When it comes to the list of super investors of India, if there is one name that can be called a ‘household’ one, it is Late Rakesh Jhunjhunwala. His stock picking acumen and knack for making truck loads of money with them is second to none. As we look at his portfolio on his 3rd death anniversary to take stock of his legacy, we have found something interesting.

Rakesh Jhunjhunwala’s portfolio currently holds 26 stocks worth Rs 60,918 cr, but what caught our attention was 2 of his long held favourite stocks, which are currently trading at over 40% discount from their all-time high prices. However, his portfolio still holds them, showing that Jhunjhunwala has left a strong legacy behind, of not being affected by temporary market sentiments.

But what is it about these companies that is still holding the attention of Jhunjhunwala’s friends and family at Rakesh Jhunjhunwala and Associates. And what are the takeaways for a common average investor. Let us find out.

Geojit: The Quiet Performer with a Big Bull’s Backing

Founded in 1987 and incorporated in 1994, Geojit Financial Services Ltd offers a complete spectrum of financial services including online broking, financial products distribution, portfolio management services, margin funding, etc.

With a market cap of Rs 2,022 cr, the company is into the Advisory business that provides fee-based financial planning, investment analysis, retirement planning, tax planning, and investor education services. It is also into financial product distributions and broking.

The Big Bull, Rakesh Jhunjhunwala and associates have been holding a stake in the company since December 2015 (as per data on Trendlyne). Currently that stake is 7.2% worth Rs 146 cr.

The company’s sales have grown at a compounded rate of 20% form Rs 306 cr in FY20 to Rs 749 cr in FY25.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) was at Rs 101 cr in FY20 and for FY25, it was at Rs 285 cr logging in a compound rate of 23%.

The net profits also grew from Rs 51 cr in FY20 to Rs 172 in FY25, which is a compound growth of 27%.

The share price of Geojit Financial Services Ltd was around Rs 35 in August 2020, and as of closing on 14th August 2025, it was Rs 72.5, which is a jump of 107%.

At the current price of Rs 72.5, the stock is trading at 54% discount from its all-time high of Rs 159.

The company’s current PE is 13x while the industry median is16x.

The company has plans to expand with 50 new branches and more than 1,000 new hires, focusing on Tier 2 and Tier 3 cities. Geojit has also received an in-principle approval for a DIFC entity in Dubai to grow its NRI business, targeting profitability within the next 3 years. The wealth management arm of Geojit has a goal to grow AUM from Rs 1,500 cr to Rs 20,000 cr in three years, leveraging 50,000+ high-net-worth NRI clients and increasing the number of relationship managers from 54 to 100.

Tata Motors: Navigating a Bumpy Road Post-Turnaround

Incorporated in 1945, Tata Motors Ltd is a leading global automobile manufacturer and a part of the multi-national giant, the Tata group. It offers a wide and diverse portfolio of cars, sports utility vehicles, trucks, buses, and defence vehicles to the world.

With a market cap of Rs 2,44,723 cr, Tata Motors Ltd has operations in India, the UK, South Korea, South Africa, China, Brazil, Austria and Slovakia through a strong global network of subsidiaries, associate companies and Joint Ventures (JVs), including Jaguar Land Rover in the UK and Tata Daewoo in South Korea.

Rakesh Jhunjhunwala and Associates have held a stake has held a stake in Tata Motors since September 2020 as per data on Trendlyne.com. Current holding is 1.3% worth Rs 3,175 cr.

The company’s sales scaled up from Rs 261,068 cr in FY20 to Rs 439,695 cr in FY25 logging in a compound growth of 11%.

EBITDA was Rs 17,987 cr in FY20 and in FY25 it jumped to Rs 55,216 cr, which is a 25% compound growth.

