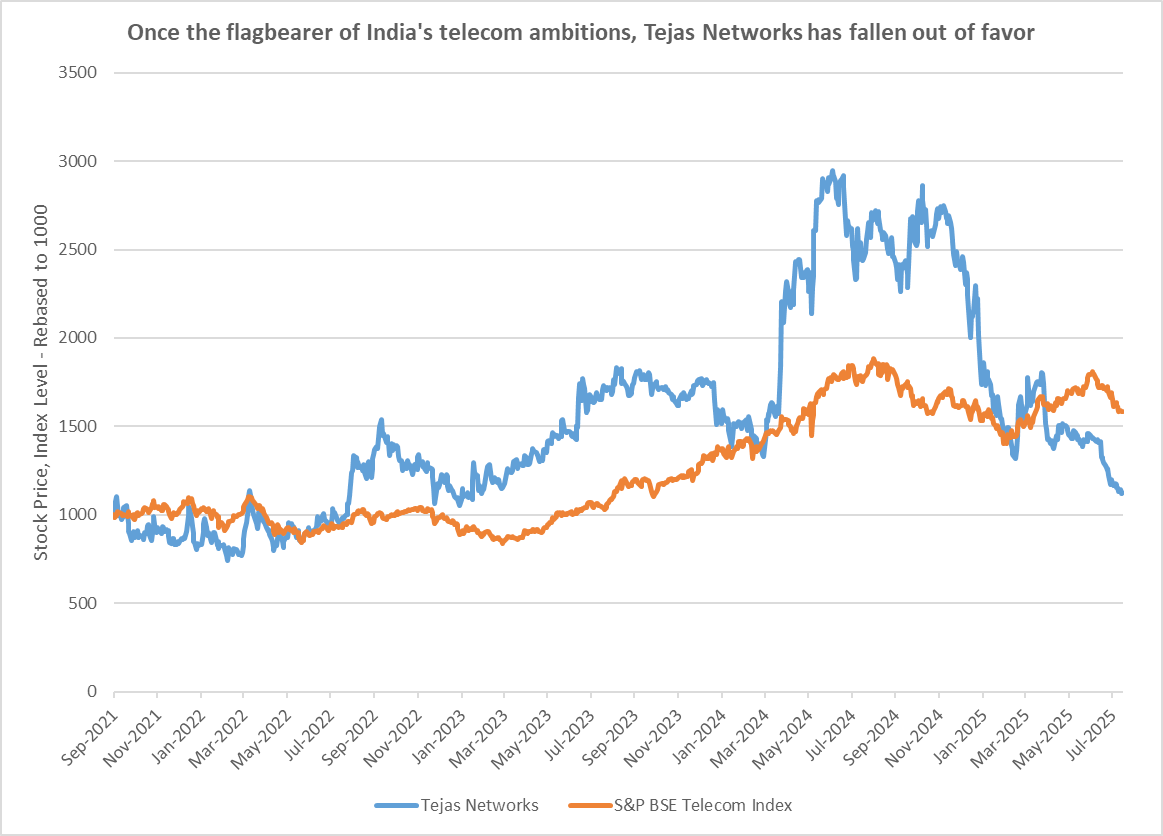

Tejas Networks used to be flagbearer of India’s telecom ambitions. In the 3 years since July 2021, Rs 1 lakh invested in this Tata-group stock would have appreciated to almost Rs 8 lakh.

But this multibagger of the past has recently fallen out of favor with investors. According to Trendlyne, FIIs have slashed their stake in the company from 11% to 6% over the last couple of years. Long-term investor, Vijay Kedia, has also exited his position in the company. With a 60% correction off its peak last year, the stock is now trading near critical support levels.

Can investors expect a bounce back, or is this a value-trap, implying the future prospects for stock could be disappointing?

