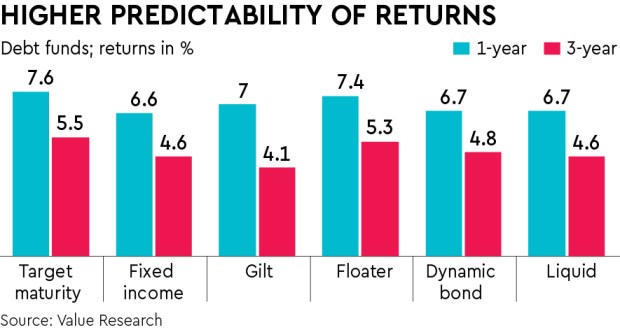

As interest rates are likely to be range-bound or declining, individuals can look at target maturity funds and lock-in at higher yields. Most of these funds at present have a yield-to-maturity (YTM) of 7.3% to 7.5%, which could be a good option for those looking for steady growth on their fixed income investment.

Target maturity funds invest in government securities, bonds of public sector companies and state development loans and hold them till maturity. Investing in a roll-own strategy gives the predictability of returns and the volatility tends to reduce as the fund gets closer to the target maturity. If a fund house buys bonds of three years it will not trade on those bonds and investors will get returns close to what the bond has to offer minus the expense ratio.

Low default risk

The default risk is lower as compared with other debt funds and the duration of the fund keeps falling with time. As these funds have an average maturity ranging from one to 10 years, those looking for a longer term can also consider investing in them. So, if investors want higher predictability of returns and have a longer time horizon, they would be better off with target maturity funds compared to actively managed short-term bond funds. Moreover, these funds use a glide path to change the asset mix to constantly reduce the risk of reaching a target date.

Feroze Azeez, deputy CEO, Anand Rathi Wealth, says considering the predicted range-bound or declining interest rates, investing in target maturity funds appears favourable. “Interest rate is expected to decline next year and this expectation arises from the inclusion of Indian bonds in the JP Morgan Emerging Market Global Bond Index. As a result, the government’s borrowing costs may decrease, aiding in managing fiscal and current account deficits,” he says. “Investing in a target maturity fund at this juncture can provide the advantage of securing higher yields, especially with the expected interest rate reversal.”

Normal debt funds are susceptible to interest rate risks which are not there in target maturity funds as they lock in the interest rates and do not play with it. Vivek Banka, co-founder, GoalTeller, says these funds are suitable for those who wish to get predictable returns without much volatility and uncertainty. “These funds being fairly passive are low-cost as well, in nature,” he says.

Hold till maturity

The portfolio from a securities and tenure perspective is predefined; hence it gives complete clarity to investors.

Harshad Chetanwala, co-founder, MyWealthGrowth.com, says the holdings are meant to be held till maturity and the returns will be in line with the committed returns of each and every security on a regular basis. “Investing and holding till maturity will be a good strategy considering that interest rates may reduce in the future. Investors can consider holding it for medium to long term depending on their need. If they have the appetite to hold it for a longer term, it will benefit them as these funds are offering good returns in the debt funds space,” he says.

The main objective of a target maturity fund is to help investors get professional asset allocation advice automatically within the fund.

Abhishek Banerjee, founder & CEO, Lotusdew Wealth & Investment Advisors, says the investor does not need to shuffle between asset classes as this is done by the fund manager. “This means the portfolio is simplified considerably as you have only one fund to monitor versus many funds in a portfolio. Simpler funds are easier to compare and easy for investors to understand in terms of portfolio returns,” he says.

Duration play

Investors must choose a duration that matches their risk tolerance and investment horizon. “Currently, a 10-year G-Sec is 7.16% and 5-year G-Sec is around 7.19%. Hence, the ideal duration is four to five years and it is perfect for someone who wants to lock-in at higher yield in a target maturity fund,” says Azeez.

Similarly, Banerjee says investors must use the complete tenure of the fund and not churn it. “The churn happens within the fund. The timing of asset classes and its allocation is made on behalf of the investor by the fund manager,” he adds.

Before investing, investors must ensure that the YTM the funds are offering should align with their investment goals. They must also note that the government this year has made returns from debt funds taxable at marginal rate without any indexation benefits.

DURATION STRATEGY

These funds being fairly passive, are generally low-cost as well

Most of these funds at present have a yield-to-maturity of 7.3% to 7.5%

Choose a duration that matches your investment horizon & risk tolerance