LIC Dhan Vridhhi (Plan 869): The Life Insurance Corporation (LIC) of India has launched a new close-ended plan – LIC’s Dhan Vridhhi (Plan 869). The new plan is available for sale from Friday (June 23) till September 30, 2023. This article looks at key details of the Dhan Vridhhi plan shared by LIC in a statement and information available on the LIC website.

What is LIC Dhan Vridhhi (Plan No. 869)?

LIC Dhan Vridhhi is a non-linked, non-participating, individual, savings, single premium Life Insurance plan offering a combination of protection and savings.

LIC says this plan will provide support to he family in case of unfortunate death of the life assured during the policy term. It will also provide a guaranteed lump sum amount on the date of maturity.

“Being a single premium plan there is no future premium obligation and no lapsation,” LIC says.

Two options

There are two options that a proposer can choose under the LIC Dhan Vridhhi plan.

Option 1: Sum Assured on Death can either be 1.25 times the Tabular Premium for the chosen Basic Sum Assured subject to certain eligibility conditions.

Option 2: Sum Assured on Death can be 10 times the Tabular Premium for the chosen Basic Sum Assured subject to certain eligibility conditions.

Also Read: LIC’s New Pension Plus Plan 867 calculator: How much can you get with Rs 5000 or Rs 10,000/month?

Policy Terms

LIC Dhan Vridhhi is available for 10,15 or 18 years of term.

Minimum and Maximum Age

Minimum entry age varies from 90 days to 8 years depending upon the term selected. The maximum age at entry varies from 32 years to 60 years depending upon the tem and option selected.

Minimum and Maximum Basic Sum Assured

The minimum basic Sum Assured is Rs 1,25,000 and can be opted for more in multiples of Rs 5000.

Death and Survival benefits under LIC Dhan Vridhhi

On death of the Life Assured, during the policy term after the date of commencement of risk but before the stipulated date of maturity, the amount payable will be ‘Sum Assured on Death’ along with accrued Guaranteed Additions.

If the Life Assured survives till the stipulated Date of maturity, the amount payable will be ‘Basic Sum Assured’ along with accrued guaranteed additions

Guaranteed Additions under LIC Dhan Vridhhi

As per LIC, the Guaranteed Additions will accrue at the end of each policy year, throughout the policy term.

“The Guaranteed Additions ranges from Rs 60 to Rs 75 (Option 1) and Rs 25 to Rs 40 (Option 2) per Rs 1000 Basic Sum Assured depending on the option chosen, Basic Sum Assured and the Policy Term,” the insurer says.

Further, the Guaranteed Additions will be higher for higher Sum Assured.

Also Read: SIP+LIC New Jeevan Shanti calculation: Rs 8416 SIP turns into Rs 5.6 lakh monthly pension

LIC Dhan Vridhhi: Premium Calculation (examples)

The LIC website provides a calculator that you can use to calculate the premium to be paid for any Sum Assured. Here are some examples –

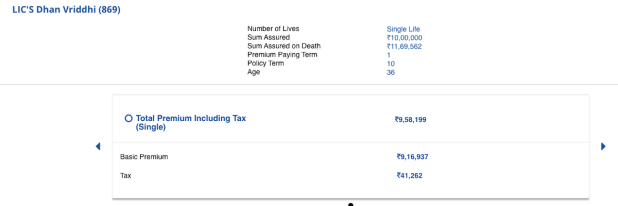

As per the policy calculator available on the LIC website, the total single premium to be paid by a policyholder aged 36 and for 10 years term for Rs 10 lakh Sum Assured will be approx. Rs 8,16,720 (including tax). This is for Option 1. The Sum Assured on Death, in this case, will be approx Rs 11.6 lakh.

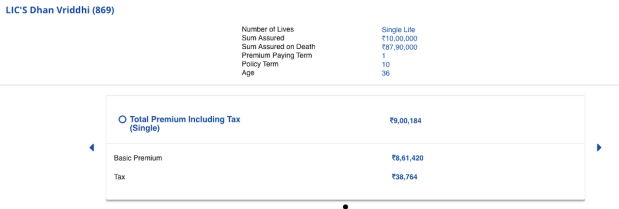

For Option 2, the total single premium to be paid by a policyholder aged 36 years and for 10 years term for Rs 10 lakh Sum Assured is Rs 9,00,184 (including tax). This is for Option 2. The Sum Assured on Death, in this case, will be approx Rs 87.9 lakh.

Riders available under LIC Dhan Vridhhi

Policyholders can opt for riders such as LIC’s Accidental Death and Disability Benefit Rider and LIC’s New Term Insurance Rider. “Settlement Option is available on Maturity/Death to avail the claim in monthly/quarterly/half-yearly/yearly intervals for 5 years. “The plan offers liquidity through Loan Facility which is available any time after 3 months from the completion of the policy.”

The plan can be purchased both offline and online from the LIC website.

Disclaimer: The above content is for informational purposes only, based on information shared by LIC. Please read the offer document carefully and consult a professional financial advisor before buying any insurance policy.