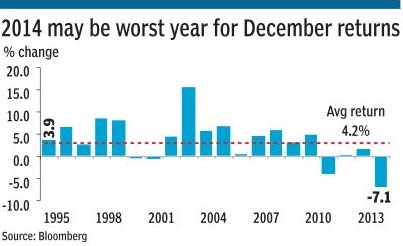

On the back of the global concerns-led collapse of the Indian equity market in the last eight trading sessions, this month may be the worst December for Indian equities in the last 20 years.

As the 30-share Sensex retreated from its record high of 28693.99 on November 28, so far the benchmark has lost close to 7%. If it continues to lose momentum and ends the year anywhere below the 27,000 mark, it would be the poorest performance of the index during December since 1995.

Data compiled by FE shows that with an average market return of 4.2%, December has traditionally been the best month of equity return in India. Even in terms of foreign purchases of stocks, since 1999 there have been only two years (2000 and 2006) when FIIs have sold equities through December ($88 million and $806 million) . Between 2004-2013, the average FII net buying in December stood at $1.4 billion while the last two years have been exceptionally good with net FII buying of $4.4 billion and $2.5 billion respectively.

This trend may reverse in 2014 given that excluding December 8 when the Infosys founders sold close to $1 billion worth of stake in open market, FIIs have so far sold Indian equities worth $ 506 million.

Historically while financials, materials and utilities have led the markets in December, this year during December the correction has been led by Tata Steel (-17%), Tata Power (-15%), Hindalco (-15%), BHEL(-13%), Sesa Sterlite (-13%) and RIL (-12%).

Recent correction notwithstanding, the Street remains optimistic about 2015 as they factor in impending interest rate cuts, recovery in earnings growth and government’s policy actions into their expectations.

Earlier this month, three foreign brokerage including Citi, Morgan Stanley and Macquarie Securities released their 2015 market outlook that set forth 14-16% gains in the benchmark indices for the year.

This week, BNP Paribas reiterated its overweight stance on India for 2015 in its Asia strategy as the foreign brokerage cited its preference for markets that benefit from lower commodity prices or policy transition.