As non-banking financial companies (NBFCs) are offering higher interest rates on fixed deposits than banks, individuals, especially senior citizens, can lock in for a longer tenure. However, they must keep in mind that these deposits, unlike banks, are not insured under Deposit Insurance and Credit Guarantee Corporation and carry a higher risk compared to bank deposits.

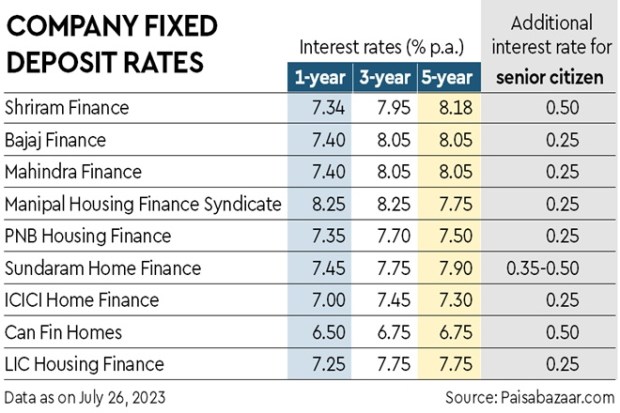

Companies such as Bajaj Finance are offering 8.05% on fixed deposits (FD) for a tenure of five years and an additional 25 basis points for senior citizens. It has also launched special tenure FDs for senior citizens. One of the highest interest rates offered to senior citizens is 8.60% for a tenure of 44 months. Similarly, Shriram Finance is offering 8.18% for a tenure of five years and an additional 50 basis points to senior citizens.

In contrast, State Bank of India is offering 6.5% for a five-year FD. Its 400-day special scheme Amit Kalash is offering 7.1% to the general public and 7.6% to senior citizens. HDFC Bank is offering 7% for a tenure of five years. The bank also has a special FD scheme offering 7.2% for 35-month and 7.25% for 55-month tenure. Senior citizens will get 50 basis points more. Also, the 5-year post office time deposit is offering 7.5%.

“We have seen how FDs have peaked after consistent hikes in repo rates. Currently, banks are offering more than 7% while NBFCs are giving more than 8%. This is the right time to lock your FDs at the higher rates and reap the benefits,” says Adhil Shetty, CEO, Bankbazaar.

Consider the risks

Companies or NBFCs typically offer higher interest rates on FDs due to their higher risk profile compared to banks. Before investing in an NBFC’s FD, it is essential to check the company’s credit rating and financial stability. Higher-rated ones are generally considered more stable and trustworthy. Theyshould research the company’s financial health and track record to ensure that the company has a history of meeting its financial obligations. Investors must compare the interest rates and factor in the maturity period to see whether it aligns with their financial goal. Also, they should consider their risk appetite before investing in corporate deposits.

Naveen Kukreja, co-founder and CEO, Paisabazaar, says investors should always check the credit ratings for the FD issuing NBFCs/HFCs, with higher ratings implying higher income certainty and capital protection. “However, these could still be prone to default risk as there have been instances of credit rating agencies failing to identify the deteriorating health of the FD issuing companies,” he says.

Alternative to company Fds

As an alternative to corporate FDs, retail investors can also consider FDs offered by small finance banks offering interest rates of 8% and above. Investors opening FDs with these banks would be covered under the Deposit Insurance and Credit Guarantee Corporation. This insurance covers cumulative bank deposits, including current, recurring, fixed and current account, of up to `5 lakh opened by each depositor in each scheduled bank, in case of bank failures. Moreover, senior citizens opening FD with SFBs get additional benefits of higher interest rates as well as tax deduction of `50,000 on FD interest income under Section 80TTB.

Risks vs returns

* Company FDs are not insured under Deposit Insurance and Credit Guarantee Corporation (DICGC)

* Small finance banks are offering interest rates of 8% and above on their FDs. These are also covered by DICGC

* Senior citizens get tax deduction of `50,000 on their fixed deposit interest income under Section 80TTB