Small-cap funds have been on a roll of late, with the category receiving nearly Rs 18,000 crore of inflows, or 25% of the fresh inflows into actively managed equity mutual funds, in the first half of calendar 2023.

The strong inflows are led by the category’s strong performance compared with other equity mutual fund categories, particularly large and mid-cap funds, in recent times. The category gave 34% returns in the past 1 year ending June 23 versus 23% and 30% for the large and mid-cap categories, respectively.

Even when considering long-term investment horizon of 5 years, the small-cap category has performed better, with returns of 17% versus 12% and 15% for the large-cap and mid-cap categories respectively.

But while the returns are high, investors drawn to the category need to understand that the risks may be substantial, too. A case in point is the huge divergence in the returns of the best-performing and worst-performing small-cap funds.

In this article, we delve into the factors contributing to the divergence and what investors should look at while investing in this category.

Also Read: Should you invest in multi-cap or flexi-cap mutual funds?

Divergence in returns of small-cap funds versus major large and mid-cap fund categories

While at an aggregate level, small-cap funds have generated superlative returns, the variability of returns offers a more nuanced story.

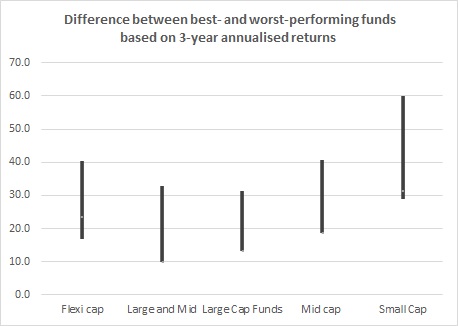

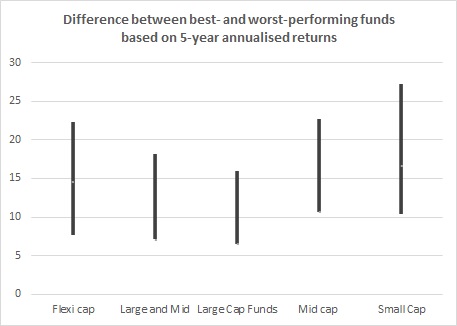

For a three-year return period, the variability in returns of small-cap funds stood at 31% compared with 13% for large-cap funds, 19% for midcap funds, 10% for large and mid-cap funds, and 24% for flexi-cap funds.

The variability is higher when analysed for a longer period of five years, as seen from the chart.

Variability – an outcome of portfolio allocation

Small-cap funds are mandated to invest at least 65% of their assets in small-cap stocks.

As per the list published by Association of Mutual Funds in India, when classifying companies according to market capitalisation, barring the first 250 companies in terms of market capitalisation, all other companies are classified as small cap. So technically speaking, small-cap funds have a universe of more than 4,500 stocks to choose from while making an investment decision.

Large-cap funds can invest only in the top 100 companies in terms of market capitalisation. Thus, the difference in returns between the best- and worst-performing funds is lower.

Given the large universe, the small-cap fund manager has ample choice. Hence, the securities chosen differ widely in every small-cap fund.

Also Read: Why you should not start SIP in a top-performing mutual fund (always)

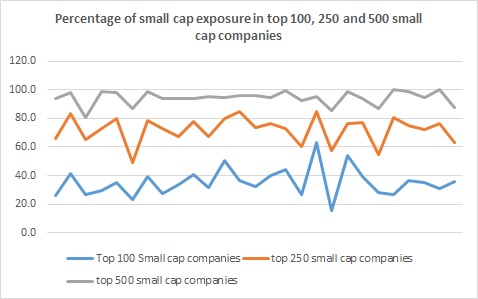

Examining the portfolio of 24 small-cap funds for the month ended May 2023, we find small-cap funds have invested in 438 unique companies as on May 31.

Rebasing the small-cap exposure within the small-cap funds to 100, the small-cap funds investment is further divided in terms of market cap. We find that on average, 94% of the small-cap stocks in which the funds have invested fall in the top 500 small-cap companies. On average, 72% of the small-cap stocks in which the funds have invested fall in the top 250 small-cap companies while 35% are among the top 100 small-cap companies.

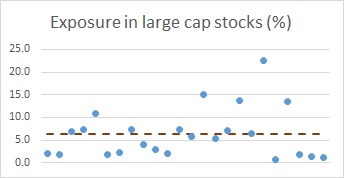

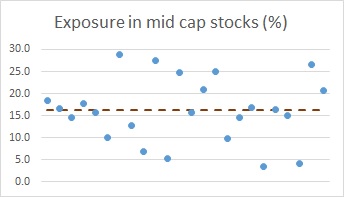

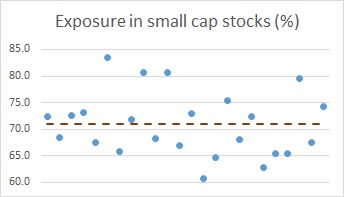

Similarly, on examining the overall market cap allocation of small-cap funds, we find some funds have taken as high as 23% exposure in large-cap stocks, while others have kept it to a low 1%. Similarly, some funds have 29% exposure in midcap stocks, while others have kept midcap exposure as low as 3%. Their exposure in small-cap stocks ranges from 60% to 85%. In short, small-cap funds have a diverse portfolio composition in terms of market-cap allocation.

Investors should look at portfolio investments and volatility

While small-cap funds provide opportunities for significant returns, they also come with increased risks. One factor we analysed was the variability of returns in the schemes due to wide variance in portfolio allocation and utilisation of their investment universe.

Beyond this, investors should note that volatility of underlying stocks cannot be ignored. Small-cap stocks tend to have a higher level of volatility compared with large-cap stocks. They can experience larger price swings and be more susceptible to market fluctuations and investor sentiment.

Also, small-cap stocks often have lower trading volumes and less liquidity compared with large-cap stocks. This higher volatility translates into greater risk and return potential.

Also, a fund manager cannot own more that 10% of any company’s paid-up capital. Given the small market cap of these companies, it is difficult for the fund manager to take a meaningful stake in very small company.

Investors should therefore invest in the category only if they have high risk appetite and a long investment horizon. Factors they should look at while selecting the funds include consistency of performance, diversification and liquidity of the underlying portfolio.

This column has been written by Piyush Gupta, Director – Funds Research, CRISIL Market Intelligence and Analytics

Disclaimer: The views expressed in this article are that of the respective authors. The facts and opinions expressed here do not reflect the views of www.financialexpress.com. Please consult your financial advisor before investing in mutual funds.