India is the second largest cement producer globally, with a current installed capacity of more than 620 Million Tonnes Per Annum (MTPA). Cement is one of the core sectors for a particular country’s economic development. One that is highly correlated with GDP growth, infrastructure spending, and the housing market. That also makes it cyclical in nature.

The sector is characterized by its regional nature due to high freight costs, significant energy intensity, and ongoing consolidation, with the top 3 players controlling over 50% of the market.

Let us understand the nuances of this sector.

The cement value chain

The process of making cement is fundamentally about transforming limestone into a fine powder with binding properties.

Inputs & Process

The core process involves mining limestone, crushing it, and heating it at very high temperatures (~1450°C) in a kiln to produce an intermediate product called clinker. This clinker is then cooled and ground with gypsum and other additives (like fly ash or slag) to produce the final cement.

The economics of a cement bag: A game of freight and fuel

It is also important to understand the cost structure of cement. Cement sells for about Rs 350-400 per bag. Each bag is 50 kgs in weight. That means the retail price of cement will be about Rs 7-8 per kg. However, this includes the distributor and retailer margin. For the company, the realization works out to close to Rs 5.5 per kg, or Rs 5,500 per tonne. This makes cement a bulk commodity, where cost control becomes very important for firms to keep profitability intact.

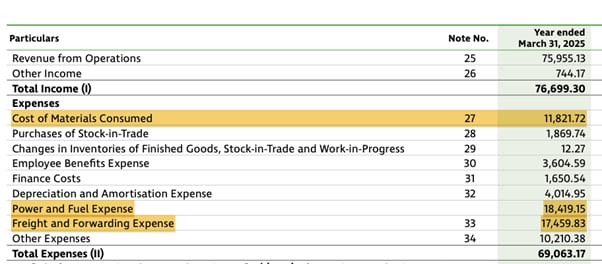

If you look at the cost structure of a cement firm, the key costs are Power & Fuel, Freight, and Raw Materials (Example – Ultratech Cement’s P&L Snapshot below)

If we were to calculate on a per kg basis, the following would be the approximate costs

- Power and Fuel ~ Rs 1.4 per kg

- Freight ~ Rs 1.3 per kg

- Raw Material ~ Rs 1 per kg

Typical Earnings before interest, tax, depreciation and amortization (EBITDA) Margin is around 15-20%, which also translates into Rs 1-1.3 per kg.

It becomes obvious, that this is a bulk commodity, that cannot be transported long distances, because the freight cost may become unviable. This makes cement a regional play. A player in South India will only cater to Southern Regions, while another in North, will cater to northern regions.

Given the bulk nature of the commodity, and the fact that freight is a big cost, even the raw material providers tend to be close to the company production facilities.

It also means that cement cannot be exported over long distances.

An Oligopoly in the making: Why a few giants dominate the market

Cement capacity expansion has a gestation period. Due to this, it is easier for an existing player to buy another player. This has resulted in a wave of consolidation in the sector. The top 2 players have been on a buying spree. Ultratech now has nearly 185 million tonnes as capacity, and Ambuja Cements is close to 100 million tonnes.

Another interesting observation is with the industry structure.

The industry exhibits what is commonly known as an Oligopoly – few large players, and lots of small players. This also results in some sort of implicit agreement, where players do not engage in aggressive price wars. They tend to manage supply by using less of their capacity, rather than operate at 100% utilization, and risk price erosion. Interestingly, almost all firms use 70-80% of their capacity, rather than trying to produce more, and risk a price war.

Also, larger a firm becomes, higher its pricing control and power, and hence ability to manage margins. The smaller firms with higher cost structures cannot afford to get in pricing war with the market leaders.

The foundation of demand: Housing today, infrastructure tomorrow

Predominant amount of cement used in India is in housing and construction, making it linked to the housing sector for its growth. There is hope that with government boosting capital expenditure, a larger usage of cement will happen in infrastructure development. But for now, it remains a product that is dependent on housing growth. Schemes such as PMAY and urbanisation are key drivers.

To aid all these, supply is also coming up. Current cement capacity stands at around 640 million tonnes, and this is expected to grow upto around 840-850 million tonnes by the end of this decade. Most of these will be by the larger players, further consolidating the industry. However, the rapid pace of capacity addition is likely to keep utilizations around 75% or so for this decade.

A sector that grows with India’s growth

It is expected that cement demand will steadily increase in the coming decade. With India poised to massively increase its expenditure in infrastructure, cement would be a sector to watch out for. While valuations remain rich, the predictability and stability of earnings may keep the interest in the sector high.

Cement isn’t just a building material.

It’s the backbone of India’s economic journey.

Dig deeper into the cement sector:

>> List of Cement Sector Stocks in India

>> Screen for the Best Cement Stocks in India

>> Latest news on Cement Sector

Note:

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Peeyush Chitlangia runs a firm FinShiksha, that specializes in financial education

and content design. An Alumnus of IIM Calcutta; MNIT Jaipur, Peeyush has been in the financial services industry for the last 21 years; has extensive exposure to Equity Research, Investment Analysis; Financial Modeling, along with training. Peeyush is also a CFA Charterholder.