By P Saravanan and A Paul Williams

The Government of India has recently announced plans to introduce a Unified Pension Scheme (UPS), aiming to streamline and simplify the current pension landscape. This new scheme is expected to merge the existing pension scheme, namely National Pension System (NPS), into a single, unified framework. While the details are still being finalised, this announcement has sparked considerable interest and debate about its potential benefits and drawbacks, especially in comparison to the existing NPS.

Unified Pension Scheme: The proposed framework

Although the specifics are yet to be released in detail, the Unified Pension Scheme is envisioned to bring the existing pension scheme under one umbrella, creating a more straightforward and accessible system for retirement planning. It aims to offer a standardised set of benefits and features, making it easier for employees (subscribers) to understand their pension options and make informed choices.

The scheme is likely to incorporate elements from the existing NPS, such as the defined contribution structure and the choice of investment options. However, it also introduces new features such as a guaranteed minimum pension or a more flexible withdrawal mechanism. The Government’s objective is to create a pension system that is inclusive, portable, and sustainable, catering to the diverse needs of the Indian population.

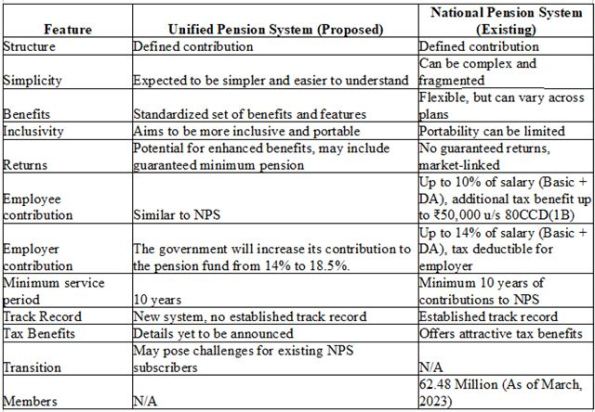

The proposed UPS has drawn comparisons to the existing NPS, raising questions about its relative advantages and disadvantages. The UPS is expected to simplify by merging multiple schemes into one. The scheme is likely to offer a standardised set of benefits and features, ensuring consistency across different pension plans and making it easier for individuals to compare and choose the most suitable option. The objective of UPS is to create a pension system that is inclusive and portable, catering to the diverse needs of the subscribers and allowing them to carry their pension benefits across different jobs and locations.

Also Read: What to do when your Credit Card benefits get revised?

Advantages and limitations of the NPS

The NPS has been in existence for several years, offering an established track record and a degree of certainty about its functioning and performance. The NPS offers flexibility and choice in terms of investment options and withdrawal mechanisms, allowing individuals to tailor their pension plans to their needs and risk appetite. The NPS offers attractive tax benefits, making it a popular choice for retirement planning. However, NPS is not free from flaws. For instance, the NPS does not offer guaranteed returns, exposing individuals to market risks and potential fluctuations in their pension corpus.

UPS vs NPS: Which one is more beneficial?

Determining which scheme is more beneficial is a function of each subscriber’s circumstances and preferences. The UPS with its potential for simplicity, standardised benefits, and enhanced features, could probably be attractive to subscribers seeking a straightforward and inclusive pension system. However, the lack of clarity about its specifics and the potential transition challenges of a concern. On the other hand, the NPS, with its established track record and flexibility might be preferred by subscribers who are comfortable with market risks and generally risk takers. However, the complexity of the current pension landscape and the lack of guaranteed returns may be a drawback.

The Government’s announcement of the UPS marks a significant development in India’s retirement planning landscape. Although the final details are still in the works, the scheme has the potential to streamline the pension system, provide consistent benefits, and improve both inclusivity and portability. Having said that it is not without its hurdles; uncertainties persist, the transition might be complex, and it will take time to establish a proven track record. Individuals considering their pension options should carefully evaluate the features and benefits of both the UPS and the NPS, taking into account their individual circumstances, risk appetite, and long-term financial goals.

It is advisable to seek professional financial advice to make informed decisions about retirement planning. Once the details of the UPS become clearer, it will be important to monitor its implementation and assess its actual impact on the pension arena. Indeed, it is a welcome step, but its success will depend on its effective execution and ability to address the diverse needs of the Indian working population.

Comparative Analysis of UPS vs NPS

(P Saravanan is a Professor of Finance and Accounting at IIM Tiruchirappalli, and A Paul Williams is Head of India at Sernova Financial)

Disclaimer: Views expressed are personal and do not reflect the official position or policy of FinancialExpress.com. Reproducing this content without permission is prohibited.