The government has kept the interest rate on general provident fund (GPF) and related funds unchanged at 7.1% for the three months from April-June 2024. The Ministry of Finance revises the interest rate for GPF and related provident funds for government employees every three months. The rate has not been chnaged for the last 17 quarters.

Under GPF, a retirement savings avenue exclusive to government sector employees in the country, a subscriber needs to contribute a minimum 6% of his or her total salary, and the maximum contribution can go up to 100% of the salary.

According to a notification by the Department of Economic Affairs (DEA), Ministry of Finance, dated June 10, 2024, “It is announced general information that during the year 2024-2025, accumulations at the credit of subscribers to the General Provident Fund and other similar funs shall carry interest at the rate of 7.1% w.e.f. 1st April, 2024.”

Also read: EPFO further eases claim settlement process in these cases! No more uploading of…

Besides GPF, the rate of 7.1% has been kept unchanged for the following funds applicable to various government services and departments for the April-June 2024 period.

- The General Provident Fund (Central Services).

- The Contributory Provident Fund (lndia).

- The All lndia Services Provident Fund.

- The State Railway Provident Fund.

- The General Provident Fund (Defence Services).

- The lndian Ordnance Department Provident Fund.

- The lndian Ordnance Factories Workmen’s Provident Fund.

- The lndian Naval Dockyard Workmen’s Provident Fund.

- The Defence Services Officers Provident Fund.

- The Armed Forces Personnel Provident Fund.

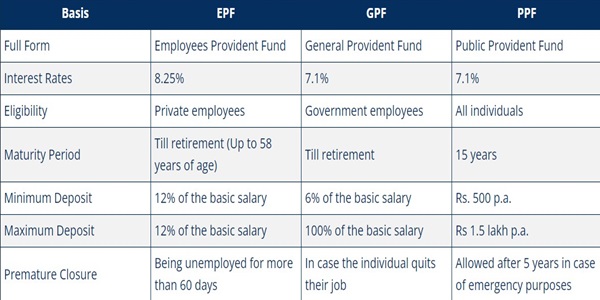

Difference between GPF, PPF and EPF

(Source: Paisabazaar)

General Provident Fund (GPF)

The GPF is a savings-cum-retirement scheme run by the central government for employees serving in the government departments. The GPF is applicable for those government employees who joined service before 2004. One can withdraw the GPF amount on retirement or leaving government service prematurely. The subscribers are also allowed to withdraw amount partially after 15 years of service.

Public Provident Fund (PPF)

Public provident Fund (PPF) investment is available for all individuals working in private oand government sectors. The main purpose behind starting the scheme back in 1968 was to mobilise small contributions from the public and help them build a good retirement corpus for themselves. Along with savings, the PPF helps individuals save taxes through availing deduction under Section 80C up to Rs 1.5 lakh.

Employees’ Provident Fund (EPF)

As the name suggests, EPF is available for employees of the private sector in the country. Private firms with more than 20 employees have to mandatorily deduct provident fund from the salary of employees. Under EPF, the company can deduct 12% of the basic salary of an employee as EPF contribution and the employer needs to match the contribution. An employee has the option to raise the voluntary contribution beyond 12%.