Step into a microbrewery in Bengaluru on a Friday night and you’ll see the premium alcohol story unfolding: buzzing tables, imported lagers, and craft cocktails flowing. Now visit a small town in rural UP or Bihar, and the mood instantly changes: weak demand, stressed incomes, and fewer crates moving.

India’s alcohol industry has been writing out a mixed review this year.

On one side, premium beer and spirits in urban markets are enjoying stable demand as rising incomes and lifestyle upgrades keep glasses full in cities.

On the other side, rural markets tell a different tale. Rural demand, which still makes up a substantial share of volumes for mass-market spirits and beers, is subdued due to inflation.

Moreover, low wage growth and regulatory issues have reduced the demand for both beer and Indian Made Foreign Liquor (IMFL).

Layered over this demand divide is another challenge: rising input costs. Glass bottles, barley, and packaging materials are eating up margins, making it difficult for beverage makers to pass on the hikes in regulated states. The result?

Investors in brewery and beverage stocks are staring at a split outlook, where urban cheer balances rural caution.

To understand this mixed picture, we’ll look at three listed names, United Breweries, Radico Khaitan, and Globus Spirits, that together cover beer, premium IMFL, and country liquor plus ethanol.

How we chose these stocks

We focused on listed Indian players where at least 50% of revenue comes from alcoholic beverages or related distillery products. Mega-caps with varied portfolios were excluded to capture the “pure play” businesses.

Companies chosen have a market cap below ₹60,000 crore, have either expanded in capacity or launched new products. They also have reasonable debt-to-equity ratios and improving cash flows.

The King – United Breweries

United Breweries (UBL), the maker of Kingfisher beer, is the market leader in India’s beer segment with over 50% market share. Its Heineken association provides the global support it needs. And its robust distribution capacity lets it outdo its competition in metros and Tier I cities.

The good news: Premiumisation in urban India supports stable demand. Beer sales grew in the southern (+16%) and western markets (+13%).

After the pandemic, the company promoted premium variants like Kingfisher Ultra, Heineken Silver, and Amstel Grande, which have higher margins.

The catch: Input costs remain a challenge with the rising cost of barley and glass bottles.

In Q1 FY26, the revenue increased 15.72% YoY, reaching ₹ 2,864 crore. The net profit for the quarter rose 6% YoY to ₹184 crore from ₹174 crore the previous year, excluding exceptional items.

The stock price grew at a CAGR of 3%, while the average return on equity was 10% over the last three years.

While the Tier I markets keep the toplines stable, the rural slowdown restricts short-term growth visibility. For investors, UBL offers stability, but margin expansion depends on easing input costs.

UBL has stayed the undisputed leader in urban centers thanks to brands like Kingfisher Ultra and Heineken in its portfolio. This is true especially where beer drinking is connected to consumer income.

The company’s earnings before interest and tax (EBIT) margin shrank 44bps to 9% in Q1 FY26, from 9.5% in Q1FY25. The decline was because of other brand investments, interstate transfers, etc., which offset some of the gains from premiumisation.

The company has kept a steady topline growth thanks to urban demand, but its profitability is still weak.

The company is valued at a premium currently, with the Enterprise Value / Earnings before interest, tax, depreciation, and amortization, i.e., EV/EBITDA, at 52.54 x compared to the industry median of 17.95x.

For investors, UBL’s story is one of resilience in metros and tier-1 cities. However, the weak performance in semi-urban and rural areas, where beer consumption is more price-sensitive, shows that the overall growth is moderate.

UBL’s short-term returns will potentially depend on cost rationalisation and its ability to sustain the premium demand momentum.

Radico Khaitan – Entering premium spirits

If United Breweries is the king of beer, then Radico Khaitan is the King of Indian made Spirits.

The Indian made foreign liquor brands like Magic Moments vodka and Rampur single malt are attracting younger, urban consumers. The company has focused on premiumisation, which helps it boost both brand equity and margins.

