The big buzz in the power sector right now is about nuclear energy. India wants to lift nuclear capacity from under 9 GW right now to 100 GW by 2047. That is a very long build cycle. Keeping that in mind, the Department of Atomic Energy has asked the government to give nuclear power the same kind of support that renewables get. Things like GST relief, green-financing access and easier project clearances.

The idea is simple. If nuclear is also clean energy, then it should not be taxed and financed like a high-risk sector.

While solar and wind components saw GST slashed from 12% to 5% in the September 2025 reforms, nuclear equipment often remains stuck in the 18% bracket. Closing this 13% tax gap is vital; for a sector where a single plant can cost Rs 40,000 crore, this parity could unlock billions in immediate capital efficiency.

For companies in the nuclear supply chain, this sounds like an important shift. Today, many projects move slowly because costs are high and approvals take time. If taxes come down and financing gets cheaper, project execution can pick up pace. That also means better visibility on future orders and longer-term work pipelines.

There is also a bigger opportunity here. The 2024-25 Union Budget has pivoted toward ‘Bharat Small Reactors’ (BSRs)—indigenous 220 MW units designed for faster deployment.

The ₹20,000 Crore Small Modular Reactor (SMR) Pivot

With a ₹20,000 crore allocation under the Nuclear Energy Mission, these SMRs (Small Modular Reactors) are the key to bringing private players like Tata Power and Reliance into a previously PSU-only domain. If policy support improves, these companies could see steadier demand instead of stop-and-start project activity.

That is why we have kept our stock list very focused. We have chosen companies that are closely tied to the nuclear ecosystem and have worked on core plant systems for many years. Their role is not peripheral or one-off. They are long-term partners in the program, with high entry barriers and proven execution history.

#1 Larsen and Toubro (L&T): The Infrastructure Pivot Toward Nuclear

Larsen and Toubro (L&T) is a multinational conglomerate which is primarily engaged in providing engineering, procurement and construction (EPC) solutions in key sectors such as infrastructure, hydrocarbon, power, process industries and defence, information technology, and financial services in domestic and international markets.

L&T: Managing a ₹6.7 Lakh Crore Order Book

Larsen & Toubro reported steady progress in Q2 FY26.

The company said group revenue rose 10.4% year-on-year (YoY) to Rs 67,987 crore. Consolidated net profit increased 16% YoY to Rs 3,900 crore. The order book stood at Rs 6.7 lakh crore, 31% higher than last year. This gives better visibility for execution in the coming quarters.

International business made up 56% of the revenue. The company also reported an improvement in working-capital efficiency and return on equity.

Growth at present is coming from large hydrocarbon and infrastructure projects. The company is also expanding capacity in thermal and nuclear-adjacent engineering, and has seen a higher share of private-sector domestic orders. L&T secured ultra-large hydrocarbon orders in the Middle East and is chasing opportunities in gas, renewables and grid networks.

It has also signed partnerships in defence, semiconductors and green energy, including green ammonia projects. Management said execution is on track, and expects a stronger second half of FY26. Hydrocarbon margins may stay soft for some time as older projects move toward closure.

If nuclear projects receive renewable-style incentives such as faster approvals, lower costs and easier financing, it could help projects move faster and at larger scale. That would support steadier demand for engineering and equipment work in areas where L&T is already building capacity and executing long-cycle projects.

