If you have a high loan quantum requirement to fund big-ticket expenses like children’s wedding or higher education, home renovation or a medical emergency, etc., getting a loan against your property could be a viable option for you. And apart from high loan quantum, these securitized loans also offer longer repayment tenures and are usually available at lower interest rates than unsecured financing facilities like a personal loan.

But before applying for a loan against property, do note that many banks offer such loans only up to 65% of the pledged property’s market value. And while these loans are available against both residential and commercial properties, the associated terms and conditions could be different, according to BankBazaar.

Also, if your property is too old or dilapidated, or it has disputed ownership, you might not be eligible for a loan against property. Lastly, while a loan against property is a securitized loan, your lender would consider your credit score while processing your application and would offer you the best repayment terms only if your score is above 750-800.

You also need to keep in mind a couple of other important things regarding LAP. Most banks also charge a processing fee that’s usually up to 1% of the loan amount plus taxes. Also, while many banks do not charge for part-prepayments in loans against property for individual borrowers who have taken the loan for non-business purposes, it’s better to read the terms and conditions of your shortlisted loan product to get complete clarity before finalizing your decision, as per BankBazaar.

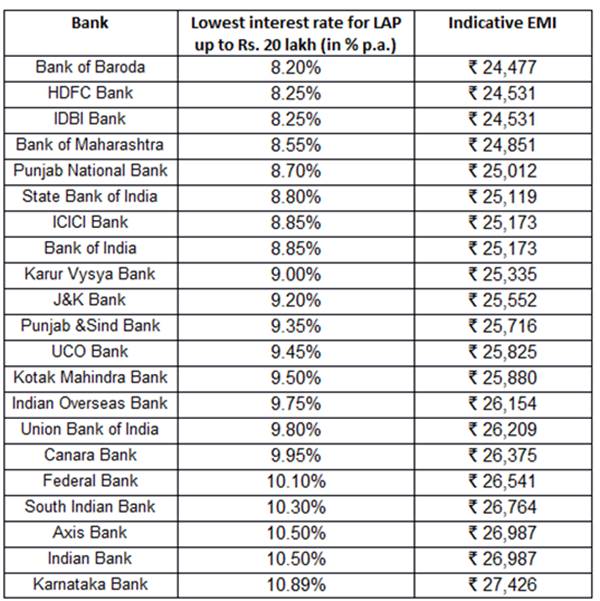

So, if you’re looking for a loan against your residential property, here are the lowest advertised interest rates currently being offered by all the major banks in the country for loans up to Rs 20 lakh. We’ve also provided the indicative EMIs for all the offers of the same loan amount for a 10-year tenure.

Do note, processing fee or any other charges have not been considered for EMI calculation. The applicable interest rate and EMI amount could be different based on your chosen lender, your property’s value, loan amount, tenure, or any other terms and conditions of your bank.

Interest Rates and Indicative EMI for a Rs 20 Lakh Loan Against Property Taken for a 10-Year Tenure

Disclaimer: Interest rates on Loan against Residential Property (LAP) for all listed (BSE) public and private banks have been considered for data compilation; banks for which data is not available on their website have not been considered. Data collected from respective bank’s websites on May 18, 2021. Banks are listed in ascending order on the basis of interest rates. The lowest interest rate offered by the banks on loans up to Rs 20 lakh is shown in the table. The EMIs have been calculated on the basis of interest rate mentioned in the table for Rs 20 lakh loan with tenure of 10 years (processing and other charges are assumed to be zero for EMI calculation). The interest rates mentioned in the table are indicative and may vary depending on the bank’s T&C. Data compiled by BankBazaar.com, an online marketplace for loans, credit cards and more.