The good news: Premium spirits are a structural growth story in India. Consumers are moving away from mass-market labels, and Radico has a strong 25+ brands in this space. Its premium whisky and vodka segments are doing well in metros.

The catch: Regulatory controls are playing havoc. States like Uttar Pradesh and Haryana have price caps, which means Radico cannot fully pass on higher input costs. This can affect margins even if the demand increases.

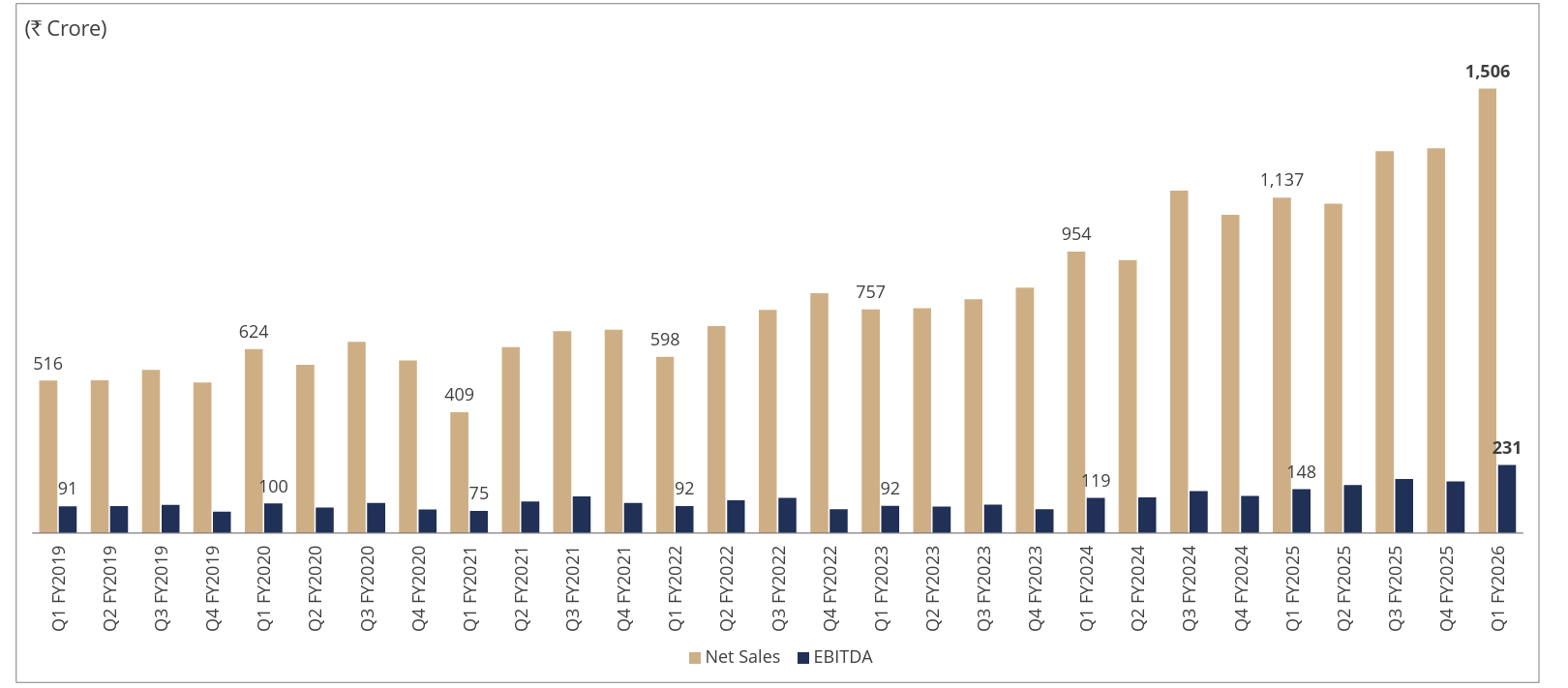

The topline has grown steadily over five years, and investors are betting the premium push will offset regulatory headwinds. The sales for Q1 FY26 were ₹ 1,506 crore, marking a growth of 32.5% YoY. The net profit excluding exceptional items for the quarter was ₹ 139 crore, which is an 82% YoY growth.

