The Select Committee of the Lok Sabha has submitted its report on the new Income Tax Bill, 2025, to Parliament in record time. The Bill, which was introduced in the Lok Sabha during the Budget session this year, was referred to the select panel to examine the Bill and suggest changes to further improve the income tax laws.

When this Bill was referred to the select committee, comprising 31 parliament members, taxpayers and tax experts expected that the panel would recommend some changes to one of the controversial provisions, which allows tax officials to access taxpayers’ social media accounts, emails and other digital assets.

The Select Committee of the Lok Sabha has retained these controversial provisions, raising serious concerns about the privacy of crores of taxpayers in the country.

On July 21, the 4,575-page report of the Select Committee was presented in parliament. The report has no objections on the controversial provision. It means that the panel has decided to retain these provisions, even though many experts and civil society representatives had given their opinion against them.

What does the new Income Tax Bill say?

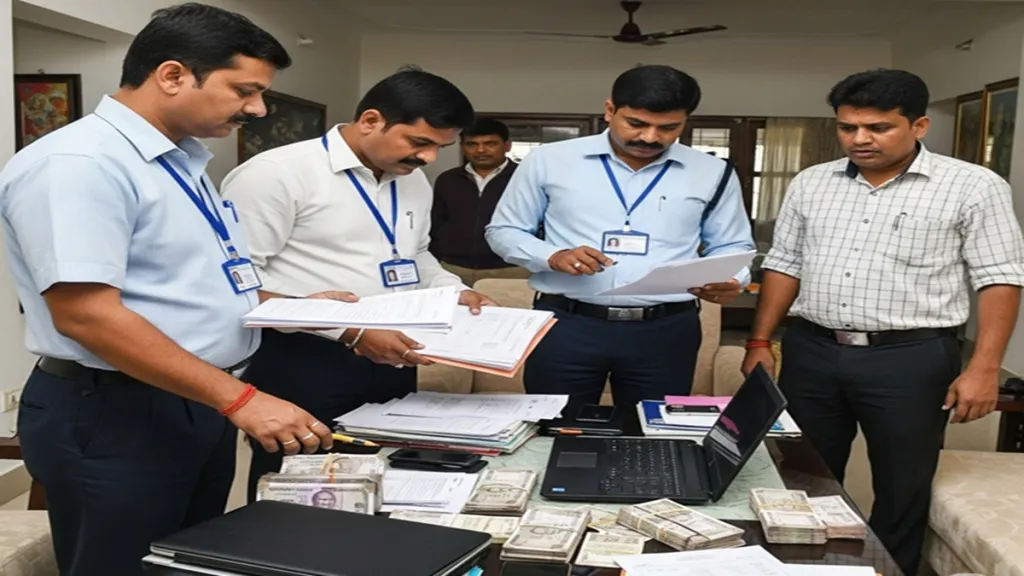

The Income Tax Bill 2025, introduced in Parliament in February 2025, gives unprecedented digital powers to tax officials during search and seizure operations.

According to the Bill, if a person is found to be in control or ownership of any document, record or information held in digital form, he will have to provide all technical assistance to the income tax officer that helps him to get access to the information held in that computer system, device or cloud storage – this includes providing passwords, access codes, login credentials.

If the password or access code is not available, the officer can forcibly break it and access that virtual digital space.

What does ‘virtual digital space’ mean?

This includes your social media accounts (such as WhatsApp, Facebook, Instagram), email accounts, online investment or trading platforms, banking apps, cloud storage and other digital applications.

That is, if any search/investigation is going on against you, then now the income tax officer can access your personal data and communications – that too without your permission.

Experts had expressed concern, but the government did not listen.

The committee report acknowledged that during the review of the bill, many parties and experts had raised serious objections and concerns about these provisions.

Experts said that it could go against the privacy and freedom of expression of citizens and there is also a possibility of its misuse.

Despite this, the committee did not make any changes to it and recommended to keep it as it is.

What does this mean for taxpayers?

-Now income tax officers can access your social media, email, cloud data during search.

-If you do not give the access code/password, it can be broken through technical means.

-This will be applicable only in the event of investigation or search, but no clear procedure has been given so far regarding its limits and monitoring.

Conclusion: Taxpayers need to be cautious

Experts are of the view that the government is moving towards strictness regarding digital investigation. In such a situation, the common taxpayer will have to be more careful about his digital behavior and financial activities. Also, it is also important that there should be a system of monitoring and accountability on the misuse of such powers, which is not clear at the moment, they said.