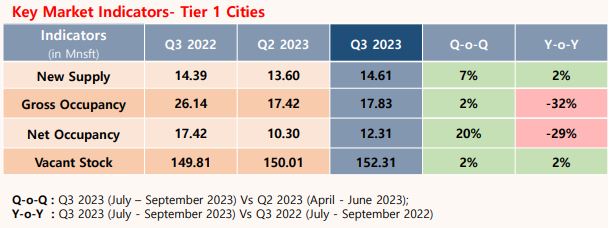

In the third quarter of 2023, India’s top Tier-1 cities witnessed a 7% surge in commercial real estate supply, amounting to a total of 14.61 million square feet, according to a PropEquity study. This can be attributed to the government’s proactive measures to stimulate growth in the IT sector through tax incentives and infrastructural improvements.

The city of Hyderabad emerged as the frontrunner, claiming approximately 35% of this new supply. Following closely behind was Bengaluru, accounting for 25% of the new supply.

During the same period, there was a remarkable 20% surge in net occupancy, representing a significant increase from 10.30 million square feet (in Msft) in the previous quarter, Q2 CY’23, to 12.31 million square feet (in Msft) in Q3 CY’23. On the other hand, gross occupancy slightly increased by 2% during the third quarter of 2023 when compared to the preceding quarter, Q2 2023.

Also Read: Should you opt for No-Cost EMI this festive season? Find out

This substantial growth in occupancy is a testament to the dynamic nature of the market and the heightened demand for commercial real estate during that period. It suggests that businesses and enterprises have been actively expanding their presence and operations, underscoring the vibrancy of the sector and its potential for continued development in the near future.

Among the Tier 1 cities, MMR ranks the top where net occupancy outstrips new supply and also records a 9% Y-o-Y increase in new supply.

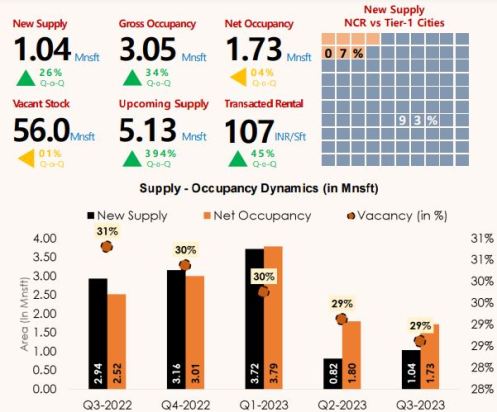

The Delhi-NCR region, however, has seen a significant reduction in new supply over the past few quarters, with a Y-o-Y decline of 65%. This is largely due to the surplus stock from previous quarters and high rental prices in the current quarter. Consequently, Delhi NCR’s share in new supply across Tier-1 cities stands at 7%.

Rental rates in Delhi-NCR have seen a substantial increase, with a Y-o-Y rise of 17% and a Q-o-Q surge of 45%. This can be attributed to the higher net occupancy relative to new supply in this quarter.

Gurugram’s sector 18 and Noida Expressway have emerged as the top micro-markets in Delhi NCR, based on occupancy levels. This is primarily due to leasing activities undertaken by Citi Bank and Teleperformance.

Delhi NCR – Supply & Occupancy Dynamics

“India’s commercial real estate has bucked the downtrend which is witnessed in top global cities. The reason why India has not got affected is due to the increase in demand of global captive centers (GCCs) in India, which is because of several factors such as availability of good quality workforce at lower costs, lower real estate costs and favorable exchange rates, among other factors,” said Samir Jasuja, Founder & CEO of PropEquity.

“As we approach the coming quarters, the demand will remain stable as can be seen in uptick in occupancy in this quarter,” he added.

“In the realm of India’s commercial real estate, this expansion sparks the vital connection between businesses and dynamic commercial spaces tailored to their ever-changing demands. Tier-1 cities in India witnessed a 7% surge in commercial real estate supply, and with this surge, we witness a promising horizon for India’s commercial real estate market, and we’re thrilled to play a role in this exhilarating journey. The current wave in Indian commercial real estate is set to ride high for the next quarter, fueled by the forthcoming festive season and bolstered by demographic strengths, enhanced business sentiment, and government-driven initiatives in high-value sectors like manufacturing and infrastructure,” said Garvit Tiwari, Director & Co-Founder, InfraMantra.

The vacancy rates in the top Tier-1 cities of India have remained relatively stable. The latest figures indicate a marginal 2% increase vacancy levels compared to Q2 2023. The total vacant stock in Q3 2023 amounts to 152.32 Mnsft across these cities, out of which the largest share was of Hyderabad and Bengaluru about 43%, followed by MMR with 15%.

This trend is emblematic of the persistent evolution within India’s real estate market, as it remains influenced by a multitude of factors, including the delicate balance between supply and demand, the evolving requirements of businesses, and the prevailing economic circumstances, all of which collectively sculpt the commercial property arena. Although the marginal increase in vacancy offers a promising outlook, it is imperative for key players in the industry to maintain a watchful eye and a flexible approach, ensuring they can adeptly maneuver through the continually shifting landscape of the commercial real estate sector.