The Indian rental housing markets achieved steady recovery during the first quarter of 2022, which was complemented by strong growth in the second quarter. The robust surge in rental demand in the first two quarters of this calendar year was fueled by the gradual reopening of educational institutions and offices. This led to migration of the workforce to key metro cities and boosted demand for rental housing.

In comparison to the previous quarter, however, rental activity was a little subdued in Q3 2022, as demand for properties stabilized while the availability reduced, primarily due to higher take up of ready and vacant homes resulting in reducing inventory.

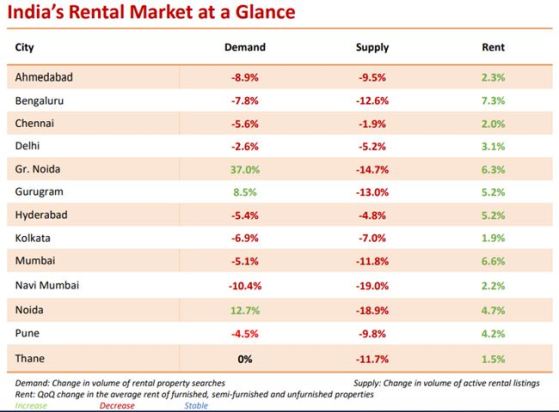

According to Magicbricks Rental Index for Q3, 2022, the Pan India rental housing demand (searches) witnessed a cyclical decline of 3.9% QoQ in Q3 2022, even as the YoY growth was 29.0%. The demand in Greater Noida, Noida and Gurugram witnessed the highest growth of 37.0%, 12.7%, and 8.5% QoQ, respectively. The rental demand in Thane remained stable, while Delhi, Pune and Mumbai registered declines of 2.6%, 4.5% and 5.1% QoQ, respectively.

Also Read: 5 tips to invest in a rising stock market for good returns

The cumulative rental housing availability (listings) at the pan India level recorded a decline of 9.8% QoQ and 12.6% YoY. Although all the tracked cities observed a drop in availability, Chennai, Hyderabad and Delhi witnessed the least QoQ declines of 1.9%, 4.8%, and 5.2%, respectively. Limited availability of ready-to-move-in units, delays in delivery of under-construction projects and higher leasing activity in the previous two quarters have caused a reduction in the availability of rental housing units.

The pan India average rent appreciated by 5.2% QoQ, in addition to an 8.4% increase in Q2 2022. Bengaluru, Mumbai, Greater Noida and Hyderabad witnessed maximum growth in their average rents at 7.3%, 6.6%, 6.3% and 5.2% QoQ, respectively.

Elaborating on the trends, Sudhir Pai, CEO, Magicbricks, said, “The Indian rental housing market recovered steadily during the first quarter of 2022, which was complemented by growth in the second quarter fueled by the gradual reopening of offices and educational institutions, and workforce returning to these cities. Hence in Q3, the rental demand declined marginally and available inventory reduced, thus stabilizing the rental housing market relative to the peak quarter of Q2’ 2022. With the effects of pandemic now waning, we can expect this normal cycle to persist henceforth.”

Macro trends spotted from Magicbricks’ India Rental Housing Update Q3, 2022:

* Pan-India rental demand (searches) across the 13 cities declined 3.9% QoQ but increased 29% YoY. Demand in Greater Noida (37%), Noida (12.7%) and Gurugram (8.5%) registered QoQ growth.

* Cumulative availability (listings) declined 9.8% QoQ. Supply in Chennai (1.9%), Hyderabad (4.8%) and Delhi (5.2%) witnessed least decline QoQ.

* Pan- India rents increased 5.2% QoQ, with Bengaluru (7.3%), Mumbai (6.6%), Greater Noida (6.3%), and Hyderabad (5.2%) observing maximum growth QoQ.

Market-specific takeaways from Magicbricks’ Rental Housing Update Q3, 2022:

1. Bengaluru’s average rents increased 7.3% QoQ while demand (7.8%) and supply (12.6%) declined QoQ. There was a preference for semi-furnished 2 BHKs, constituting 52% of the total demand and 55% of the total supply.

2. In Chennai, 40% of tenants were interested in units within 500 – 1,000 sf. The average rent increased 2% QoQ, while demand for rental units declined 5.6% QoQ and there was a marginal dip of 1.9% QoQ in supply

3. Delhi’s average rent increased 3.1% QoQ, demand registered a marginal decline of 2.6% QoQ, and the supply reduced 5.2% QoQ. The residential market was dominated by 2 BHKs and 3BHKs with an aggregate demand and supply share of 75%.

4. Average rent in Mumbai increased 6.6% QoQ while demand (5.1%) and supply (11.8%) declined QoQ. Tenants preferred smaller units (500-1,000 sf) which constituted 52% of demand and 44% of supply.

5. In Noida, average rent increased 4.7% QoQ while aggregate demand increased 12.7% QoQ and supply reduced by 18.9% QoQ. Greater Noida witnessed an increase of 6.3% QoQ in average rent while residential demand increased 37% QoQ while the supply declined 14.7% QoQ with.

6. Average rent in Gurugram increased 5.2% QoQ, demand increased 8.5% QoQ while supply declined 13% QoQ. Homebuyers preferred medium-sized apartments, with demand for 3BHKs constituting 41%.

7. Average rent in Ahmedabad increased 2.3% QoQ with a decline of 8.9% QoQ in demand and 9.5% QoQ decline in supply of rental units. 2BHK and 3BHK units continue to hold a majority share in the market with a demand of 43% each.

8. Kolkata’s rental market was driven by demand for unfurnished properties (50%), indicating a preference for longer tenancies. Average rent in the city increased 1.9% QoQ while the rental demand declined 6.9% QoQ and the supply reduced by 7% QoQ.

9. Demand for rental properties in Hyderabad declined 5.4% QoQ while supply declined 4.8% QoQ. The 2BHK and 3BHK units continue to hold a majority share in the market with a demand of 45% and 43% respectively.