Avionics, or aviation electronics, are the electronic systems used in aircraft, satellites, and spacecraft. It is the digital brain of modern aerospace. It encompasses a wide range of systems that make flight safer, more efficient, and more autonomous. These include navigation and communication systems, flight control, surveillance, and in-flight entertainment and connectivity.

And it’s growing fast, driven by AI-based flight systems, connected cockpits, electric aircraft, drones, and space technologies. Although the US remains the world’s largest aviation market, India is also growing rapidly and now ranks fifth. Jefferies estimates that, with only 4% of global traffic, India’s aviation market remains underpenetrated relative to its population size. Per capita air travel is also low, indicating big growth opportunities.

Furthermore, increased defence spending is creating more opportunities in the supply chain. On a similar line, here are 3 stocks that could benefit from the rising avionics market…

#1 Paras Defence and Space Technologies:

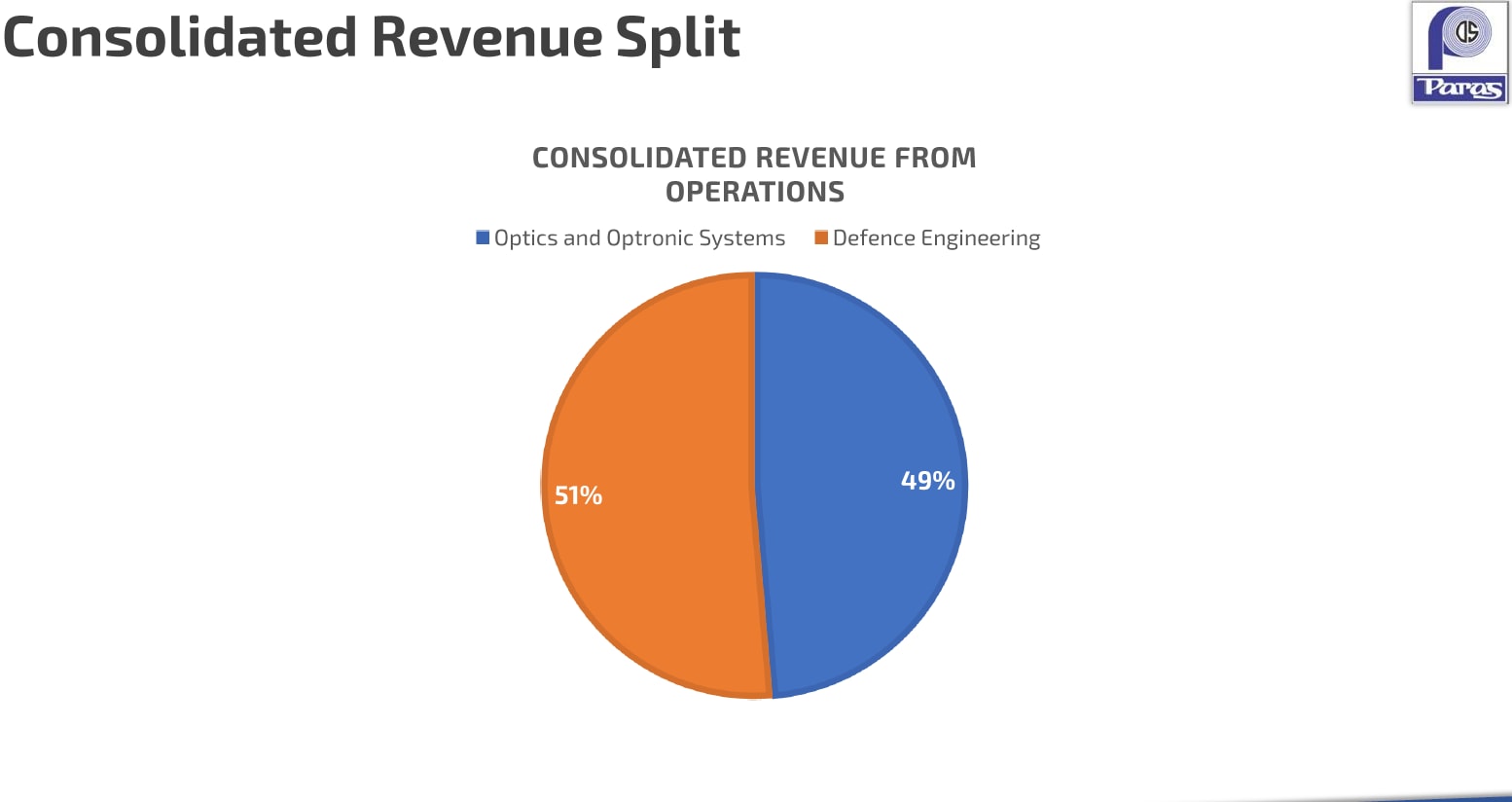

Paras Defence manufactures integrated electronic systems for aircraft and provides optical and mechanical components crucial for airborne navigation and surveillance. Its services are segregated into two core verticals: Optics and Optronic Systems and Defence Engineering. The former accounted for 49% of revenue in FY25, and the latter contributed 51%.

Paras Revenue-Mix

Expanding Play in Avionics Systems

Paras’ customer base spans government organisations in defence and space research, as well as various defence public sector undertakings such as Cochin Shipyard, Bharat Electronics, Bharat Dynamics, Hindustan Aeronautics, and the Indian Space Research Organisation. It also includes private entities, including the Tata group and L&T.

