Called the ‘Big Whale’ of the Indian stock markets, Ashish Kacholia is known for his investments specially in midcap and smallcap stocks. According to trendlyne.com, he currently owns 48 stocks in his portfolio, with a net worth of over Rs 2,766 cr. He holds shares across diverse sectors like hospitality, education, infrastructure and manufacturing etc.

What is intriguing is that Kacholia is holding 2 microcap stocks in his portfolio that are trading at a discount of over 60% from their all-time high prices. There seems to be panic among investors. But Kacholia (at least till the data is available) seems to be holding firm.

Here is everything you need to know about these 2 stocks.

TBI Corn Ltd

Incorporated in 2000, TBI Corn Ltd is a manufacturer and exporter of corn-based products like cleaned and fat-free corn grits, corn meal, corn brewery grits, stone free broken /cracked /crushed maize & corn flour and corn flakes, turmeric finger.

With a market cap of Rs 216 cr, the company sources the highest quality raw maize from Northern Karnataka and Andhra Pradesh, which accounts for 38% of India’s total maize cultivation.

Ashish Kacholia has been holding a stake in TBI Corn since its listing in June 2024 as per data available on Trendlyne.com. Currently he holds a 4.2% stake in the company worth Rs 9 cr.

The company’s sales have grown from Rs 115 cr for the reported 9 months in FY23 to Rs 212 cr in FY25, which, after adjustment of the tenure difference, is still solid growth.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for TBI Corn in the same period grew from Rs 11 cr to Rs 24 cr.

The net profits grew from Rs 6 cr in the 9 months reported for FY23 to Rs 14 cr in FY25, which is again solid growth.

However, despite the strong financials, the share price has moved the other way, as it trades at a huge discount to its highs.

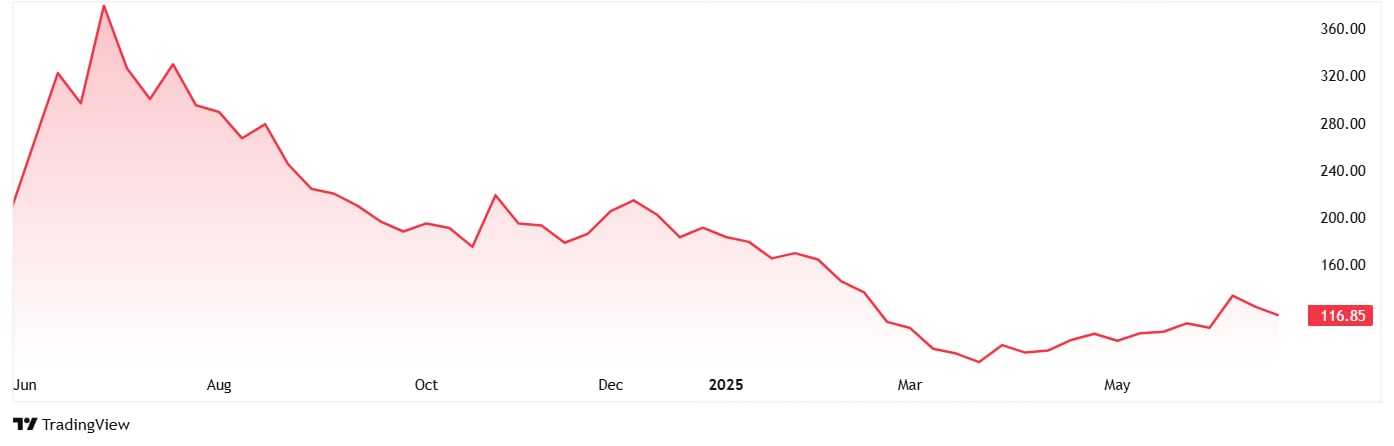

The share price of TBI Corn Ltd was about Rs 208 when listed in June 2024 and is currently Rs 119 as of closing on 25th June 2025. That is a drop of 43%.

At the current price of 119, the stock is trading at a discount of 70% from its all-time high of Rs 399.

The company’s share is trading at a current PE of 16x, while industry median is 19x. The 10-year median PE for the industry is 20x.

The company in August 2024, set-up a wholly owned subsidiary company under the name M/s. Agripivot Ventures Private Ltd. It also has a manufacturing plant in Sangli, Maharashtra, with an installed capacity of 4,500 tons per month.

BEW Engineering Ltd

Incorporated in 2011, BEW Engineering Ltd designs and manufactures special range of filtration mixing and drying equipment.

