There is probably no investor interested in the Indian stock markets who does not know about Mukul Agarwal. He is an ace investor who we also call one of the Warren Buffetts of India. Founder of Param Capital Group, known for his bold investment strategies and a significant impact on the capital markets, Agarwal is one of the most followed super investors of India.

Mukul Agarwal has just made 2 big moves in his portfolio and followers are trying to find out the rationale behind the moves. As per the exchange filings made for the quarter ending June 2025, Mukul Agarwal has added one new bank to his portfolio and cut stake in another which was supposed to be one of his favourite stocks.

Let us try and see if we can find out the reason behind these changes

#1 Jammu and Kashmir Bank Ltd – The Fresh Addition

Jammu & Kashmir Bank (J&K Bank), incorporated in Jammu & Kashmir, India, is a publicly held banking company engaged in providing a wide range of banking services including Retail Banking, Corporate Banking & Treasury Operations.

With a market cap of Rs 12,352 cr, it is the only Private Sector Bank in the country assigned with responsibility of convening State/UT Level Bankers’ Committee (SLBC/UTLBC) meetings.

As per the exchange filings made for the quarter ending June 2025, Mukul Agarwal has just bought a 1.3% stake in the bank worth Rs 157 cr.

The bank’s June 2025 financials are yet to be released, but between FY20 and FY25, the bank’s revenues grew at a CAGR of 8% from Rs 8,446 cr to Rs 12,541. If we look at the financing profits, there is a turnaround story there. From losses of Rs 30 cr in FY20 to profits of Rs 1,792 cr in FY25.

In terms of the Net profits as well, the bank has shown some solid turnaround. From losses of Rs 1,183 cr in FY20 to profits of Rs 2,082 in FY25.

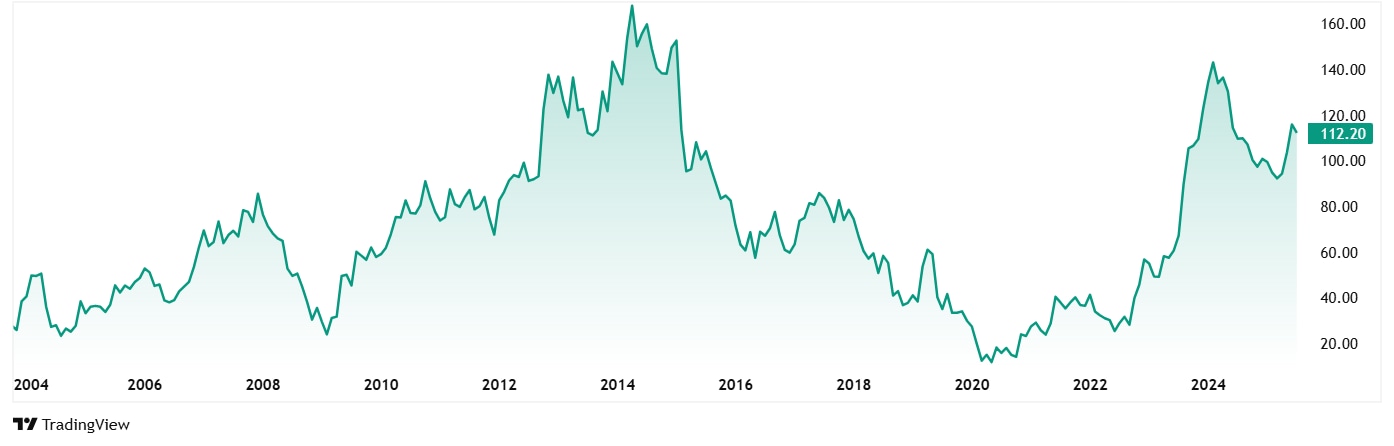

The share price of Jammu and Kashmir Bank Ltd was around Rs 19 in July 2020, which has now grown to its current price of Rs 112 (as of closing on 8th July 2025), logging in growth of 490% in just 5 years. This could be attributed to the solid growth in financing and net profits.

Rs 1 lac invested in the banks stocks 5 years ago would have been close to Rs 6 lacs today.

Even at the current price of Rs 112, the stock is trading at a discount of 44% from its all-time high price of Rs 200.

If you look at the valuations, the bank has a current PE of just 6x while the industry average is 14x. The 10-year median PE for the bank is also 6x while the industry median for the same period is almost 17x.

The bank maintained its FY24 NIM (Net Interest Margin) of 3.92% in FY25, perhaps the only bank to maintain NIMs of 2024.

The NII (Net Interest Income) grew from Rs 5,203 cr in FY24 to Rs 5,793 cr in FY25, logging a growth of about 12%.

