India’s capital markets are busy with action. From the most sought-after IPOs to millions of first-time retail investors opening demat accounts, the stock market in India is a happening place.

But behind the scenes are the real heroes of market action –the exchanges. Most people know companies like Infosys, Reliance, or TCS. But few pause to think about the platforms that power these trades.

Exchanges are where investors and traders meet, deals are settled, prices are discovered, and transparency is maintained.

In India, three such exchanges, the Bombay Stock Exchange (BSE), the Multi-Commodity Exchange (MCX), and the Indian Energy Exchange (IEX), not only provide infrastructure, but they are publicly listed companies. It means you can buy shares in them.

Each exchange helps a different part of the economy. BSE manages shares, equity derivatives, and IPOs, MCX deals with commodities like gold, crude oil, and natural gas, and IEX handles the electricity and energy certificate markets.

These exchanges faced big challenges in the recent past, such as a record number of companies listing, new retail investors trading, major policy changes, and tech improvements.

How did they fare through this all? Let’s find out.

1. Bombay Stock Exchange (BSE)

Founded in 1875, the Bombay Stock Exchange is Asia’s oldest and one of the fastest trading platforms globally. But it has played second fiddle to NSE when it came to equity volumes for a long time. However, things looked up a bit in recent times.

With India’s IPO market growth, retail investor flows surging, and small- and mid-cap stocks beating the indices, BSE saw its cash market activity rise.

BSE’s revenue in the past three years grew 56% CAGR while the profit also grew at 72% CAGR.

Per a KPMG report, over 80 mainboard companies were listed in FY25, raising ₹163,000 crores. Also, the BSE has over 22,31,10,767 registered investors on its platform.

BSE’s revenue was ₹3,212 crore in FY25, with a net profit of ₹1,389 crore (excl. exceptional items), growing 136.6% YoY. The operating margin for the same period rose to 58% from 45% in FY24.

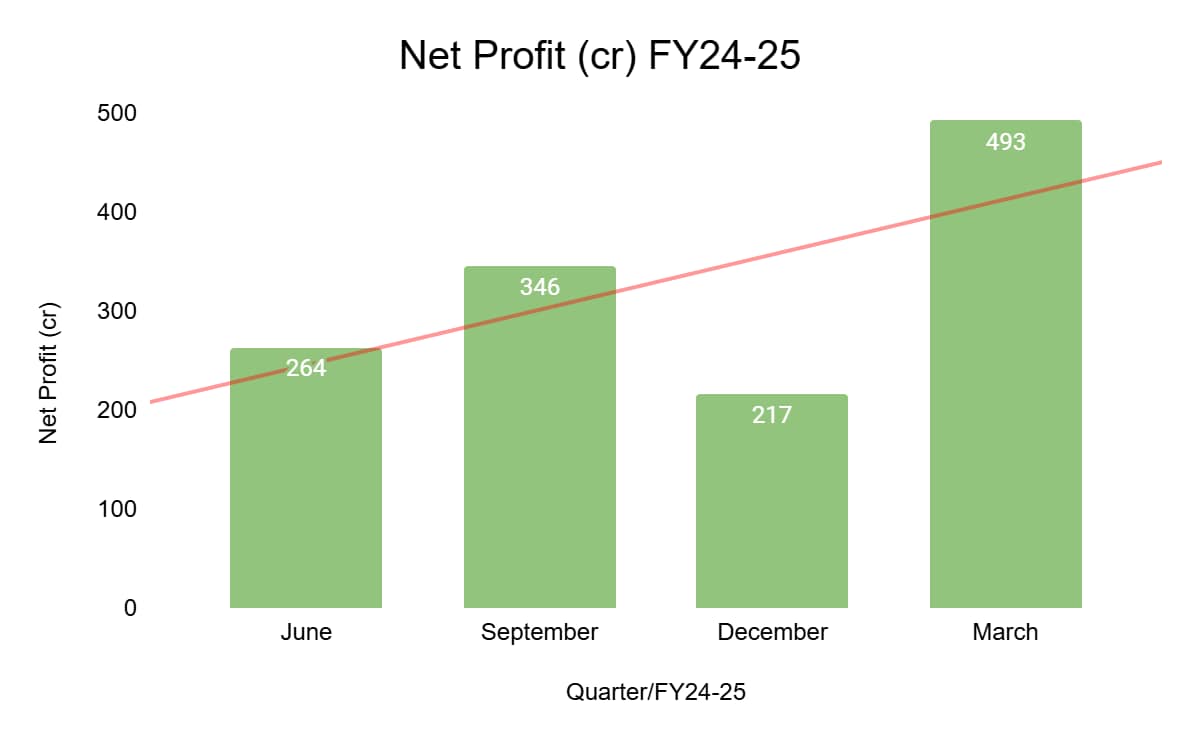

Net Profit Quarterly Growth Trends

The share price grew at a compounded annual growth rate of 119% in three years, while the return on equity (ROE) was 22%. But behind this growth lies a more complex picture.

