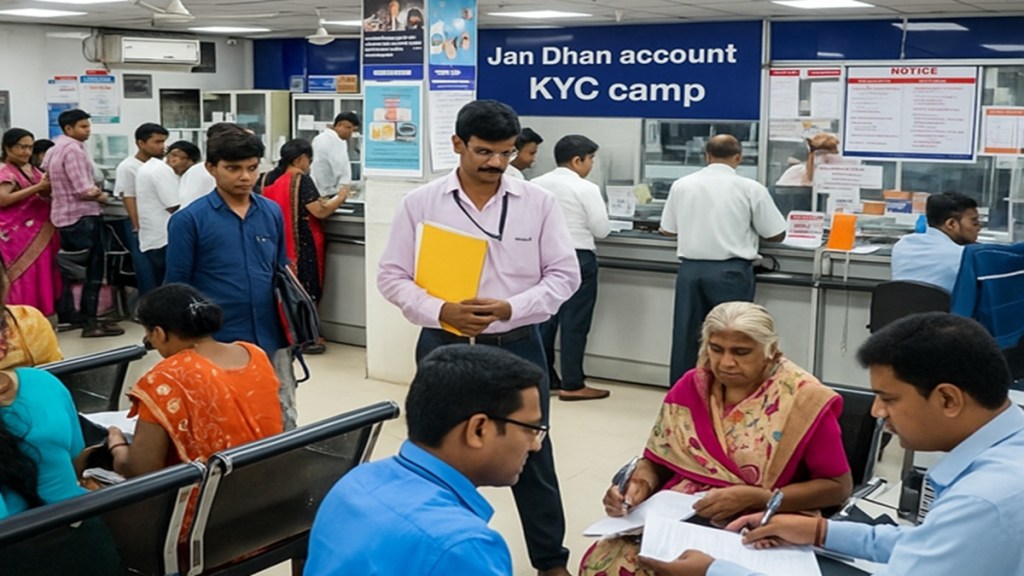

Reserve Bank of India (RBI) Governor Sanjay Malhotra on Wednesday said that a large number of Jan Dhan bank accounts are due for re-KYC (know your customer), for which camps are being organised by banks.

The Pradhan Mantri Jan Dhan Yojana (PMJDY) was launched in 2014, and approximately 56 crore PMJDY accounts have been opened so far. PMJDY bank accounts become due for periodic updation or re-KYC after 10 years.

As Jan Dhan scheme completes 10 years, a large number of accounts have fallen due for re-KYC, the RBI governor said in a statement.

Jan Dhan accounts re-KYC: Banks organising camps

“The banks are organising camps at Panchayat level from 1st July to 30th September, in an endeavour to provide services at customer doorsteps. Apart from opening new bank accounts and re-KYC, the camps will focus on micro-insurance and pension schemes for financial inclusion and customer grievance redress,” the RBI chief said in his monetary policy review statement.

Claims settlement procedure for bank accounts and lockers

In yet another measure to ease banking services for customers, Malhotra said the central bank will standardise the claims settlement procedure for bank accounts and lockers. The move is aimed at simplifying the process for settlement of claims in favour of nominees of deceased customers.

“We will be standardising the procedure for settlement of claims in respect of bank accounts, and articles kept in safe custody or safe deposit lockers of deceased bank customers. This is expected to make settlement more convenient and simpler,” the statement said.

Expansion of RBI Retail-Direct platform function

Besides, the central bank plans to expand the functionality in the RBI Retail-Direct platform to enable retail investors to invest in treasury bills through systematic investment plans.

Announcing these three measures, the RBI governor said that “let me underline that for us at RBI, the interest and welfare

of the citizens of India is foremost. It is the people of India, including those at the bottom of the pyramid, who are our raison detre, or the reason of our being. In this regard, I have three consumer-centric announcements to make.”

Under the provisions of Banking Regulation Act, 1949, nomination facility is available in respect of deposit accounts, articles kept in safe custody or safe deposit lockers, according to the RBI.

“This is intended to facilitate expeditious settlement of claims or return of articles or release of contents of safe deposit locker upon death of a customer and to minimise hardship caused to family members,” the central bank said.

“The extant instructions require banks to adopt a simplified procedure to facilitate expeditious and hassle-free settlement of

claims made by survivors/ nominees/ legal heirs, the procedures vary across banks,” it added.

With a view to enhance customer service standards, the RBI said, it has been decided to streamline the procedures and standardise the documentation to be submitted to the banks. “A draft circular in this regard shall be issued shortly for public consultation,” the central bank informed.