The Net NPA (Non-Performing Assets) went up from Rs 737 cr in FY24 to Rs 818 cr in FY25, which is a 11% jump.

The bank is however still having one of the highest Dividend yields at 1.92% in comparison to industry peers.

#2 Raghav Productivity Enhancers Ltd – The Stake Cut

Incorporated in 2009, Raghav Productivity Enhancers Ltd is engaged in manufacturing of quartz based ramming mass, quartz powder, and tundish board. It sells its products under the brand name of “Raghav”

With a market cap of Rs 3,170 cr, Raghav Productivity Enhancers Ltd is the largest manufacturer of Silica Ramming Mass, a high-purity refractory material used to line induction furnaces, shielding them from extreme temperatures and chemical reactions during metal melting, while offering strong thermal and mechanical durability.

Agarwal has held a stake in the company since the filing made for the quarter ending December 2022 as per Trendlyne. However, as per the filings made by the company for the quarter ending June 2025, Agarwal has cut his stake in the company from 1.6% in March 2025 to 1%.

Raghav’s sales have seen a compound growth of 33% from Rs 65 cr in FY21 to Rs 200 cr in FY25. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) grew from of Rs 15 cr to Rs 54 cr in the same period, logging in a compound growth of 38%

The net profits also jumped from Rs 9 cr in FY21 to Rs 37 cr in FY25, which is a compounded growth of 42%.

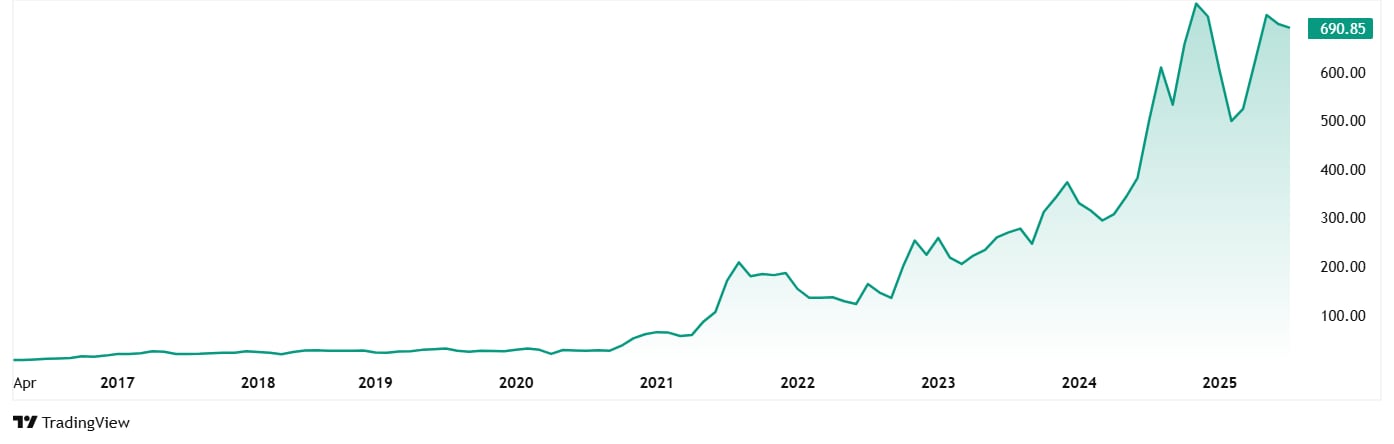

The share price of Raghav Productivity Enhancers Ltd went from Rs 24 in July 2020 to its current price of Rs 692 as of closing on 8th July 2025, a jump of 2,783%. Rs 1 lac invested in the stock 5 years would have been almost Rs 29 lacs today.

And even at the current price, the share is trading at a discount of 22% from its all-time high price of Rs 890.

The company’s share is trading at a current PE of 86x, while the industry median is 44x. The 10-year median PE for Raghav is however 57x while the industry median for the same period is 27x.

Apart from Mukul Agarwal, Rekha Jhunjhunwala holds 4.8% stake in the company and Utpal Sheth holds another 3.7% stake.

Caution Ahead?

The changes Mukul Agarwal has made are big and command attention. After all, Agarwal has been known for picking some solid small and midcap winners over the years.

While the decision to buy Jammu & Kashmir Bank Ltd could attributed to its turnaround in terms of revenues and profits, the one to cut stake in Raghav Productivity Enhancers Ltd is raising some questions, given the company’s strong financials.

Has Agarwal gotten what he wanted out of Raghav or is it time to practice caution? Only time will tell. But for now, keeping an eye on these stocks is a good idea, given that both are backed by solid financials.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do / do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.