The Tussle With NSE, F&O Pivot, and SEBI

Despite its success in equities, most of BSE’s money comes listing fees, and corporate compliance charges. And of course, it’s stake in the Central Depository Services Limited (CDSL). BSE is taking steps to break NSE’s dominance in derivatives, so that it can increase its growth.

In December 2023, to revitalise and improve its share in derivatives, BSE re-launched its derivatives segment with smaller lot sizes and broader indices (Sensex and Bankex).

The market responded with enthusiasm, so much so that BSE’s F&O volumes surged 7 times in six months. But SEBI flagged this surge as “unusually high options turnover.

Meanwhile, BSE’s market cap grew to ₹97,930 crores, with the share rising as much as 182% in the past year.

Things Investors Should Watch Out For:

Sustainable F&O Growth

The Bombay Stock Exchange (BSE) is seeing a lot of activity in its derivatives trading, but some important changes might happen soon. And some, of course, have already happened, which have dented the growth of this segment.

If the Securities and Exchange Board of India (SEBI) decides to set limits on how many weekly option trades people can make, or if it requires traders to put more money down as security, it could make trading safer but may also reduce the number of people trading in options.

These changes could mean that the BSE earns less money, which could slow down its growth. This is an important thing to watch, especially if the amount of regular stock market trading doesn’t increase as quickly.

Continued IPO and SME Listings

Over 80 mainboard IPOs sold their shares to the public for the first time in FY25, especially on the BSE. However, if these IPO valuations continue to go higher, or in case the IPO market pops, then investors may start losing interest in investing in them. If that happens, it may affect BSE’s earnings.

Overestimated CDSL Stake

Nearly 35–40% of BSE’s value comes from its holding in CDSL. If the depository business slows down, it faces tech challenges or has fee limits set by SEBI, then BSE’s value of CDSL shares could fall.

Create Competitive Moats

Most of BSE’s growth depends on becoming a key player in the futures and options market. However, if the NSE fights back with lower prices, new products, or captures more volume, then BSE’s growth drive may end.

BSE makes money by helping other companies sell their shares. Its success now depends on people buying and selling shares more, following rules that allow different opportunities to trade, and innovating to stand out from the NSE.

2. Multi-Commodity Exchange (MCX): Tech Troubles to Turnaround?

MCX is India’s leading commodity derivatives exchange, a platform where traders trade in options and futures contracts in gold, aluminium, other metals, and crude oil among other commodities.

It has a market share of 95.93% in the futures segment today. It is the seventh-largest commodity derivative and the third-largest commodity options exchange in the world.

The exchange makes money through transaction fees. The amount of money depends on the number of contracts traded in futures and options. MCX’s growth is driven by global commodity prices, domestic risk appetite, and market volatility.

In the past, MCX found its growth was limited due to its lengthy technology changeover. From 2014 to 2023, MCX used 63 Moons Technologies, formerly FTIL, as its core platform for trading, clearing, and settling trades.

In September 2023, it changed to a new in-house trading platform developed with TCS after many delays due to legal and technical issues. And during this phase, MCX sustained twice the costs of running its trading platform, which hurt its viability.

Better Starts

Moving to its new platform helped MCX launch new products, manage its clearing processes more effectively, and increase its profit margin.

Its FY25 profits went up ~575% YoY from ₹83 crore in FY24 to ₹560 crore in FY25.