The company also exports to companies in Israel, Singapore, and the US (accounting for 12% of total sales). Defence engineering provides the core electronic systems needed for aviation platforms. This includes avionics suites, which are integrated electronic systems designed primarily for aircraft. These suites include flight displays, controls, and mission management modules.

It is executing a contract for the complete glass cockpit, avionics suite, and autopilot systems for the Saras MK-II program (India’s Civilian Aircraft).

Strengthening Optics and Optronics Capabilities

The Optics and Optronics Systems segment, on the other hand, provides high-precision components critical to navigation and reconnaissance systems used in avionics. It manufactures Electro-Optical systems, which are advanced sensor-based solutions that combine optics, electronics, and precision engineering to support target detection, tracking, and surveillance.

Furthermore, the company collaborates through a joint venture, Controp-Paras Technologies, aimed at manufacturing world-class Electro-Optical systems in India under the Make in India initiative, catering to various platforms, including drones, and delivering advanced surveillance and reconnaissance solutions critical for the defence and space sectors.

Deepening Its Avionics Footprint

Looking ahead, the company aims for sustained growth in its specialized sectors, including avionics. Paras is diversifying its product portfolio and deepening participation in global defence and space supply chains. Its revenue grew 10% year-on-year to ₹930 million in Q1FY26, while net profit stayed flat at ₹140 million. The company estimates an opportunity size of ₹140 billion over the coming 1-5 years.

#2 Azad Engineering

Azad Engineering supplies products, including actuator assemblies and components for hydraulic systems, which are essential to flight control and landing gear systems. The Aerospace and Defence Segment is the key growth engine for the company, as the segment accounted for 18% of total revenue in FY25.

