Smart investors often look for companies with less or no debt on its shoulders and a high return on capital employed (ROCE). Zero debt implies less risk because the company does not have to worry about interest payments which eat into their profits. A high ROCE on the other hand shows the company is good at making profits with its money or in other words is highly “Capital Efficient.”

This is a great combination, especially when markets are shaky, because these companies are more stable and can still grow making some solid returns for investors.

Smaller companies with these qualities are even more interesting. No debt makes them safer, and a high ROCE means they are likely to give good returns. For anyone who is looking for growth clubbed with possible stability, these kinds of companies can be a sweet spot. They are often newer businesses with strong foundations.

Let us look at 2 less known smallcap companies, that recently got rid of their debt and have an impressive ROCE.

Steelcast Ltd (SCL)

With a market cap of Rs 1,658 cr, Steelcast Ltd is engaged in the business of manufacturing Steel and Alloy Steel Castings catering to a host of OEMs for diverse industrial sectors.

SCL offers casting products like Carbon Steel, Low Alloy Steel, High Alloy Steel, Manganese Steel, and other Superior Grades of Wear and abrasive resistant Steel Castings produced by Bake and Shell Moulding Processes.

It is one of few casting companies to manufacture steel castings through the sand and shell moulding process to produce 300+ parts ranging from 2.5 kg to 2,500 kgs.

Here is how SCL’s debt trajectory looked for the last decade…

| Debt 2014 | Debt 2017 | Debt 2019 | Debt 2022 | Debt Preceding Year | Current Debt |

| 137.22 | 89.6 | 64.43 | 23.11 | 23.65 | 0 |

With the burden of paying interest off their shoulders, the company is well poised to grow profits at a better rate than earlier.

Add to that their current ROCE, which is 40% and it makes the company worthy of a spot in our watchlist. ROCE means the returns a company makes on the capital it employs. For example, if the company is investing a capital of Rs 100, then with a 40% ROCE, the company makes back Rs 140, a profit of Rs 40.

The company can then use this money to expand or pay back to investors as dividends.

When compared to the peers in its group, this is the highest ROCE, which means the company is better than its competitors when it comes to capital efficiency.

The 10-year ROCE average for SCL is about 19%, while the industry average is about 13% for the same period.

And according to the company’s latest investor presentation in February 2025, SCL plans to explore potential growth opportunities by entering new geographies, strengthening relationship with existing customers, adding new sectors to their portfolio and enhancing component basket through new product development.

The presentation also says that SCL will continue their efforts to foray into sectors such as Defence, Ground Engaging Tools, and Railways.

As for the financials, the company’s sales grew at a compounded rate of 5% in between FY19 and FY24, from Rs 318 cr to Rs 410.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) was Rs 59 cr in FY19 which grew to Rs 117 cr in FY24. The CAGR growth for EBITDA in the last 5 years has been around 15%.

The net profits also grew from Rs 25 cr to Rs 75 cr in the same period, making it a compounded rate of 25%.

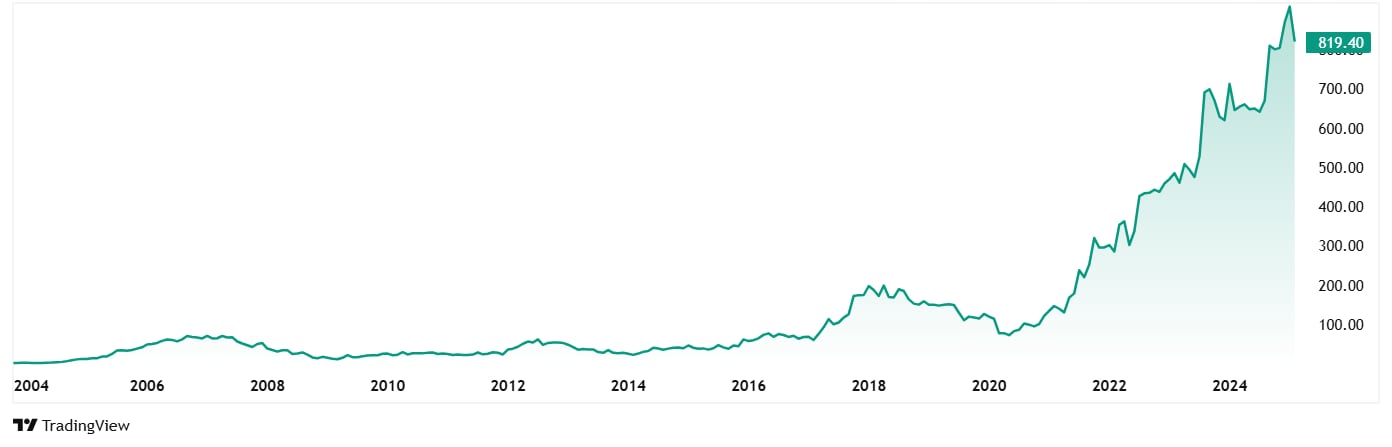

The current share price of Steelcast is Rs 819, which is almost a 640% jump from the 5-year-old price of Rs 111.