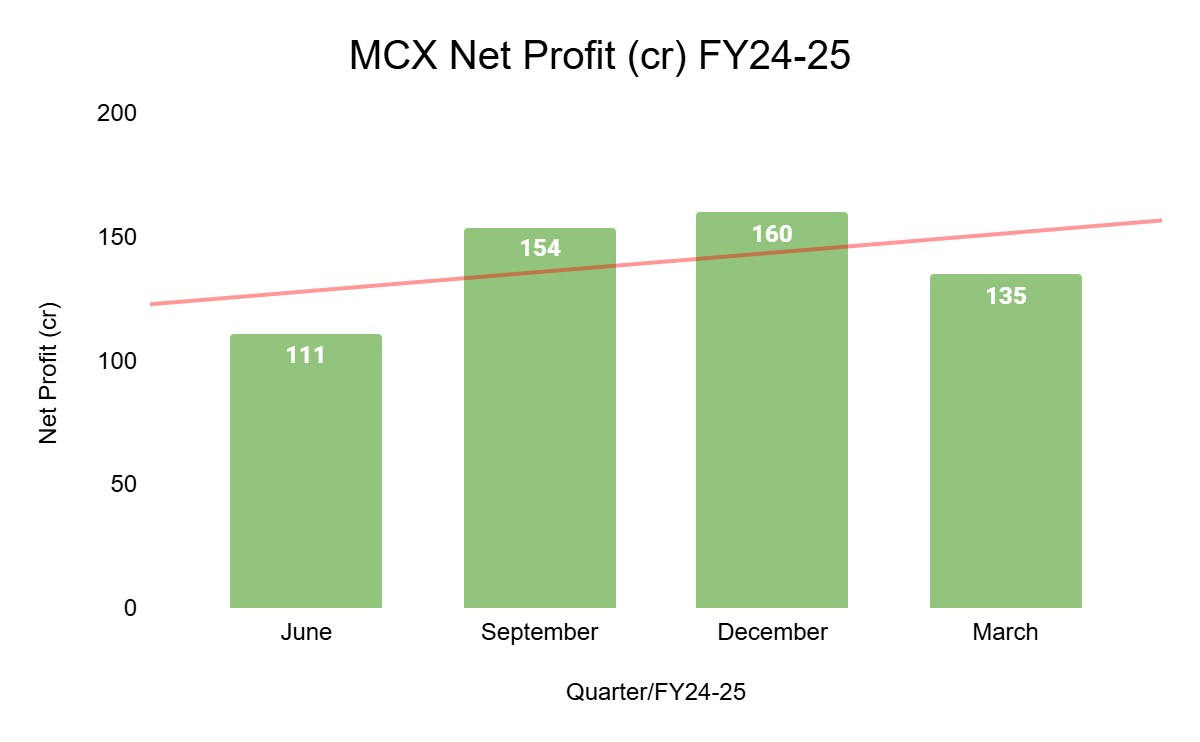

In its Q1FY26 results, it reported a ~59.4% jump YoY in its revenue to ₹373 crores. Its net profit rose to ₹203 crores, from ₹111 crores in Q1FY25. The numbers exclude exceptional items.

Net Profit Quarterly Growth Trends

With a market cap of ₹38,736 crores and a P/E of 59.4, the market has considered its growth potential to some extent. However, will MCX continue to grow? It depends on its ability to scale after changing to an in-house trading platform and capitalising on opportunities in the global commodities market.

Things Investors Should Watch Out For

Options on Metals Gaining Traction

The exchange launched options to expand into contracts like electricity and carbon credits. But these trades require strong investor interest, quick regulatory approvals, and market liquidity. Whether these changes help the metal options trades grow remains to be seen.

Competing Global Platforms

India is pushing to internationalise its commodity trade. This move could bring global players or new exchanges into the mix. Any change in institutional volumes could influence MCX’s dominant share in the commodity market.

High Dependence on Gold and Crude Oil

Around 70% of MCX’s turnover comes from just two commodities. Any global stabilisation in oil or gold prices could decrease trade interest and volumes, affecting its earnings.

Tech Boosts Scale or Eats Profit Margins

MCX’s new platform may reduce long-term dependence on vendors, but if the system requires continuous upgrades or suffers outages, the cost-savings theory could unravel.

MCX’s fundamentals may be improving, but what it needs is a steady rise in volumes, global volatility, and regulatory support to realise its potential.

3. Indian Energy Exchange (IEX)

IEX operates India’s largest electricity trading platform, enabling day-ahead, real-time, and longer-term power contracts between generators and distribution companies.

With nearly 94% market share in power spot markets, IEX has long enjoyed a virtual monopoly, thanks to its first-mover advantage, tech infrastructure, and deep liquidity.

The company’s business model is straightforward: it earns fees per megawatt-hour of electricity traded. More volumes equal more revenue and higher operational leverage.

IEX also runs the green energy and certificate markets, making it a key player in India’s energy transition.