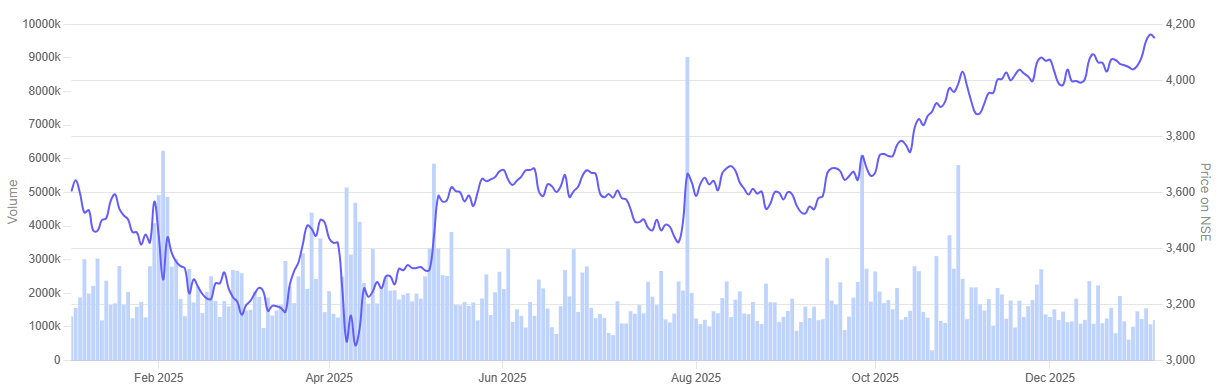

In the past year, Larsen Toubro share price is up 15.2%

Larsen Toubro 1 Year Share Price Chart

#2 Walchandnagar Industries: A High-Risk Turnaround Play?

Incorporated in 1908, Walchandnagar Industries is in the heavy engineering and foundry & machine shop business.

Walchandnagar Industries showed some improvement in Q2 FY26.

Revenue from operations was Rs 51.8 crore, which is lower than 68 crore reported in a year ago period. However, the company reported a net loss of Rs 12 crore, which is more than 11 crore loss reported in Q2 FY25. However, this was the second straight quarter of positive operating performance. Management said cash flows in the first half improved because of tighter working-capital control.

Walchandnagar’s DNA: Defence, Nuclear, and Aerospace Shift

The company is gradually moving its business mix toward defence, nuclear and aerospace (DNA) programs. These segments now form a larger share of its active pipeline. Management also expects fresh orders in the second half of the year, along with repeat work from existing programs.

Investors should note that the company’s performance has been volatile in recent years, with uneven margins and lumpy execution. The foundry division remains weak, and profitability is still sensitive to project timing.

If nuclear projects receive renewable-style policy support — lower costs, easier financing and faster clearances — project execution may become smoother over time. For Walchandnagar, this could mean more steady work in long-cycle nuclear manufacturing, instead of uneven or stop-start orders.

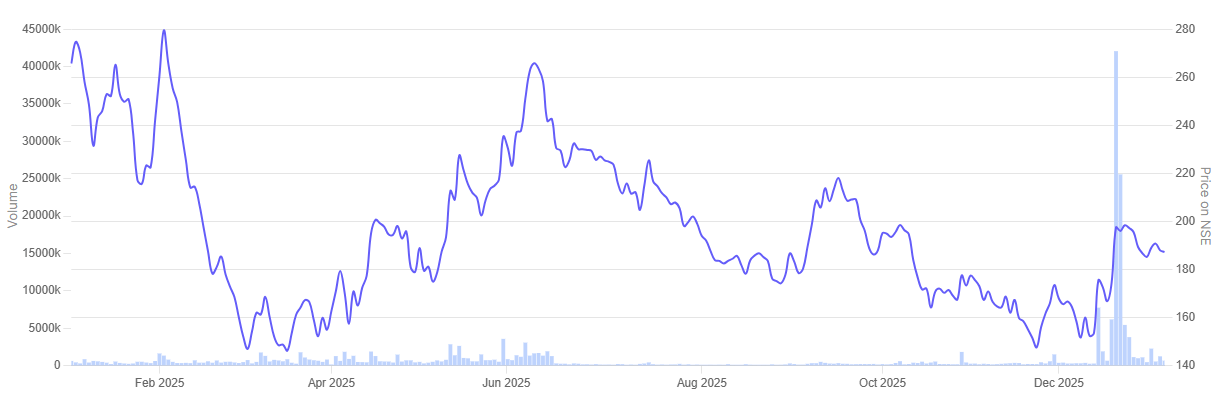

In the past year, Walchandnagar Industries share price tumbled 30.6%

Walchandnagar Industries 1 Year Share Price Chart

#3 MTAR Technologies: Precision Engineering for the 100 GW Goal

MTAR Technologies develops and manufactures components and equipment for the defence, aerospace, nuclear and clean energy sectors. The company was incorporated to cater to the technical and engineering needs of the Indian government in the post embargo regime.

MTAR Technologies reported revenue of Rs 135 crore in Q2 FY26. This was lower than Rs 190 crore in the same quarter last year. Profit after tax was Rs 4.2 crore, compared with Rs 18.8 crore a year earlier. The company said the decline was mainly due to inventory build-up and orders that are scheduled for execution in the coming quarters.

