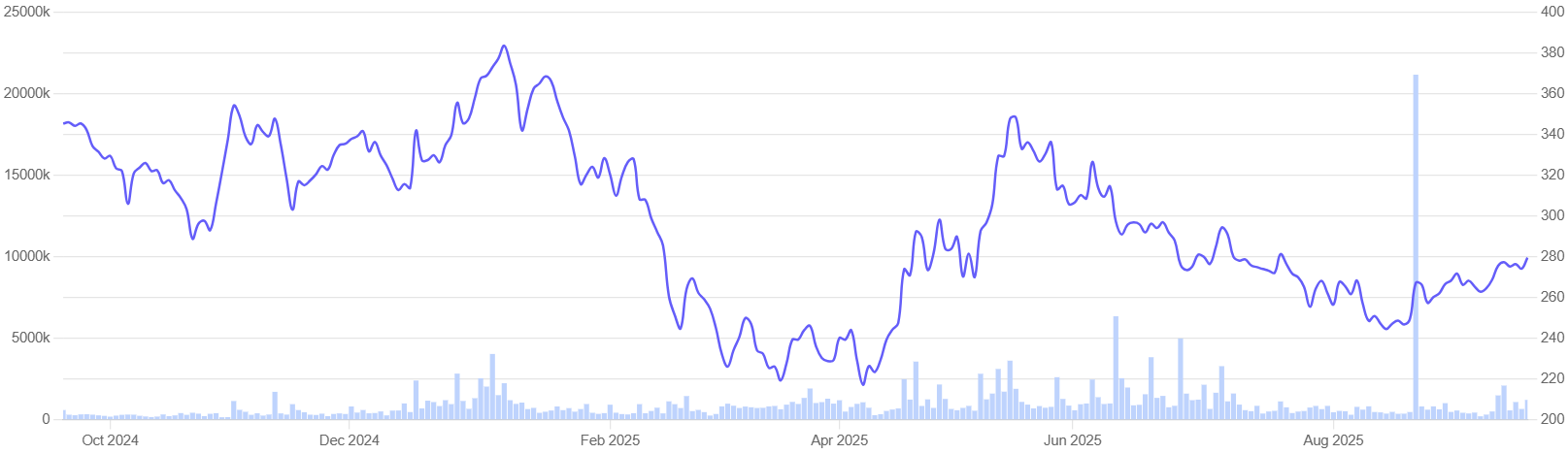

DCX Systems share price return: 1 Year

The stock currently has an EV/EBITDA ratio of 24.6 as compared to the 10-year median of 24.1. The current industry median is 37 times.

It has a trailing price-to-earnings ratio of 77.9.

Valuation Comparison With Peers

| Company | TTM P/E | ROCE | ROE | EV/EBITDA |

| ideaForge Technology | – | -9.7% | -10.3% | -40.8 |

| Hindustan Aeronautics Ltd. | 39.5x | 33.9% | 26.1% | 23.2 |

| DCX Systems | 77.9x | 5.1% | 3.11% | 24.6 |

| Bharat Electronics Ltd. | 54.4x | 38.9% | 29.2% | 37.1 |

| Zen Technologies Ltd. | 57.7x | 37.2% | 26.1% | 33.7 |

| Apollo Micro Systems Ltd. | 168x | 14.5% | 10.2% | 77.0 |

| Industry Median | 76.4 | 18.7 | 14.3 | 37.0 |

It is to be noted that with negative EV/EBITDA, Return on Capital Employed (ROCE) and Return on Equity (ROE), ideaForge Technology is a substantial underperformer compared to its peers. This indicates a valuation concern for the company, stemming from operational inadequacies.

On the contrary, prominent industry names like Bharat Electronics and HAL have reported higher valuations on account of higher return ratios.

In conclusion, it can be said that India’s A&D sector is brimming with massive growth potential both at domestic and international levels. With more proactive participation from industry stakeholders and policymakers, it is only a matter of time before India emerges as the most preferred manufacturing hub and investment destination for the sector.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information. A few other sources used for various data points are Press Information Bureau and Ministry of Defence.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Sriparna Ghosal is an experienced financial writer. She has studied Economics at the Calcutta University. She started her career as a financial writer with Zacks Investment Research. Post that, she moved into consulting firms like Crisil. Her interest extends to global stocks as well.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.