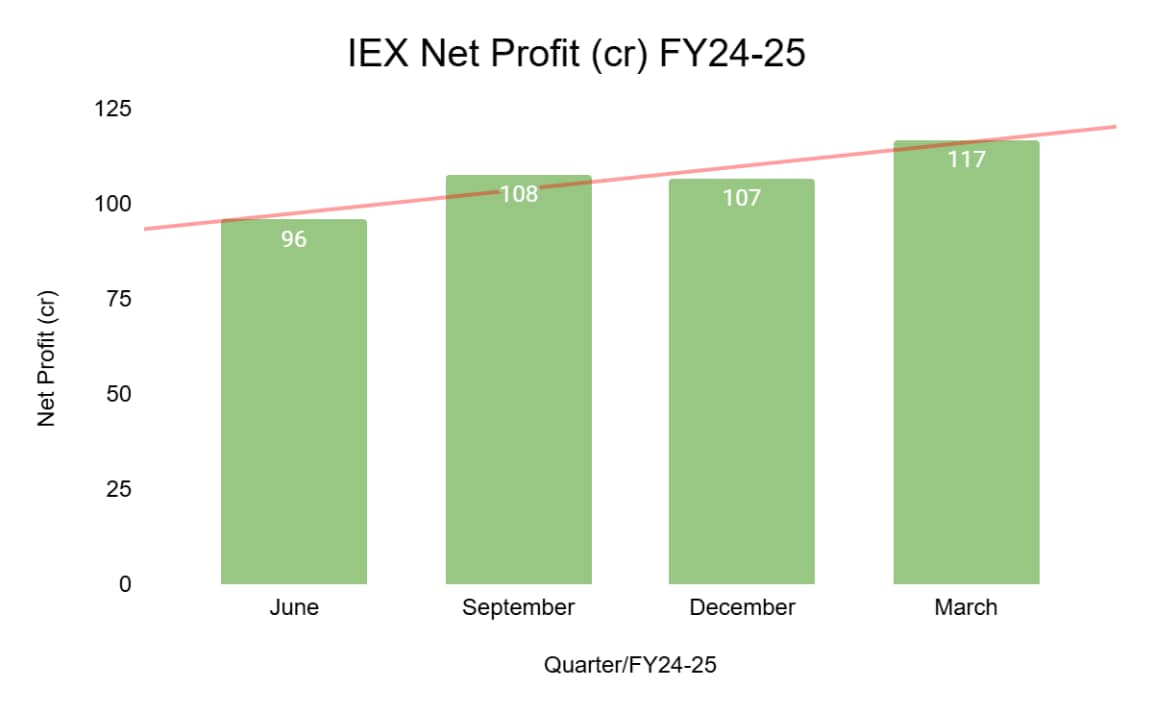

In Q1 FY26, IEX had a revenue of ₹140 crore and a net profit of ₹113 crore. The operating margin of 81% one of the highest among Indian exchanges.

What’s more, among the three listed exchanges, IEX is trading at a P/E of 27.12x while the median P/E is 43.4.

But these numbers tell only half the story.

The Market Coupling Surprise

IEX has come under pressure due to a major regulatory proposal, market coupling. India currently has multiple power exchanges (IEX, PXIL, HPX), and each runs its own auction.

SEBI’s proposed market coupling framework would create a central clearing mechanism that would aggregate all buy/sell bids from different platforms and determine a single uniform price for power across the country.

While the aim is improved price efficiency and grid stability, the economic implications for IEX are severe. It could lose control over price discovery, its key differentiator, see a drop in volumes and margins, while new rivals like PXIL and HPX could gain ground. These factors could reduce IEX’s dominance.

Investors reacted strongly, and the stock corrected nearly 30% over the past year as market coupling appears even more inevitable. The regulatory pressure from CERC and the Ministry of Power has added a layer of policy unpredictability, which may not be good news for unchallenged platforms like Indian Energy Exchange.

Things Investors Should Watch Out For

Price Coupling Uncertainty

The implementation of market coupling, where a central agency decides clearing prices instead of the exchange, could eat into IEX’s pricing power and transaction fee model. The speculation about its implementation has already affected its stock price, down over 35% from its peak.

Reforms Dilute IEX’s Prominence

If new green energy platforms (like HPX or Pranurja) gain volume share through policy support, IEX may lose its 98% market share in the power exchange space, especially as state distribution companies look for better rates.

Carbon or REC Trading Delivers Growth

IEX has invested in subsidiaries like IGX (gas trading) and seeks to monetise carbon credits and green certificates. But these markets are still emerging in India. It may take several quarters, if not years, for them to materially impact revenue.

Fixed-Cost Model Limits Upside

IEX earns ₹0.02–₹0.05 per unit traded. If volumes grow but margins shrink due to regulatory capping, then operating leverage may not translate into profit growth.

Increase in Earnings Volatility

Given the highly regulated nature of power markets, any central policy change in how prices are discovered (as proposed under market coupling) could make IEX’s earnings less predictable and reduce investor appetite.

Capitalising on India’s Market Structure

As India’s capital markets grow, these three exchanges offer unique ways to invest in the wheels behind all the trades, not just in companies, but in the platforms where economic decisions unfold every second.

BSE is growing as more people are trading with it, while MCX is getting better at handling trades after improving its technology. IEX makes a lot of money now, but it may need to follow rules that could change how it works.

NSE gets a lot of attention in the news, but these three exchanges give us a clear view of how Indian markets work and could be good opportunities for those who pay attention.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Archana Chettiar is a writer with over a decade of experience in storytelling, and, in particular, investor education. In a previous assignment, at Equentis Wealth Advisory, she led innovation and communication initiatives. Here she focused her writing on stocks and other investment avenues that could empower her readers to make potentially better investment decisions.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.