Investing in fixed deposits is a popular choice among investors looking for a safe and steady way to grow their savings. While banks are the most common avenue for fixed deposits, company fixed deposits also offer an attractive alternative.

However, before investing your hard-earned money in company fixed deposits, there are several crucial factors to consider.

Let’s understand what to keep in mind before investing in company fixed deposits.

Creditworthiness and Reputation

Before investing in a company fixed deposit, it is crucial to assess the creditworthiness and reputation of the company. Research the company’s financial stability, track record, and credit ratings provided by recognized credit rating agencies. Companies with high credit ratings indicate a lower risk of default, offering more security for your investment.

Also Read: WEALTH CREATION: 10 ways to set your financial goals and achieve them

Interest Rates and Terms

Compare the interest rates offered by different companies providing fixed deposits. While higher interest rates may seem enticing, exercise caution and ensure the rates are in line with market standards. Beware of companies offering exceptionally high returns, as they may indicate a higher risk of default. Additionally, understand the terms and conditions of a fixed deposit, including the duration, compounding frequency, premature withdrawal penalties, and whether the interest is paid out periodically or reinvested.

Regulatory Compliance

Ensure that the company offering fixed deposits is compliant with the rules and regulations set by regulatory authorities such as the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI). Companies accepting deposits are required to adhere to specific guidelines to safeguard the interests of depositors.

Financial Performance and Stability

Scrutinise the financial performance and stability of the company over the years. Analyse their annual reports, financial statements, and profitability trends. Look for signs of consistent growth, healthy profit margins, and a strong balance sheet. A financially stable company is more likely to honour its fixed deposit commitments.

Diversification and Risk Management

Adopt a diversified investment approach by spreading your investments across multiple company fixed deposits rather than putting all your eggs in one basket. This strategy helps mitigate risk as it reduces the impact of a potential default by a single company. Choose companies from different sectors and evaluate their individual creditworthiness.

Investor Protection Measures

Investigate the investor protection measures offered by the company. Some companies provide an insurance cover or a debenture redemption reserve that acts as a safeguard for depositors in case of default. Understand the terms and conditions of these protection measures and evaluate their effectiveness.

Tax Implications

Consider the tax implications of investing in company fixed deposits. The interest earned on fixed deposits is taxable as per the individual’s income tax slab. Assess how the interest income will impact your overall tax liability and plan accordingly.

Investing in company fixed deposits can be a viable option for individuals seeking stable returns. However, it is essential to approach such investments with caution and due diligence. Thoroughly research the creditworthiness, reputation, interest rates, and terms offered by companies. Additionally, evaluate the regulatory compliance, financial stability, and investor protection measures provided.

By considering these crucial factors, investors can make informed decisions and mitigate the risks associated with company fixed deposits in India. It is advisable to seek advice from a financial advisor before making any investment decision to align your investments with your financial goals and risk appetite.

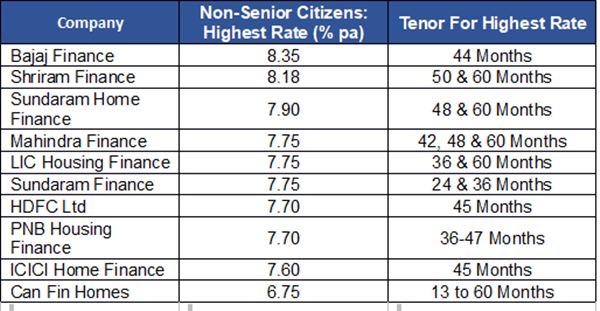

The table below helps you compare the company deposit interest rates. You can compare and decide as per your requirements.

WHERE CAN YOU GET THE BEST FIXED DEPOSIT RATES TODAY?

AAA & AA-RATED COMPANY DEPOSITS

Compiled by BankBazaar.com

Note: Interest rates as advertised by the companies (Rated AA or higher) on 06 Jun 2023. Rates pertain to cumulative retail deposits (Deposit below Rs 1 Cr). Rates will change as per the company’s policies. Highest rates (applicable for non-senior citizens) by each company are mentioned here. Some rates are as per special schemes which are for limited periods. Contact the company to understand the scheme risks and details.