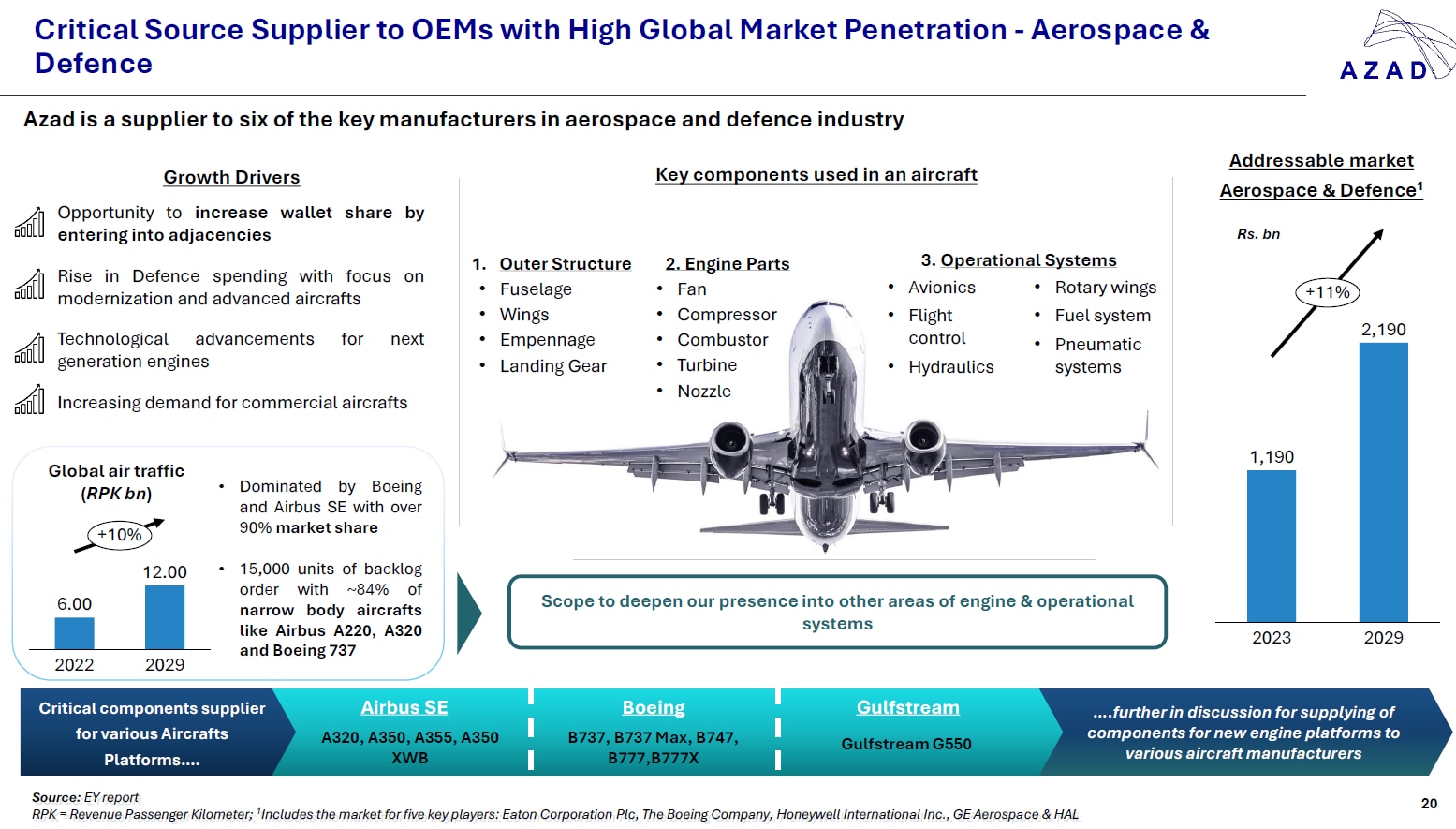

Azad Engineering Aerospace and Defence Product Portfolio

Precision Manufacturing at the Core of Aerospace Growth

The segment delivered standout growth of 84% year-on-year in FY25 and is expected to grow significantly in FY26. Growth drivers include the increasing demand for commercial aircraft (driven mainly by Boeing and Airbus), fleet modernisation programs, and heightened defence spending globally. Azad aims to increase its wallet share by entering into related segments.

Expanding Capacity and Deepening Client Relationships

The company plans to further strengthen its presence with existing customers in the aerospace and defence sector. Since avionics is classified as a key component of operational systems, this sector aligns with the company’s goal of increasing its market share by expanding its presence in critical components for various aircraft platforms and entering adjacent sectors.

Azad supplies parts used in flight control, actuating systems, and hydraulic (fuel) distribution systems. It manufactures key components, including Actuator Guides, covers and housings, shafts and bearing rods, and Piston Plates, which form a critical part of actuator and hydraulic systems that work in tandem with avionics to control aircraft movement.

