One of India’s Warren Buffett, Radhakishan Damani, also known as the ‘Retail King’ of India, is not an unknown investor. Many investors who are into long term value investing, follow Damani and his portfolio. He is known for staying calm during turbulent times and trusting his picks through ups and downs of the market.

Damani is very well known for not getting swayed by market sentiments in times of a crash or other tricky situations. And that goes not only for his big holdings, but also his less known holdings in the portfolio. 2 of his such less known small cap stock picks are currently trading at over 30% discount on the all-time high prices.

Are these a good get-in opportunities at the discounted prices, ready to grow? Or will Damani decide on moving monies to other stocks? Let us take a deep dive into these stocks to understand better.

Bhagiradha Chemicals & Industries Ltd

Bhagiradha Chemicals & Industries, incorporate in 1993 is an Agro Chemical Company in India involved in the manufacturing of insecticides, fungicides, herbicides etc.

With a market cap of Rs 3,864 cr, Bhagiradha Chemicals exports its products to various countries viz. USA, Brazil, Columbia, Argentina, Mexico, Costa Rica, Germany, UK, France, Portugal, Italy, Israel, Turkey, Iran, Indonesia, Taiwan, Malaysia, New Zealand, and Australia.

Retail King Radhakishan Damani has been holding a stake in Bhagiradha Chemicals & Industries Ltd since June 2024 (as per data on Trendlyne.com), through his company Derive Trading and Resorts Private Limited. Currently he holds 3.32% stake in the company.

One of the freshest entries in his portfolio, what is it about this company that grabbed the attention of one of the biggest value investors of India?

The company’s sales were at Rs 246 cr for FY20 and it jumped to Rs 440 cr for FY35, which is a compounded growth of 12% in 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for the company was Rs 17 cr in FY20 which has grown to Rs 37 as of FY25, logging in a compound growth of about 17%.

The net profits for Bhagiradha Chemicals saw a compound growth of 22% as it jumped form Rs 7 cr in FY20 to Rs 14 cr in FY25.

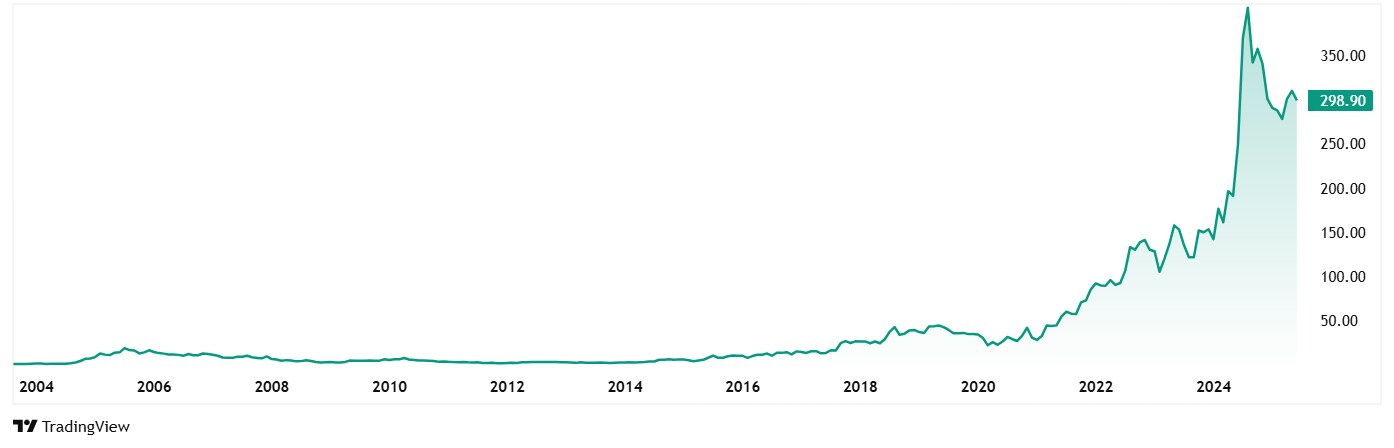

The share price of Bhagiradha Chemicals & Industries Ltd jumped from around Rs 27 in June 2020 to its current price of Rs 299 (as of closing on 23rd June 2025). That is a jump of almost 1007% in just 5 years.

If one had invested just 1 lac in the company 5 years back, it would today be a little over to Rs 11 lacs.

Now, even at the current price of Rs 299, the stock is trading at about a 34% discount from its all-time high of Rs 448.

The company’s valuations right now however seem stretched as the share is trading at a current PE of 279x, while industry median is just around 38x. The 10-year median PE for Bhagiradha Chemicals is 37x, while the industry median for the same period is a just 29x.