Management expects a stronger second half, with sales in H2 likely to be almost twice the first-half level. The company has increased its full-year revenue growth guidance to 30–35 per cent. This is supported by firm order inflows that are planned for execution within FY26.

The order book stood at about Rs 1,296 crore at the end of Q2 and rose to nearly Rs 1,703 crore by early November after new orders were added. MTAR expects the year-end order book to be close to Rs 2,800 crore, led by clean-energy, nuclear and space programmes.

MTAR: Precision Engineering for the Kaiga 5 & 6 Fleet

Civil-nuclear work is emerging as a key growth driver for the company. MTAR expects about Rs 500 crore of fleet-reactor orders for Kaiga 5 and 6, along with refurbishment-related work and other packages in the nuclear division. This could take total nuclear orders this year to around Rs 800 crore. Execution is expected to run over the next three years.

If nuclear projects receive renewable-style incentives such as faster approvals, lower project costs and easier financing, project execution may become smoother. For MTAR, this could mean steadier demand in high-precision nuclear and clean-energy manufacturing, although quarterly results may still depend on program schedules.

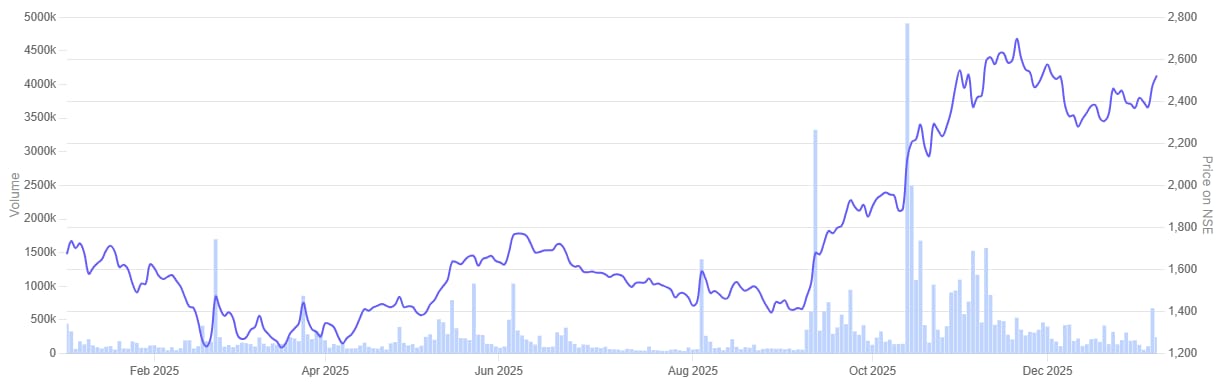

In the past year, MTAR Technologies share price rallied 51.6%

MTAR Technologies 1 Year Share Price Chart

#4 Bharat Heavy Electricals (BHEL): Scaling the Thermal-Nuclear Hybrid Model

Bharat Heavy Electricals is an integrated power plant equipment manufacturer engaged in design, engineering, manufacture, erection, testing, commissioning and servicing of a wide range of products and services for the core sectors of the economy, viz. power, transmission, industry, transportation, renewable energy, oil & gas and defence.

Bharat Heavy Electricals reported a steady quarter in Q2 FY26.

Revenue from operations was Rs 7,512 crore, 14% higher the revenue reported in same quarter last year. Profit after tax jumped 279% to Rs 368 crore on a YoY basis. Profit jumped significantly due to margin expansion and reduced provisions.

The company’s outstanding order book at the end of September 2025 was a little over Rs 2.2 lakh crore. Most of this comes from the power business, while the rest is from industry and export projects. Order inflows in the first half crossed Rs 35,000 crore, supported by thermal power equipment, solar projects, transformers, railway systems and industrial BTG packages.

During the quarter, BHEL also achieved several execution milestones across thermal, hydro and industrial projects.

The company extended its memorandum of understanding with Nuclear Power Corporation of India (NPCIL) for collaboration on pressurized heavy water reactor (PHWR) based nuclear power plants. It also continued work across defence, railways, space and clean-energy programs.

If nuclear projects receive renewable-style incentives such as faster approvals, lower costs and easier financing, it may help improve project visibility and execution timelines. For BHEL, this could mean steadier opportunities in nuclear-linked equipment and project work over time, alongside its existing power and industrial business.

