At time when stock market indices have been witnessing a broader uptick, it is getting difficult for actively managed funds to outperform the benchmark. Investors are increasingly looking at passive funds as these have outperformed actively managed funds and have low costs.

Individuals consider passive funds to be less risky as the investment happens predominantly in index companies which are selected based on market cap and volatility. The idea of a passive fund is not to beat the index through active stock selection but just to get returns as much as the index. The focus is purely on reducing the tracking error.

Nirav Karkera, head, Research, Fisdom, says many portfolios are replacing actively managed large-cap funds with benchmark indices. “At the same time, the rise of factor-based indices offer investors a thematic play minus risks associated with fund managers’ subjective discretion. Such factor-based indices offer investors an effective and cost-efficient play. A combination of these developments are leading to the rise of index investing in India,” he says.

Why AUM is rising

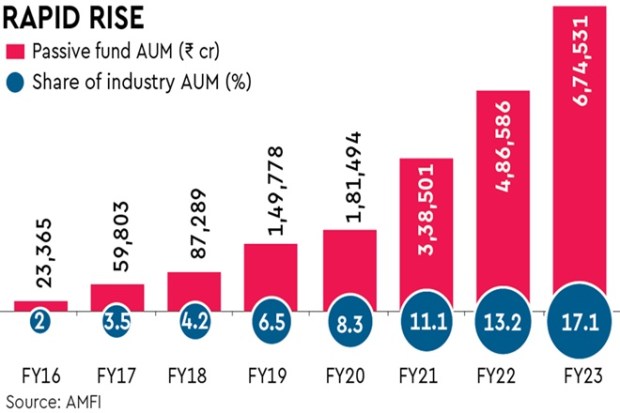

Passive investing is certainly picking up. As of July 2023, the assets under management (AUM) of passive funds accounted for 16.8% of the total mutual fund AUM of Rs 46.28 trillion. Passive funds include index funds, index exchange traded funds as well as linked funds like gold funds and fund of funds.

Nehal Mota, co-founder & CEO, Finnovate, a hybrid financial fitness platform, says there are two reasons for this phenomenon. “The first reason is Kurtosis. If you look at the Nifty or Sensex, only a handful of stocks really outperform. However, the mutual fund is limited to 10% exposure to one stock. Secondly, the costs (expense ratio) are up to 2.5% in active large-cap funds. Index ETFs have a total expense ratio of under 0.45%, which makes a big difference to returns.”

Kurtosis is a statistical measure of the extent to which a distribution contains outliers.

Keep an eye on tracking error

Passive funds portfolio is the same as their indices which are created based on certain criteria like market capitalisation. There is no human intervention or research done on these companies. There is no scope for any fundamental analysis done on companies before adding them to the portfolio.

Harshad Chetanwala, co-founder, MyWealthGrowth.com, says fund managers have to restrict the exposure as same as the index and recommends that Nifty 50 Index and Sensex Index Funds are the index funds an investor can consider in their portfolio. “These funds are based on market capitalisation and are large-cap oriented. There is a high possibility of getting invested in top and well-established companies in India.”

While the investment objective of an index fund is to replicate the underlying index, it is important to ensure that the fund has been delivering minimal tracking error at the lowest possible cost. “It is important to have conviction in the fact that the segment, factor or theme that the index focuses on, offers limited scope for alpha generation through active management. For instance, an actively managed small-cap fund has the potential to outperform the benchmark in a reasonably consistent manner, but the premise may not extend to large-caps under most considerations,” says Karkera.

Type of index

Index funds offer a variety of options to investors. There are index funds on generic large cap indices like the Nifty and Sensex. There are index funds and ETFs on broad based indices like the BSE 200 or the NSE 500 besides sectoral index funds pegged to sectors like banking, IT, financial services, etc. However, the risk of investing in a sectoral index fund is relatively high because of the concentration risk. Also, there are debt index funds pegged to an index of government securities or even to corporate bond indices.

“Investing in index funds or index ETFs pegged to generic indices can be lower on the risk scale and less volatile than individual stocks,” says Mota. Another important application of index funds or index ETFs is to realign the portfolio.

“For instance, if you need to reduce your equity or debt allocation and do not want to trade too much in stocks, the allocation tweaks can be achieved through index funds/ETFs,” she says.

Finally, investors must note that a better way to reduce the cost of holdings in index funds will be through systematic investment plans. In fact, the combination of rupee cost averaging and market volatility will ensure that the index funds costing work in your favour.

PASSIVE PLAY

- Passive funds include index funds, index ETFs, linked funds like gold funds and fund of funds

- The aim is not to beat the index through active stock selection but just to get returns as much as the index

- Investors can go for Nifty 50 Index & Sensex Index Funds