Let us look at the valuations now. The company is currently trading at a price to earnings (PE) multiple of 26x. The median PE for the last 10 years is 22x, which would suggest that the current valuation multiple is at a premium to its long-term median.

Thanks to the efficient capital management, the company has been maintaining a healthy dividend payout ratio of over 22%.

Premier Polyfilm Ltd (PPL)

Premier Polyfilm Ltd which was incorporated in 1992 is into manufacturing of vinyl flooring, PVC Sheeting and Artificial leather cloth which are used for a variety of industrial and consumer application.

PPL is an ISO: 9001-2015 certified manufacturer of Specialty Calendared Films and Sheets which are used for various industrial and consumer applications. It is capable of Coating,

Calendaring, Printing, Lamination, Embossing, Complete inhouse testing with own fabric manufacturing.

With a market cap of Rs 727 cr, PPL supplies PVC membrane flooring sheets to the Indian Railways and PVC leather sheets to tier-2 and tier-3 suppliers of automotive OEMs.

Here is how the company’s debt has looked in the last decade:

| Debt 2014 | Debt 2017 | Debt 2019 | Debt 2022 | Debt Preceding Year | Current Debt |

| 3.72 | 24.53 | 27.78 | 14.15 | 23.3 | 0 |

PPL has a ROCE of 30% currently. The average for the last 5 years was 21%, and that for the last 10 years is 18%.

Once again, PPL just like Steelcast above beats its contemporaries in terms of current ROCE.

The current Industry average is 15% and PPL is double of that, making the company’s capital efficiency quite clear.

The company has recorded a compounded sales growth of 12% in the last 5 years as it grew from Rs 150 cr inn FY19 to Rs 259 cr in FY24.

EBITDA was Rs 11 cr in FY19 which jumped to Rs 33 cr in FY24, making it a CAGR of 25%.

The profit after Tax grew form Rs 4 cr in FY19 to Rs 21 cr in FY24, which means it grew at a compounded rate of 36%.

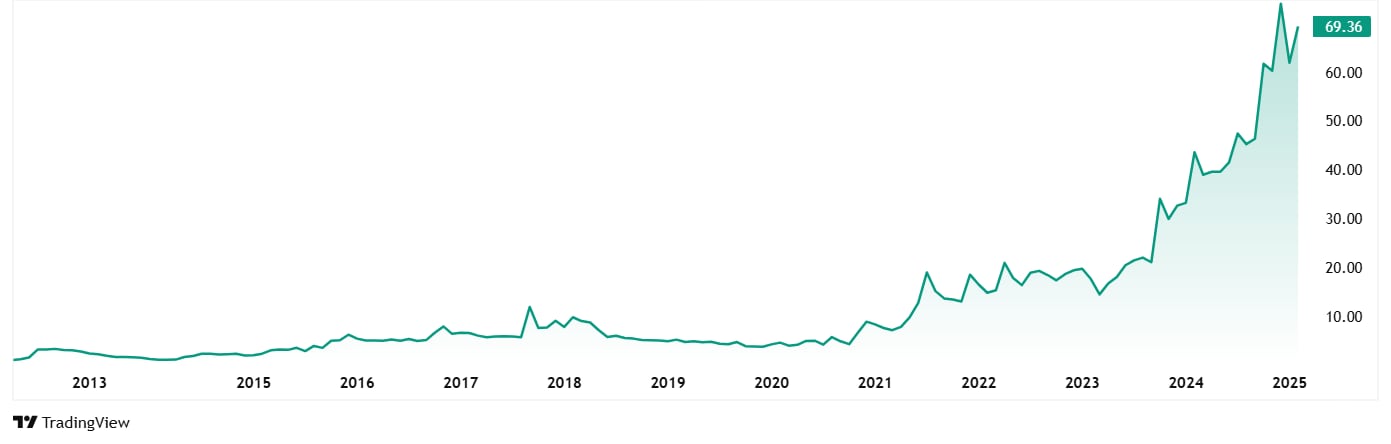

The current share price of PPL is Rs 69.4 as on closing of 11th February 2025, which is a big jump of about 1,290% from Rs 5 in the just last 5 years.

The company’s share is currently trading at a price to earnings (PE) multiple of 27x. The median PE for the last 10 years is 16x, which would once again suggest that the current valuation multiple is at a premium to its long-term median.

PPL has been maintaining a dividend payout ratio of 11% in the last 5 years.

A Combination to lock in?

To conclude, companies with less or no debt and a high return on their investments (ROCE) are usually in good financial shape. They are more resilient when the economy struggles and have the flexibility to reinvest profits to grow even more. This makes them attractive enough to track, especially when things feel uncertain, because they offer a good mix of stability and growth potential. Smart investors see these companies as a chance to back businesses that are both financially responsible and good at using their money wisely.

Steelcast and Premier Polyfilm are two small companies that currently fit this profile. Their ability to generate strong returns, combined with their focus on growth suggests they could create potentially create significant value for their stake holders. Of course, past performance is not a guarantee of future success, and it is always important to do your own research and consider the bigger economic picture before investing. But these two companies are definitely worth a closer look for anyone hunting for promising small-cap opportunities.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.