In the company’s recent investor presentation, Executive Director & CEO, A. Arvind Kumar said, “The capex plan remains firmly on track, with Phase I expected to be operational by June–July 2025, followed by a ramp-up period of 1218 months. The full impact of this phase is anticipated to reflect in FY27 performance. During the quarter/year, we also expanded our product portfolio with the launch of two new offerings in the insecticides and fungicides segments, reinforcing our market presence and supporting long-term growth.”

BF Utilities Ltd

Incorporated in 2000, BF Utilities Ltd is engaged in the generation of electricity through windmills and Infrastructure activities.

With a market cap of Rs 2,885 cr, BF Utilities primarily generates wind power which is then utilised by Bharat Forge Ltd. at its plant in Pune. Other than that, it is involved in the infrastructure business.

Damani has held a stake in BF Utilities since June 2020 as per data on Trendlyne.com. Currently he holds 1.01% stake as of the quarter ending March 2025.

As for the financials, the company has yet not released its FY25 numbers, but its sales jumped from Rs 448 cr in FY19 to Rs 969 cr in FY24 which is a compound jump of 17%. And between April and December 2024, the company logged in sales of Rs 628 cr.

EBITDA was Rs 331 cr in FY19 and in FY24 it was Rs 581 cr, which is a compound growth of 12%. Between April and December 2024, the EBITDA was Rs 472 cr.

Looking at profits, BF Utilities profits went from Rs 72 cr in FY19 to Rs 304 cr in FY24, logging a compound growth of 27%. And between April and December 2024, the profits were at Rs 254 cr.

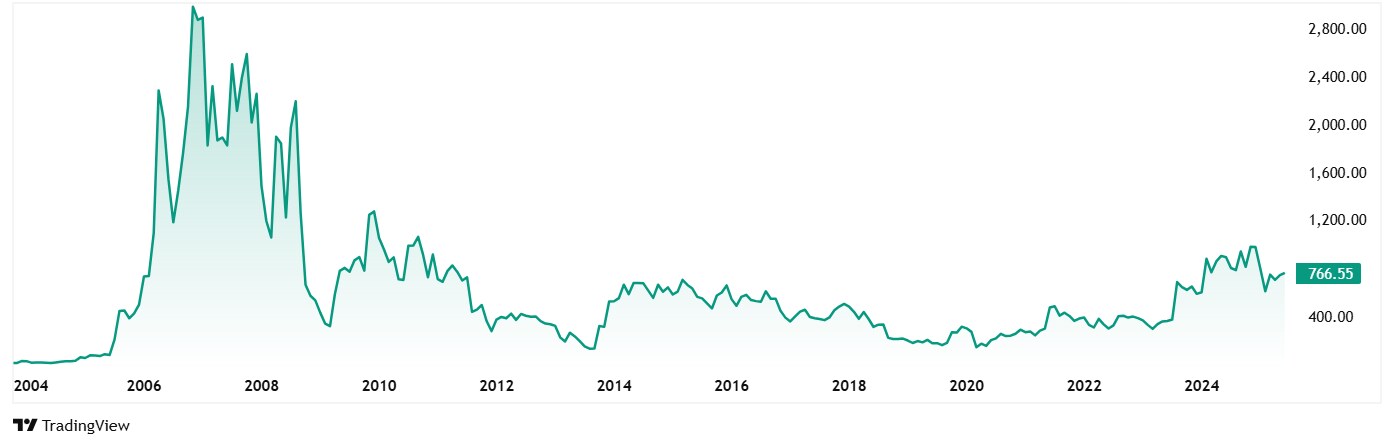

BF Utilities share price was around Rs 203 in June 2020 which has grown to its current price of Rs 766 (as of closing on 23rd June 2025). This is a jump of about 280%.

At the current price of Rs 766, the company’s share is trading at a discount of 32% from its 52-week high of Rs 1,129 and about 70% on its all-time high price of Rs 2,628.

The share is trading at a PE of a modest 20x, while the industry median is 80x. The 10-year median PE of BF Utilities is also 24x which is same as the industry median for the same period.

The company boasts of an enviable ROCE (Return on Capital Employed) of about 29%, which simple means that for every Rs 100 the company spends as capital, it makes a profit of Rs 29 on it.

Follow The Retail King’s vision?

While Radhakishan Damani is almost always associated with the big stock names, he also makes some under the radar moves with stocks like the ones we saw today. The financials for both the companies we saw today hint at the possible reasons for Damani’s interest in them.

While Bhagiradha Chemicals has strong financials to back Damani’s interest as one of the freshest picks in the portfolio, BF Utilities which has been aa part for longer has solid profit growth clubbed with enviable capital efficiency.

Damani’s faith and trust in these 2 underdogs only suggest that he sees something in these stocks which is why their price fluctuations has not bothered his innate value investor. It would be interesting to see how these two small cap favourites of the retail king of India fare in the near and long-term future.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.