It is also a supplier of assemblies and auxiliary power units, which are critical to defence propulsion systems. Furthermore, it supplies airfoils, unison rings, and structural parts for major aircraft platforms like the Boeing 737, Airbus A320 and A350 families, and Gulfstream G550.

Strong Order Book Provides Multi-Year Visibility

Looking ahead, management has reiterated its top-line revenue growth guidance of 25% to 30% for FY26. The margin guidance for FY26 remains in the range of 33-35%. It has also acquired two subsidiaries (Azad Prime and Azad VTC), which are also expected to become PAT positive by Q4FY26.

The strong outlook stems from a robust order book exceeding ₹60 billion. This robust order book includes long-term contracts that provide strong revenue visibility for the next 5-6 years. The energy sector contributed ₹34 billion to the order book, followed by aerospace and defence (₹17 billion) and oil and gas (₹8.5 billion).

It is also expanding its capacity, with an investment of ₹4.5 billion during FY26 in infrastructure, plant and machinery, and strategic assets. Azad also plans to commission 8 manufacturing facilities within the next 12-18 months. The expansion is expected to enable the company to increase its wallet share with existing long-standing clients. Azad also expects to be the first choice for new nuclear power projects.

From a financial perspective, its revenue in the first half of FY26 increased 32% year-on-year to ₹2.7 billion, while its margin remained at 36%. PAT surged by 65% to ₹629.9 million. This growth was driven by strong growth in the energy, oil, and gas sector (35.7%) and the aerospace and defence sector (30.3%). Exports contributed 93.9% to revenue.

#3 Expleo Solutions

Expleo Solutions is the Indian arm of the Expleo Group, a France-based global engineering, quality assurance, and technology consulting company. The parent group has a strong presence in aerospace and avionics engineering. It provides design, testing, and certification services to leading aircraft and aerospace manufacturers, including Airbus, Safran, and Rolls-Royce.

Leveraging Global Expertise in Avionics Engineering

Although Expleo Solutions itself primarily focuses on software testing and digital assurance, it benefits from the group’s deep engagement in avionics engineering and embedded systems. The company’s Bengaluru location holds the crucial Aerospace Standard AS9100D certification.

This standard encompasses rigorous quality standards tailored for aviation, space, and defence products, thereby ensuring their safety, reliability, and operational efficiency.

Defence Workflows Shifting to India Operations

This makes Expleo a viable partner for large original equipment manufacturers in the region. Indeed, Expleo is capitalising on the defence boom by strategically focusing on shifting work to its Indian facilities. The company said that clients are moving defence projects to india from France and Germany.

This relocation is driven by clients seeking to optimise costs and benefit from the Make in India initiative and the available offset benefits provided by the Indian government. Expleo anticipates that this traction will lead to an increase in its defence revenues. It also provides software services to the banking, financial services, and insurance industries (BFSI) worldwide.

