With large and listed developers dominating the new launch housing supply across the top 7 cities, homebuyers are pressing the ‘buy’ button in newly-launched projects. Customer confidence is back with a bang and Indians are unhesitatingly picking lower prices (and higher ROI) over the instant gratification of ready or nearing completion homes, according to ANAROCK.

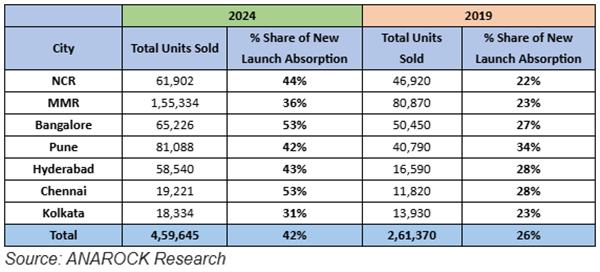

Latest ANAROCK data shows that over 42% of approx. 4.60 lakh homes sold in 2024 was in newly-launched projects – significantly up from pre-pandemic 2019’s sales share of 26% of approx. 2.61 lakh homes sold then.

This figure has been rising steadily over the past 5 years:

* In 2020, of approx. 1.38 lakh units sold in the top 7 cities, 28% were launched in that year.

* In 2021, 34% of approx. 2.37 lakh sold units were new launches.

* In 2022, 36% of out of approx. 3.65 lakh sold units were new launches.

* In 2023, 40% of approx. 4.77 lakh sold units were new launches.

Also Read: 10 hidden Credit Card perks you probably didn’t know about

Santhosh Kumar, Vice Chairman – ANAROCK Group, says, “At 53% each, Bengaluru and Chennai saw the highest share of new supply absorption in 2024 – of approx. 65,230 units sold in Bengaluru in 2024, about 53% were launched in that year; similarly, in Chennai, 53% of approx. 19,220 units sold in 2024 were launched that year.”

“NCR has clearly left its years of unsold speculative oversupply in the past – over 44% or approx. 61,900 units sold there in 2024 were launched in the same year,” adds Kumar. “Given its troubled history, NCR homebuyers’ growing preference for new launches over ready or close-to-completion homes is particularly remarkable. Just 22% of the homes sold there in 2019 were newly launched. This is a rapidly rising trend – helped by a strong pipeline of supply from financially strong and market-proven developers.”

Ready-to-move-in (RTMI) homes were, in the past, the top pick for NCR homebuyers because of the chronic project delays that had defined the region in the pre-RERA era.

Today, branded, reliable developers’ rising dominance in the Indian residential space is also attracting investors to the best projects. In particular, Bengaluru, Hyderabad and Chennai saw a massive uptick in new launch sales share, which many investors are seeking low entry points in these cities.

Unlike previous years, developers are now launching projects that truly meet market demand. These new projects are not only in prime locations but also feature the right unit sizes and configurations. Leading developers are actively acquiring land in key cities to launch residential projects tailored to customer preferences. According to ANAROCK, 2024 saw at least 133 land deals totalling over 2,515 acres, with 1,948 acres designated for residential development.

City-wise Absorption Trends

Kolkata had the lowest share of fresh supply absorption at 31% of approx. 18,330 units sold in 2024. That said, this figure was even lower in 2019, when just 23% of the 13,930 units sold that year were new launches.

* In MMR, of 1,55,334 units sold in 2024, approx. 36% were fresh launches. In 2019, of 80,870 units sold, 23% were new units.

* In NCR, of 61,902 units sold in 2024, approx. 44% were launched in the same year. In 2019, of 46,920 units sold, just 22% was in projects launched that year.

* In Chennai, of 19,221 units sold in 2024, newly launched units accounted for a whopping 53% share – up from 28% of 11,820 units in 2019.

* In Kolkata, of 18,334 units sold in 2024, about 31% were launched in that year. In 2019, 23% of approx. 13,930 sold units were newly launched.

* In Bengaluru, of 65,226 units sold in 2024, the sale share of newly launched units was 53% – up from 27% of 50,450 units in 2019.

* In Pune, of 81,088 units sold in 2024, 42% was in projects launched in that year – up from 34% of 40,790 units in 2019.

* In Hyderabad, 43% of approx. 58,540 sold units were launched in the same year – significantly up from 28% of approx. 16,590 units in 2019.

Commenting on this report, Garvit Tiwari, Director & Co-Founder, InfraMantra, said, “The rise in demand for newly-launched projects shows the growing confidence that developers have earned over the past couple of years, especially big listed developers. As a result, homebuyers are investing in those properties at a lower price. Also, the operationalisation and strict oversight of RERA has ensured fair practices, transparency and investor confidence in the real estate sector. The emergence of new micro markets across top cities has also tilted the preference of homebuyers towards newly-launched projects.”

Santosh Agarwal, CFO & Executive Director of Alpha Corp Development Limited, said, “The growing preference for newly-launched homes, which hit 42% in 2024, reaffirms our commitment to delivering high-quality, future-ready developments. As developers, we have been focusing on timely project execution, cutting-edge design, and premium amenities to meet evolving buyer expectations. This shift highlights the trust homebuyers place in reputed developers who ensure transparency and adherence to commitments. This demand surge further motivates us to continue setting new benchmarks in real estate excellence.”

Aman Trehan, Executive Director, Trehan Iris, said, “The surge in fresh launches contributing to home sales in 2024 reflects the evolving dynamics of the Indian real estate market. Buyers today are more inclined toward newly-launched projects that align with modern preferences, sustainable designs, and upgraded amenities. Moreover, in 2024, NCR saw over 44% of total units sold from projects launched in the same year. This trend underscores the growing confidence in new developments, driven by robust demand, enhanced infrastructure, and developers’ commitment to timely delivery. With homebuyers seeking smart designs and future-ready amenities, this trend reaffirms our commitment to delivering thoughtfully-designed spaces for today’s discerning buyers.”

Varun Sharma, Founder and Managing Director, MVN Infrastructure, said, “Delhi-NCR’s real estate market is thriving, with over 44% of total units sold in 2024 being newly-launched projects. This growth reflects the region’s strong demand, supported by significant infrastructure development and improved connectivity. Enhanced road networks, metro expansions, and urban planning have transformed Delhi-NCR into a hub of opportunity, attracting homebuyers and investors alike. The region’s progress highlights its potential for sustained growth and reinforces its position as a leading real estate destination in India.”

Talking about the Gurugram market, Harinder Dhillon, Vice President-Sales, BPTP, said, “According to Anarock’s Residential Annual Report 2024, homebuyers purchased approximately 4.60 lakh homes in India’s top seven cities, with Gurugram leading the trend in real estate development and resilience. The city’s strategic location, robust infrastructure, and evolving consumer preferences have driven the surge in new launch absorption. Modern infrastructure, green spaces, better connectivity, and enhanced amenities have fueled this growth, reflecting strong confidence in Gurugram’s real estate market. This positions the city as one of India’s premier investment destinations.”