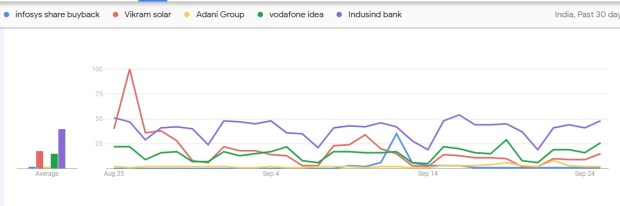

From Infosys’ largest-ever share buyback to the Adani Group getting a clean chit from SEBI in the Hindenburg case, these companies have made headlines, dominated the top trends and have been among the most searched on Google over the past month in India business news.

Infosys: Record Rs 18,000 crore share buyback

On September 11, IT services giant Infosys announced its largest-ever share buyback programme worth Rs 18,000 crore.

Infosys said it will buy back 10 crore fully paid-up equity shares of a face value of Rs 5 each, representing up to 2.41 per cent of the total paid-up equity share capital, at Rs 1,800 per share. This reflects a premium of around 19 per cent over the previous day’s closing price of Rs 1,509.5 apiece on the BSE.

With this, Infosys matches the biggest-ever share buyback programme of IT major TCS announced in 2022. TCS had then bought back 4 crore equity shares at a price of Rs 4,500 per share for an aggregate consideration of Rs 18,000 crore.

Infosys launched its first buyback in 2017, purchasing 11.3 crore shares (4.92 per cent of equity) for about Rs 13,000 crore at Rs 1,150 apiece. This was followed by buybacks worth Rs 8,260 crore in 2019, Rs 9,200 crore later, and Rs 9,300 crore in FY23. The 2022 buyback was done via the open market route at a maximum price of Rs 1,850 per share.

Vikram Solar: New order win and strong IPO debut

The Rs 2,079-crore IPO of Vikram Solar opened on August 19 and was subscribed 1.52 times on Day 1. The issue, priced at Rs 315–332 per share, included a fresh issue of Rs 1,500 crore and an OFS of Rs 579 crore, with proceeds aimed at funding projects under its subsidiary VSL Green Power.

The company also has secured a 200 MW order on Sept 15 from AB Energia to supply high-efficiency M10R N-Type TOPCon solar modules, each rated at 590 Wp and above. On Sept 8, the company had also bagged a 336 MW order from L&T Construction to supply its advanced Hypersol G12R N-type solar modules for deployment in Khavda, Gujarat.

Adani Group: SEBI clean chit

On Sept 18, the Securities and Exchange Board of India (SEBI) cleared the Adani Group and its associated entities of all allegations made in the Hindenburg case, stating that the charges “are not established.” The regulator said there was no breach of disclosure norms and clarified that the broader definition of related-party transactions, introduced in 2021, could not be applied retrospectively. The case, which began on Jan 24, 2023, had impacted the company’s image and investor sentiment.

In his address to shareholders after SEBI’s clean chit, Adani Group Chairman Gautam Adani said, “The Securities and Exchange Board of India (SEBI) delivered a resounding and unequivocal verdict dismissing the allegations against us.”

Vodafone Idea: Supreme Court to hear plea on AGR dues September 26

The Supreme Court is scheduled to hear Vodafone Idea’s plea seeking to quash additional adjusted gross revenue (AGR) demands for the period up to 2016-17 on September 26. The company has asked the Department of Telecommunications (DoT) to re-assess and reconcile its AGR dues under the 2020 Deduction Verification Guidelines.

Earlier, the apex court had dismissed pleas by telcos, including Vodafone Idea, to rectify alleged errors in AGR calculations, and in 2020 had set a 10-year timeline for clearing Rs 93,520 crore in dues.

Vodafone Idea was also in news this month as it announced the roll out of its 5G services in Kolkata from September 5, making it the second city in West Bengal after Siliguri to get access. The launch is part of Vi’s phased 5G expansion across its 17 priority circles, which already include cities like Mumbai, Delhi-NCR, Bengaluru, and Pune.

IndusInd Bank- New appointment

IndusInd Bank appointed Viral Damania as its chief financial officer on Sept 22, effective immediately, marking another key leadership move after a $230 million accounting hit earlier this year triggered a management shakeup. Veteran banker Rajiv Anand recently took charge as CEO for a three-year term, while Santosh Kumar continues as deputy CFO.

The $230 million hit, linked to years of misaccounting of internal derivative trades in FY25, led to the resignations of former CEO Sumant Kathpalia and deputy Arun Khurana, who was also relieved of CFO duties in April.