The share price grew at a solid compounded rate of 37%, while the average return on equity was 12% over the last three years.

Radico Khaitan, known for brands like 8 PM and Magic Moments vodka, has been quietly climbing the ladder in the IMFL (Indian Made Foreign Liquor) space with a volume growth of 37.5%, the highest ever volumes.

Q1 FY2026 performance highlights

The company is valued at a premium currently, with the EV/EBITDA at 51.26 x compared to the industry median of 17.95x.

The company has benefitted from the “premiumisation wave,” where consumers moved from entry-level spirits to higher-priced, better-quality options.

Its steady push into premium whiskey (Rampur and Jaisalmer) shows Radico is now looking to attract consumers seeking premium liquor in metros and affluent towns.

This push has resulted in market share gains, primarily in northern India. But challenges await in state-specific rules.

Radico’s long-term plan for brand building remains intact, but investors will need patience as margins are currently capped by regulatory intervention.

Globus Spirits – Rural dependent, Ethanol driven

Globus Spirits is a different animal; it spans the country liquor market and the ethanol blending opportunity.

The good news: The government’s ethanol blending policy targets 20% ethanol in petrol by Ethanol Supply Year (ESY) 2025-26 as per a government press release in August. This plan can help create an operational demand for Globus’s distillery products. This demand can cushion the business against cyclical swings in liquor demand.

The catch: Country liquor volumes are connected closely to rural incomes. When inflation hits rural India, Globus will feel the pain in quarterly sales.

The revenue for Q1 FY26 was ₹699 crore, which is a growth of 8.86% YoY. The net profit for the same period grew to ₹18.53 crore, from ₹16.40 crore in Q1FY25, excluding exceptional items.

Globus may not have a brand line-up like Radico or UBL in urban markets, but its ethanol business makes it a unique hedge in the portfolio.

The company is valued at a premium right now, with its EV/EBITDA at 20.15x compared to the industry median of 17.95x. Globus Spirits straddles two different markets, country liquor and ethanol blending. In its liquor business, rural demand swings directly affect quarterly numbers.

When rural income growth is weak, volumes dip, but when farm cash flows are strong, the consumption rises again. This volatility make Globus’ liquor earnings uneven.

On the flip side, its ethanol blending business provides a structural cushion. With the government pushing ethanol blending in petrol, Globus has visibility of steady demand from oil marketing companies (OMCs).

This dual revenue stream will offer investors a balance between cyclical liquor sales and structural ethanol demand.

Globus has also been expanding its distillation capacity, which should provide tailwinds in the medium term. However, rural sensitivity means its liquor business will stay connected to the broader picture of rural India.

A split pitcher

India’s alcohol sector is heading into two realities. In cities, premium consumption supports top-line growth, and companies like Radico and UBL benefit.

But in villages, rural weakness and inflation diminish demand, leaving country liquor and mass-market sales stressed. Add to that the erratic swings in input costs and the burden of state-level price limits, and you get a fragmented picture.

The opportunity may lie in careful investing. United Breweries offers stability but has limited margin growth. Radico Khaitan offers a premiumisation story, although with regulatory limits. Globus Spirits is a rural-dependent ethanol hedge.

For investors, the key is to pick exposure based on whether you want steady market leadership, premium urban growth, or policy-backed ethanol demand.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Archana Chettiar is a writer with over a decade of experience in storytelling, and, in particular, investor education. In a previous assignment, at Equentis Wealth Advisory, she led innovation and communication initiatives. Here she focused her writing on stocks and other investment avenues that could empower her readers to make potentially better investment decisions.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.