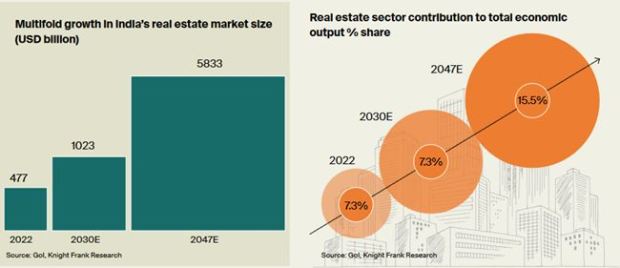

By 2047, India’s real estate sector is estimated to expand to $5.8 tn, contributing 15.5% to the total economic output, while the residential market has a potential to generate an output equivalent of $3.5 trn in 2047, according to the Knight Frank-NAREDCO India Real Estate-Vision 2047 report released recently.

Factors such as escalating demand for residential properties arising from rapid urbanisation and growing disposable incomes of individuals are supporting the fast paced expansion of the real estate industry in India. Apart from residential, the increasing need for contemporary office space, the need for hospitality and retail real estate development to cater to the growing consumption needs of the population are some of the other key growth inducing factors leading to real estate expansion in India. Furthermore, expanding e-commerce is catalysing the demand for warehousing and storage facilities in India providing a thrust to the industry.

Additionally, in recent years, the growing use of telecommunication services has necessitated the need for data centres or data storage facilities in India. From a government policy perspective, various initiatives such as focus on affordable housing, smart city projects, tax deductions on housing loans etc have enabled investment opportunities in the real estate sector in India.

“In the next 25 years, with a significant growth in the size of the economy, the real estate industry is poised for enormous opportunities in terms of shifts in consumption patterns as well as in revenue expansion,” said Rajan Bandelkar, President, NAREDCO.

Also Read: Fixed vs Floating Interest Rate: Which is better for home loan?

“Factors such as demographic advantages, improving business and investment sentiments, government policy push towards high value generating manufacturing and infrastructure sector etc will contribute to a significant expansion of the Indian economy by 2047, i.e., when India attains 100 years of Independence. Since real estate is a derived demand, a multifold economic expansion will boost the demand across all the asset classes in the segment. The demand for residential, commercial, warehousing, industrial land developments etc will grow at a multiplier rate to accommodate the growing needs of the economy and consumption needs of the individuals,” added Bandelkar.

Factors such as rapid urbanisation and growing income levels will boost the residential demand across all the price segments. The demand for commercial real estate will generate from growth in businesses in the service sector, expansion of domestic companies, startup ecosystems etc. Consumption in Tier 1 cities, along with potential growth in Tier 2 and 3 cities will generate demand for warehousing activities. Additionally, the recent policy initiatives by the central government to push manufacturing as the key growth driver will propel the demand for infrastructure supporting industrial developments.

The report ‘India Real Estate: Vision 2047’ was unveiled by Mr M Venkaiah Naidu, Former Vice President, Govt of India, at NAREDCO’s Silver Jubilee Celebration event in Hyderabad, along with other dignitaries present at the event.

Mr Naidu urged the hosts of real estate and infrastructure developers to prioritize creating happy, healthy, and affordable housing while retaining superb architectural elements for the satisfaction and sustainability of the housing sector. He also appealed to real estate and infrastructure developers to ensure the provision of adequate air, sunlight, and water availability in all housing projects. This, he emphasized, would enable residents to live in these housing units without any grievances and spend their time happily.

According to Knight Frank India, in the next 25 years, cumulatively there will be an estimated 230 million units of housing requirement in India. In terms of market value, the residential market has a potential to generate an output equivalent of USD 3.5 trn in 2047.

It is expected that with the changing income profiles, the demand for housing will emerge across all the price categories. In the next few years, while the demand for housing will remain concentrated in affordable housing, it will gradually shift towards mid segment and luxury housing. The share of lower income households will reduce from existing 43% currently to 9% in 2047. Thus, a significant share of the population will shift to lower middle and upper middle-income categories. This will enable a significant demand for mid-segment housing. Additionally, the share of HNIs and UHNIs households in India, which will likely increase from existing 3% to 9% in 2047, will generate a significant demand for luxury housing in India.

Dr Niranjan Hiranandani, National Vice Chairman of NAREDCO, said, “PMO’s ambitious project Housing for All will propel the sustainable demand for residential housing across the spectrum. A strong foundation for the upward cyclical growth of the real estate sector is being laid by the Government of India and the regulatory authorities. The northbound growth in the Indian Real Estate sector is driven by the favourable domestic economic environment with economic resilience, bolstered infrastructure growth plans, alternative investment models, and domestic consumption power. Growing GDP will stimulate commercial and industrial real estate growth, attracting global investors towards Grade A assets. Emerging alternative asset classes will also play a critical role in pooling investments and boosting investors’ confidence.”