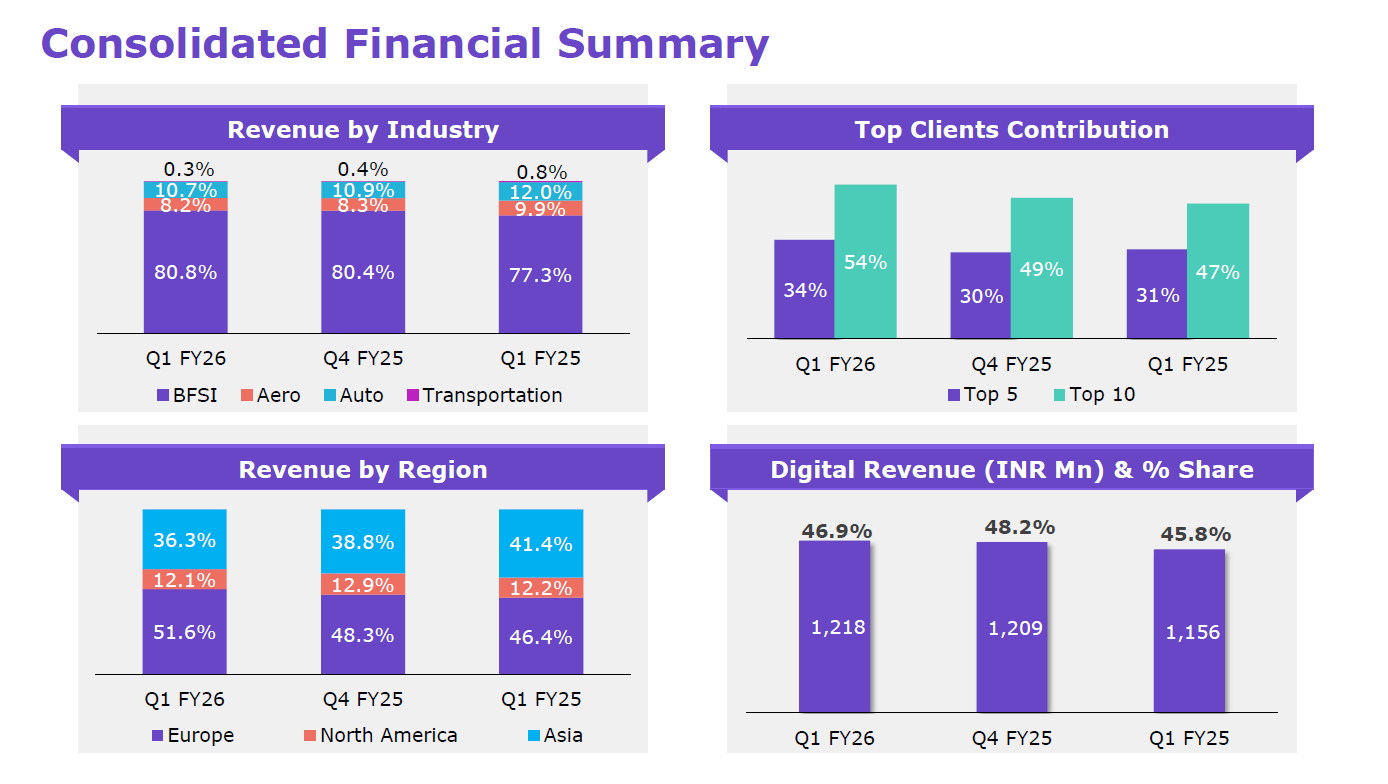

From a financial perspective, revenue grew 3% year-over-year to ₹2.6 billion. The BFSI sector contributed 80.8% of the revenue, followed by the auto sector (10.7%), the aero sector (8.2%), and others. Europe contributed 51.6% of revenue, followed by North America (12.1%) and Asia (36.3%).

Consolidated Financial Summary

Adjusted EBITDA declined 16.5% to ₹331.8 million, while margin fell 300 basis points to 12.8%. Consequently, profit after tax (PAT) declined 14.6% to ₹204.2 million. Adjusted EBITDA is calculated after accounting for Forex Loss / (Gain) and excluding the impact of Other Income.

How the Market Is Valuing the Avionics Opportunity?

From a valuation perspective, Paras and Azad are newly listed, so we’ve taken the 3-year median. Paras’s valuation of 88x price-earnings multiple is broadly in line with its 3-year median, but at a premium to the industry (66.2x). Azad trades at almost double the industry (49.9x) and is in line with the 3-year median. Expleo, being a software provider, is at a discount to the industry, but is in line with its median valuation.

Valution Comparison (X)

| Company | P/E | 3-Year Median | Industry P/E |

| Paras Defence | 88 | 83.5 | 66.2 |

| Azad Engineering | 94.4 | 101.8 (2-Year) | 49.9 |

| Expleo Solutions | 15.4 | 15.8 | 35.1 |

The growing convergence of defence, aerospace, and technology is giving rise to a new set of opportunities within avionics. Companies like Paras Defence, Azad Engineering, and Expleo are positioning themselves to capture this shift through diversification, capacity expansion, and deeper integration with global supply chains. While valuations remain rich in parts of the sector, strong order visibility, rising exports, and India’s push for indigenous manufacturing lend credibility to the long-term growth story.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.