By Suhel Khan

In news that could be termed by some as “surprising” one of India’s Warren Buffetts, ace investor Ashish Kacholia has substantially reduced his stake in a company. As per the latest shareholding pattern released by the exchanges, Kacholia has cut his holding from 8.32% to 3.54% between September 2024 and December 2024.

This 57% reduction in his position comes at an interesting time, given that the company in its latest investor presentation has stated that “Revenue uptick should start reflecting gradually from Q4FY25 onwards”.

Now for those who know Kacholia, he is known for knack of identifying potential multibaggers, especially in the small and mid-cap space. He co-founded one of India’s first digital entities Hungama Digital, with Rakesh Jhunjhunwala back in 1999 and went on to start his own company, Lucky Securities, in 2003.

Kacholia was holding a little over 8% stake in the company in question since the quarter ending September 2023. So, this partial exit has naturally raised questions among market participants about the company’s growth trajectory and valuations.

Let us look at the company in question…

Universal Autofoundry Ltd (UAL)

With a market cap of Rs 115 cr, UAL is a global manufacturer and exporter specializing in the production of Grey Iron, Ductile Iron, and SG Iron Casting. The company boasts of a varied clientele with names like Ashok Leyland, Volvo, Renault Trucks, Mahindra and JCB.

The company’s numbers for the quarter ending December 2024 are still not out with the exchanges as on the 18th of January 2025.

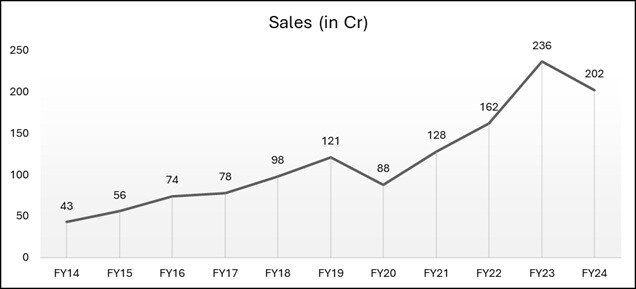

The last decade for the company’s sales were not too bad given that the company was consistent YoY growth in sales, barring in FY20, which could possible be attributed to the pandemic.

Data Source: Screener.in

The sales have grown at a compounded rate of 17% in the last 3 years, 11% in the last 5 years and 17% in the last 10 years.

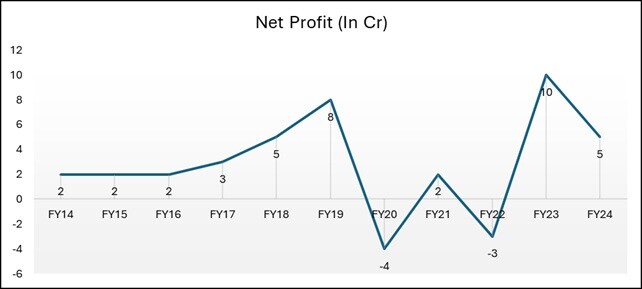

The net profit of UAL is what could be something that could be a reason behind Kacholia’s partial exit. From Rs 8 cr in FY19 to Rs 5 cr in FY24, which is almost a 38% drop, the YoY profit numbers were nothing less than a roller coaster ride.

Data Source: Screener.in

The net profits of UAL have grown by 33% in the last 3 years and 12% in the last 10 years. As for the last period of last 5 years, the company’s net profits contracted by 9% annually (CAGR).

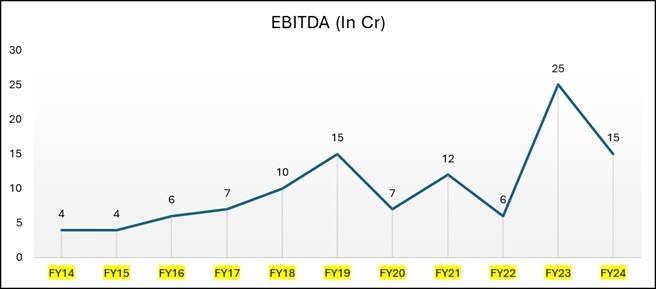

The EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) also has demonstrated a similar pattern to the profits.

Data Source: Screener.in

As you can see, the EBITDA was Rs 15 cr in FY19 and the same in FY24, which shows a flat performance. Now for an investor like Ashish Kacholia, EBITDA could very well be a deciding factor behind the decision to stay put or exit with grace.Now coming to the share price, which was trading at around Rs 35 in December 2019, is now at Rs 92.4 as on the closing of 17th January 2025. This is an absolute growth of 164% and a compounded growth of 22%.

Universal Autofoundry Ltd Share Price

When it comes to valuations, the company’s share is currently trading at a P/E of 52x which seems higher when compared to the industry average of 30x. The 10-year median however is 21x while the industry is around 23x for the same period.

The Way Ahead as Per UAL:

As per the company’s latest investor presentation released in December 2024, the company has signalled that it sees a growth opportunity in the Aluminium castings and the use of Aluminium in the transport sector.

UAL says that the increasing acceptance and government incentives on the EVs could propel aluminium demand as this category has higher intensity of aluminium usage than ICE vehicles. The company also forecasts that India will be the “stand-out growth market” for aluminium consumption in the future as it pursues construction projects to resolve an infrastructure deficit.

No wonder the company has a planned capacity expansion of 12,000 MT with newer product offering will drive volume growth with existing OEMs.

The company’s Chairman and Managing Director, Vimal Chand Jain, had echoed similar possibilities in the Annual Report for FY24 where he said “Looking ahead. the opportunities before us are abundant and promising. The expanding automobile sector. buoyed by the Production linked Incentive (PLI) scheme and significant investments. heralds a bright future for our industry. The Medium and Heavy Commercial Vehicle (M& HCV) industry and tractor production in India are also on positive growth trajectories driven by increased industrial activity, agricultural output and infrastructure development. These trends are set to create substantial demand for our high-quality casting products. Our focus on innovation, quality and customer satisfaction will continue to be the driving forces behind our success. We are confident in our ability to capitalize on these growth opportunities and deliver superior products and services to our client by leveraging our strengths and staying ahead of industry trends. We are well-positioned to achieve sustainable growth and profitability.”

Kacholia’s Partial Exit: Follow Suit?

A tough call…

Well, it will always be difficult and almost impossible for many to decode the buying and selling patterns of the Warren Buffetts of India Like Ashish Kacholia. To be invested in a stock for a good number of quarters and then a sudden cut down by 57% is enough for the investment circles go abuzz with commotion.

It is a partial exit, which means even thought he sales, profits and EBITDA numbers seem shaky now, Kacholia probably still seems potential in the company. Or this could also be a complete exit, just phased. We could only speculate.

If you own the stock, it would be not a bad idea to keep a vigilant eye on it and on how Kacholia takes his next steps. If you do not, adding the stock to your watchlist for the same reasons sounds like a wise thing to do now.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do / do not hold the stocks discussed in this article. The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.