The net profits look like an area of concern, if we look at the numbers for the last 5 years.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit/Cr * | -9,971 | 2,714 | -11,145 | 2,629 | 32,579 | 28,550 |

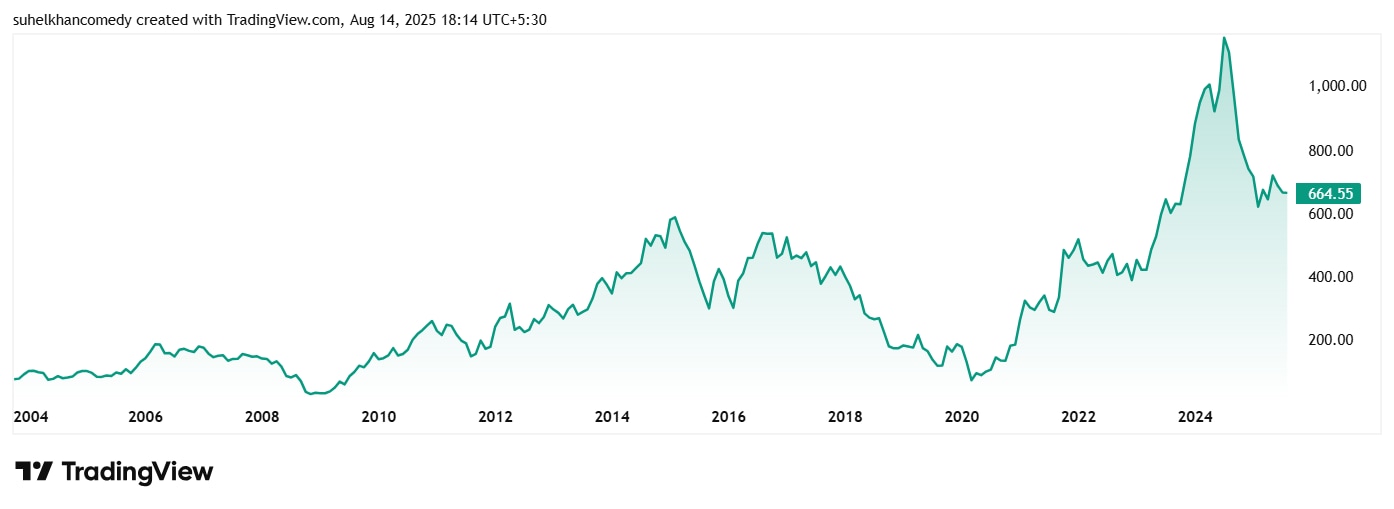

The share price of Tata Motors Ltd was around Rs 125 in August 2020 which has grown to its current price of Rs 665 as of closing on 14th August 2025. That is a jump of 425%.

At the current price of Rs 665, the company’s share is trading at a discount of almost 44% from its all-time high of Rs 1,179.

The share is trading at a PE of 11x, while the industry median is 37x.

According to the company’s latest investor presentation from August 2025, Q1 FY26 was a challenging quarter for Tata Motors, especially at JLR due to tariffs and China taxation, and in domestic PV due to weak demand and discounting. However, management is executing a clear playbook to restore margins, drive premiumization, and leverage new product launches, with a sequential recovery and stronger H2 anticipated.

The Big Bull’s Play – A Legacy Bet or a Value Trap?

Rakesh Jhunjhunwala was known to be the extravagant big shot investor, with a knack for finding stocks just at the right time and staying with them for the long haul, irrespective of what the market sentiments dictate. So is the case with the 2 stocks we saw today.

Both Geojit Financial and Tata Motors are leader in their industry and have shown promising financials in the last few years. While Geojit has consistently performed keeping losses at bay, Tata Motors saw a series of losses in the last 5 years. But what they have in common is Jhunjhunwala’s interest in them, despite the big decline.

Whether Geojit becomes the money magnet or Tata Motors adds wheels to the growth of the Jhunjhunwala portfolio, or will they both turn to be traps, is something only time will tell. But adding these stocks in thee watchlist to keep an eye out, would not be such a bad idea.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.