Fixed deposits (FDs) remain the favored investment option for risk-averse individuals, particularly senior citizens. The appeal lies in guaranteed returns, preferential rates of up to 0.5%, enforced savings, high liquidity, and the simplicity of the investment process.

During periods of increased market volatility, senior citizens in general prefer to avoid investments linked to the market in order to preserve and enhance their retirement savings by investing in fixed deposits. Indeed, many senior citizen depositors rely on the regular interest payments from their non-cumulative FDs, which are available on a monthly, quarterly, semi-annual, or annual basis, to cover their daily expenses.

Fixed deposits serve as effective instruments for establishing emergency funds, as they not only provide capital growth but also allow for easy liquidation prior to maturity. This enables individuals to access funds for urgent needs, albeit with a potential loss of up to 1% in interest income.

Also Read: Income Tax Refund: How to check your ITR Refund status and what to do if refund is delayed?

Nevertheless, in order to increase potential rewards without assuming any investment risks, elderly depositors may consider utilizing the FD laddering method. This approach involves dividing their savings into multiple FDs with varying maturity periods, allowing for reinvestment opportunities to create a continuous investment cycle.

For instance, if a depositor has Rs 5 lakh, instead of depositing the entire amount into a single fixed deposit, they could opt to split it into five FDs of Rs 1 lakh each, each with different maturity periods ranging from 1 to 5 years. By adopting this strategy, senior citizens can take advantage of higher interest rates in the future while reducing the need to prematurely close an FD to address any immediate financial needs resulting from lost interest income.

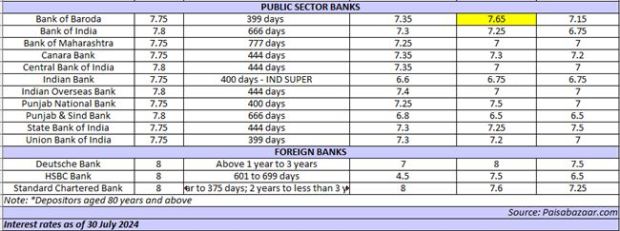

In case you are seeking the top fixed deposit deals tailored for elderly individuals, you can find the latest interest rates provided by most of India’s leading banks, such as the State Bank of India, HDFC Bank, PNB, ICICI Bank, Axis Bank, RBL Bank, BoB, BoI, and Kotak Bank, among others. Review the rates carefully and select the ones that align with your needs.