The Indian equity benchmarks, Sensex and Nifty 50, ended lower for the third consecutive day on Monday, July 28, 2025. The Nifty 50 index dipped below 24,700, while the Sensex slid past the critical psychological level of 81,000. Despite these back-to-back losses and the Nifty 50 hitting a fresh one-month low, the Relative Strength Index (RSI) has not yet entered the oversold region. Typically, an RSI reading below 30 signals an oversold condition.

Focus on Nifty India Defence Index

Amid this volatility, the Nifty India Defence Index, which had gained significant attention earlier in May 2025, saw a shift in momentum. This index, tracking stocks from the Defence sector, experienced a change in trend. As of July 28, 2025, the 14-period daily RSI for the Nifty India Defence Index slipped below 30, indicating that it has entered oversold territory. This marks a stark contrast to its performance following ‘Operation Sindoor.’

Turning Point for the Nifty India Defence Index: ‘Operation Sindoor’

The turning point for the Nifty India Defence Index occurred on May 7, 2025, when India launched ‘Operation Sindoor,’ a retaliatory strike following the Pahalgam attack. This operation targeted terrorists and terror infrastructure in Pakistan. Following this, the Nifty India Defence Index surged nearly 35 per cent from its lows on May 7, reaching a record high of 9,195.15 on June 6, 2025, in just 52 trading sessions.

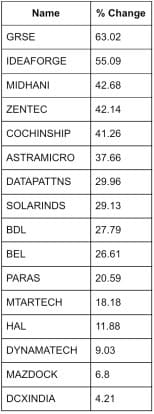

Stunning Performance by Defence Stocks: GRSE and Ideaforge Gain Over 50%

From early May to June, during the record-high rally of the Nifty India Defence Index, all of its constituents delivered positive returns. Among the top performers were Garden Reach Shipbuilders & Engineers (GRSE) and Ideaforge Technology, with returns of 63 per cent and 55 per cent, respectively.

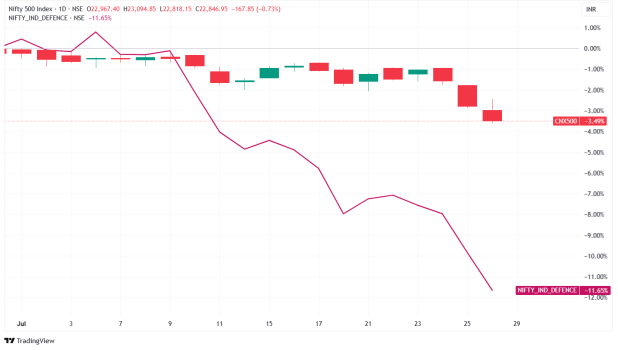

Nifty India Defence Index Corrects 15% from Record High, Enters Oversold Region

After hitting record highs in June 2025, the Nifty India Defence Index has corrected by over 15% in just 32 trading sessions. As a result of this decline, the 14-period RSI has now entered the oversold region, falling below the level of 30, and has dropped below the level seen during the ‘Operation Sindoor’ phase. Additionally, the Defence Index is now trading below its important short-term averages, such as the 50-day and 20-day moving averages (DMA).

50% of Defence Stocks in Oversold Territory

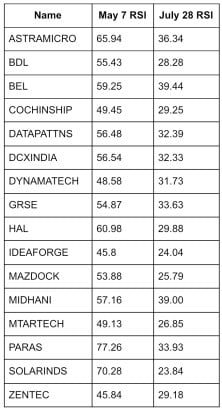

As of July 28, 2025, approximately 50 per cent of the constituent stocks of the Nifty India Defence Index were trading in oversold territory. Notably, Ideaforge Technology, which had been one of the top gainers post ‘Operation Sindoor,’ is now among the stocks in oversold conditions. Other significant defence stocks, including Hindustan Aeronautics (HAL), Bharat Dynamics (BDL), and Cochin Shipyard, have also seen their RSI fall into the oversold range.

Defence Stocks RSI Comparison: May 7 vs. July 28

Here is a comparison of the RSI levels of key defence stocks on May 7, 2025 (following ‘Operation Sindoor’) versus their levels on July 28, 2025:

All the stocks in the Nifty India Defence Index now have an RSI below the level seen during the ‘Operation Sindoor’ phase

Defence Index Underperformance in July

A comparative analysis between the Nifty India Defence Index and the Nifty 500 index reveals that the Defence Index drastically underperformed in July 2025. The Nifty India Defence Index fell by 11.65 per cent, while the Nifty 500 index saw a decline of 3.49 per cent. This highlights a significant underperformance of the Defence Index relative to the broader market in July.

Is Now the Right Time to Accumulate Defence Stocks as Many Enter Oversold Territory?

While the RSI is an important indicator, it is not the sole parameter to consider when deciding to accumulate stocks, as the RSI can remain in oversold territory for extended periods. That said, the Nifty Defence Index is approaching a crucial support level based on the 61.8 per cent retracement of the recent uptrend from the May low to the June high. If the index forms higher highs and higher lows, coupled with the RSI crossing above its 9-day moving average, it could signal that the declining trend is about to reverse.

Disclaimer: The article is for informational purposes only and not investment advice.

Dalal Street Investment Journal (DSIJ) is India’s most trusted financial media

company, providing expert stock recommendations, market insights, and wealth-

building strategies for nearly four decades. To know more about DSIJ, visit here.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.