With a market cap of Rs 221 cr the company designs and manufactures a special range of filtration, mixing, and drying equipment specifically used in Pharmaceuticals, Sterile Applications, Intermediate Compounds, Fine Chemicals, Chemicals, Agro Chemicals, Pesticides, Insecticides, Dyes, and Food Products.

Kacholia has been holding a stake in the company since June 2023 and currently holds 9.3% stake in the company worth Rs 21 cr, split across his personal portfolio and his companies – Dar’s Business Finance Pvt Ltd and Suryavanshi Commotrade Private Limited.

Madhulika Agarwal, wife of another Warren Buffett of India, Mukul Agarwal, also holds a 4.2% stake in the company apart from Kacholia.

The company’s sales jumped from Rs 59 cr in FY20 to Rs 134 cr in FY25, logging in a compound growth of 18% in the last 5 years.

EBITDA for BEW Engineering Ltd has grown at a compound rate of 38% from Rs 4 cr in FY20 to Rs 20 cr in FY25.

As for the net profits, the company logged in a compound growth of 79% in the last 5 years, from Rs 1 cr in FY20 to Rs 12 cr in FY25.

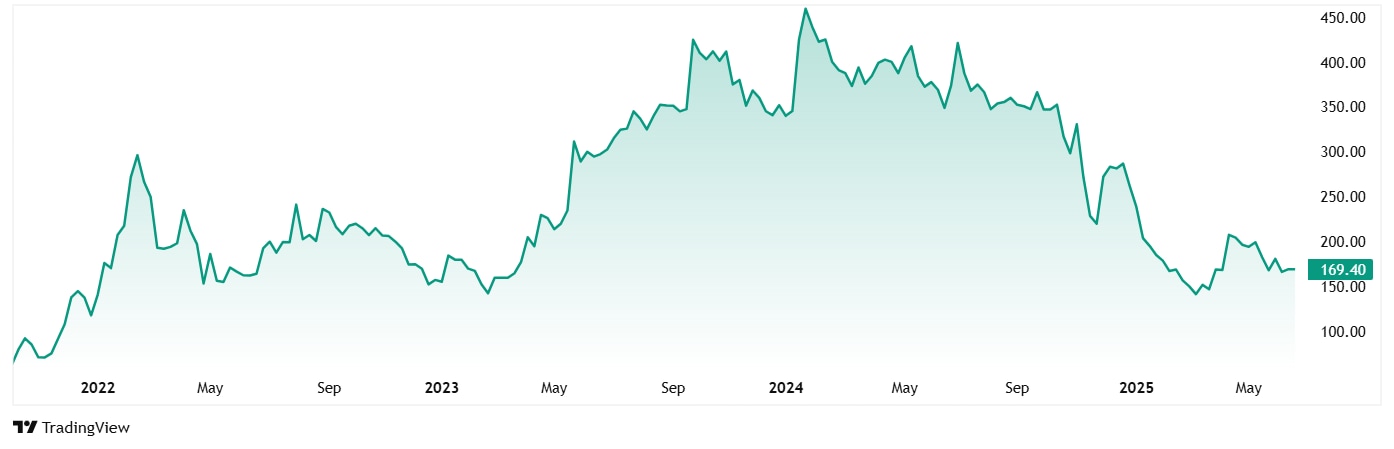

The share price of BEW Engineering Ltd was around Rs 35 when listed in October 2021, as of closing on 25th June 2025, the price was Rs 169, which is a jump of 383%.

Anow even after the overall jump of over 280%, the current price of Rs 169, the company’s share is trading at a discount of 65% from its all-time high of Rs 484.

The share is trading at a PE of 18x, while the industry median is 23x. As the company has been listed just in 2021, its long-term median PE will not be very useful, but the 10- year industry median is 24x.

As of H1FY25, the company had an order book of Rs 90 cr. The company expects the order book to grow to Rs 150 cr by the end of FY25, with filter dryers making up 70% of the order composition.

Buy Opportunity or a Trap?

While Ashish Kacholia is not known to be someone who makes rash decisions, the decision to hold on to these less known stocks despite of the big fall from all time high prices does raise a lot of questions in the minds of the average investor.

Will Kacholia buy more of these stocks at the current discounts, or will he exit them while he still can. That is a part of his strategy that only he knows. But it will be interesting to watch how things unfold after the quarterly filings start rolling in July.

Will TBI Corn Ltd and BEW Engineering Ltd keep Kacholia interested for longer? The only way to find out is to add these stocks in the watchlist and keep an eye on them.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.