Fixed Deposits (FDs) are a popular and secure investment option, offering a fixed interest rate for a specified period. However, with interest rates fluctuating, maximising returns on FDs requires strategic planning.

Here are some effective ways to enhance your FD returns:

Interest Rates and Tenure

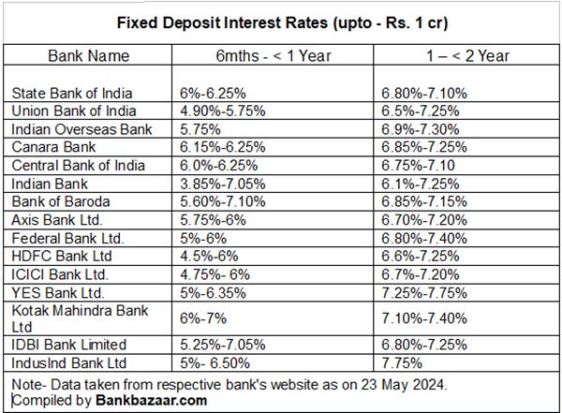

Interest rates on FDs vary significantly between banks and financial institutions. It is crucial to compare rates across different providers before investing. Private banks, public sector banks, and non-banking financial companies (NBFCs) often offer different rates.

FD interest rates are linked to the tenure of the deposit. Generally, medium-term deposits (1-3 years) offer better rates than short-term or long-term deposits. Assess your financial goals and choose a tenure that not only matches your needs but also provides the best interest rate. Avoid locking in funds for unnecessarily long tenures, as it reduces liquidity and can lead to lower returns if rates rise in the future.

Also Read: Hike in short-term fixed deposit interest rates: Opt for a laddering strategy

Opt for Cumulative FDs

Cumulative fixed deposits reinvest the interest earned, thereby benefiting from compound interest. This option can significantly enhance returns over time, as the interest earned is added to the principal and further earns interest. Non-cumulative FDs, on the other hand, pay out interest at regular intervals and do not offer the same compounding benefit.

Laddering Your Investments

Laddering involves spreading your investment across multiple FDs with different maturity periods. This strategy provides liquidity at regular intervals and reduces the risk of reinvestment at lower rates. For example, instead of investing ₹1,00,000 in a single 5-year fixed deposit, you could invest ₹20,000 each in 1-year, 2-year, 3-year, 4-year, and 5-year FDs. As each FD matures, you reinvest in new FDs, potentially at higher rates.

Senior Citizen Benefits

Senior citizens often receive higher interest rates on FDs, typically 0.25% to 0.50% more than regular rates. If you are a senior citizen or investing on behalf of one, take advantage of these higher rates. Additionally, some banks offer special FD schemes for senior citizens with even better returns.

Tax-Saving FDs

Tax-saving FDs offer the dual benefit of earning interest and saving tax under Section 80C of the Income Tax Act. These FDs have a lock-in period of 5 years and are suitable for investors looking to reduce their taxable income. While the interest earned is taxable, the principal amount invested can reduce your taxable income by up to ₹1.5 lakh.

Regularly Monitor Interest Rates

Interest rates are subject to change based on economic conditions and RBI policies. Stay informed about rate changes to take timely action. If interest rates are expected to rise, it might be wise to invest in short-term FDs and reinvest at higher rates later. Conversely, if rates are expected to fall, locking in long-term FDs at current rates could be beneficial.

Corporate FDs

Corporate FDs offered by reputable companies often provide higher interest rates than bank FDs. However, they come with higher risks. Ensure the company has a high credit rating before investing. Diversifying across multiple high-rated corporate FDs can mitigate risks while enhancing returns.

Avoid Premature Withdrawals

Withdrawing an FD before maturity typically incurs penalties and results in lower interest rates. Plan your finances to avoid early withdrawals. In cases where liquidity might be required, opt for sweep-in FDs which automatically break fixed deposits in multiples of ₹1,000 or ₹5,000 as needed, minimising penalty charges.

The table below will help you compare the interest rates of 15 banks – including SBI, HDFC Bank, ICICI Bank, Axis Bank, UBI, BoB, among others — for six months to up to two years. You can compare and take a decision based on your financial needs and goals.