Home Loan prepayment calculation: Home loan tenures are generally in the range of 15 to 20 years. In some cases, borrowers even go for very long tenures of 25 to 30 years, depending on their age and eligibility. However, the longer the tenure, the higher the interest amount borrowers end up paying to the lender.

One of the options suggested by experts to reduce home loan interest burden is to go for regular part prepayment of the principal amount, which can not only reduce the loan tenure but also save a lot of money that a borrower has to pay as interest.

Experts also say that one should prepay any amount to reduce the home loan principal. This strategy is especially beneficial during the initial years of the loan when the interest component is high.

According to Adhil Shetty, CEO, of Bankbazaar.com, paying just 5% of the loan balance every year can help a borrower close his/her 20-year home loan in just 12 years. Prepaying an additional EMI every year can help him/her close the loan in just 17 years. Additionally, the customer can also opt to increase the EMI by 5% every year to close the 20-year home loan in just 13 years.

Also Read: Should you prepay your home loan or invest for higher returns?

While not every borrower may have 5% of the principal or an extra EMI for prepayment, saving even a very small amount daily for prepayment can help them save a lot of money required to be paid as interest.

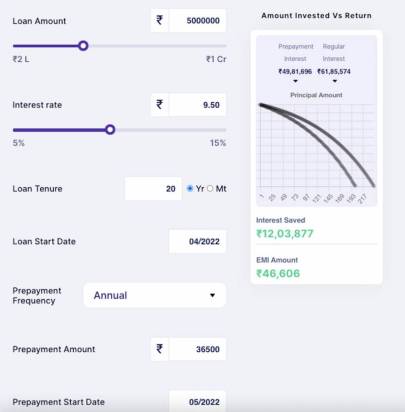

For example, if you save just Rs 100 per day, you will have Rs 36,500 at the end of the year for prepayment. The online home loan prepayment calculator available on Fisdom’s website shows that a person can save around Rs 12 lakh of interest on a Rs 50 lakh home loan of 20 years taken at a 9.5% rate. In the case of a 25-year loan of Rs 50 lakh at 9.5% interest rate, the interest saving would be around Rs 20 lakh.

Similarly, if you save just Rs 200 per day, you will have Rs 73,000 at the end of the year for prepayment. The calculator shows that a person can save around Rs 19 lakh of interest on a Rs 50 lakh home loan of 20 years taken at 9.5% rate. In the case of a 25-year loan of Rs 50 lakh at 9.5% interest rate, the interest saving would be around Rs 32 lakh.

Disclaimer: The above content is for illustration and information purposes only. Home loan prepayment rules and charges vary from one lender to another. Before going for prepayment, customers should check the rules with their lenders.