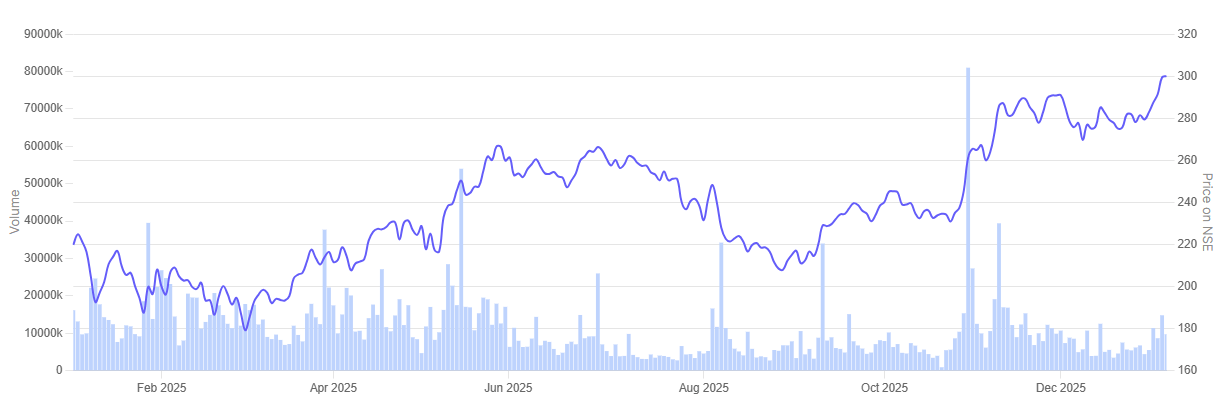

In the past year, Bharat Heavy Electricals share price surged 36.5%

Bharat Heavy Electricals 1 Year Share Price Chart

Valuation

Let’s now turn to the valuations of the companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of Companies in focus

| Sr No | Company | EV/EBITDA | Industry Median | ROCE |

| 1 | Larsen and Toubro | 17.5 | 18.3 | 14.5% |

| 2 | Walchandnagar Industries | NM | 16.1 | -8.3% |

| 3 | MTAR Technologies | 65.8 | 18.1 | 10.5% |

| 4 | Bharat Heavy Electrical | 58.4 | 28.1 | 4.9% |

Larsen & Toubro trades at an EV/EBITDA of 17.5, which is quite close to the industry median of 18.3. Its ROCE is 14.5 per cent. This shows that the business is running fairly efficiently and generating steady returns. The stock is not very cheap, but the valuation seems in line with its scale and stable earnings profile.

Walchandnagar Industries stands out for a different reason. It has a negative EBITDA and therefore its EV/EBITDA is not meaningful. It’s ROCE is –8.3 per cent. This is mainly because of losses and uneven margins over the past few years. The company remains important from a strategic and program-linked point of view, but the financials are still weak and the risk level is higher.

MTAR Technologies trades at a much higher multiple. Its EV/EBITDA is 65.8, compared with an industry median of 18.1, while ROCE is 10.5 per cent. A large part of this valuation already reflects expectations of future growth from clean-energy, space and nuclear manufacturing. Investors here seem to be paying up for what the business may deliver over the long term.

Bharat Heavy Electricals also trades at a premium. Its EV/EBITDA is 58.4 against an industry median of 28.1, and ROCE is 4.9 per cent. The rerating appears to be driven by the revival in power-equipment demand and a stronger order pipeline, even though returns are still on the lower side.

Taken together, the broader policy and capex outlook looks encouraging for these companies. But investors may still need to think about how much of the future growth story is already reflected in current valuations.

Conclusion

India’s nuclear push is still at an early stage, but the conversation around it is getting stronger. The companies linked to this supply chain are also starting to come into focus. Each of them plays a different role — some are large and diversified, while others are small, specialised or strategically placed.

The financial picture, however, is not uniform. Some businesses have stable earnings and healthy returns, while others are still dealing with weak margins or uneven performance. In a few cases, the stock price already seems to reflect a lot of future expectations.

So, the opportunity is there, but it is likely to play out over time. Investors may need to look beyond the theme and pay close attention to valuations, execution strength and financial comfort before deciding.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.