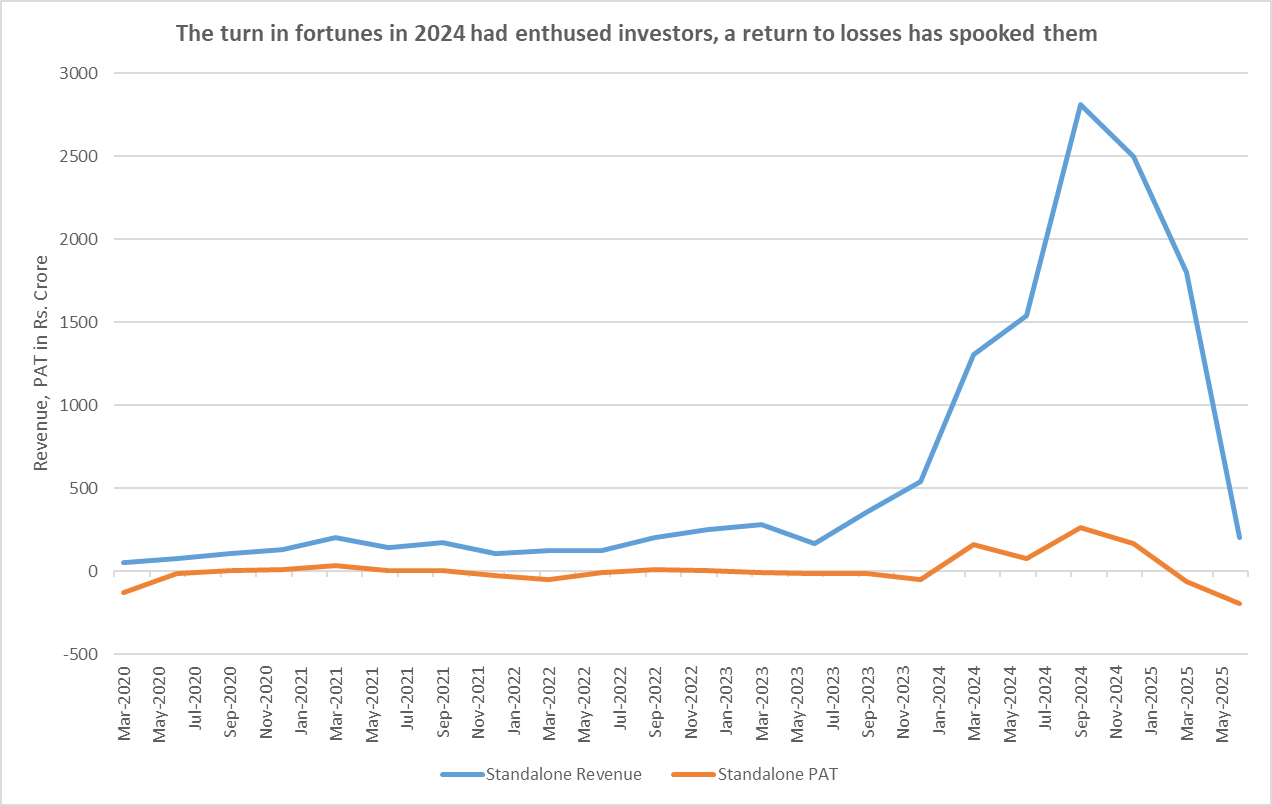

From Revenue Rocket to a Return to Losses

Back in 2020, Tejas Networks used to post Rs 50-100 crore in quarterly revenues. As it started bagging orders from industry-giants including BSNL, this spiked to Rs 500 crore by the end of 2023 and eventually, to Rs 2,500 crore in the quarter ending December 2024. The turn in fortunes had enthused investors.

But by the end of FY25, cracks had begun to appear. Despite a multifold expansion in profits, cash-flows were not keeping up. Inventory was piling up, further stressing out the company’s cash-conversion cycle. The order-book was not expanding raising questions on future growth prospects.

All of this came to a head in the quarter ending March 2025 when the company plunged back into losses. Despite a recent PLI (Production Linked Incentive) win, investors were spooked… and understandably so. Thanks to provisions and write-offs related to obsolete inventory worth more than Rs 100 crore, the company reported a standalone loss of 62 crore during the quarter. The topline growth of 38% to Rs 1,800 crore offered comfort, but only until one looked deeper.

Tejas was staring at receivables worth a massive Rs 4,800 crore as of March 2025. Shipments had been pushed through, even as cash-realizations remained stressed. While this pushed up the FY25 revenues to almost Rs 9,000 crore, it weighed on Q1 FY26 revenues which came in at just about Rs 200 crore. Of course, revenues during the quarter were also affected by BSNL’s large order nearing completion. Loss expanded to Rs 200 crore. The company pinned it on delayed orders and shipments, but it won’t be a stretch to consider it a consequence of frontloading shipments during the previous quarter.

The Client Trap: When Your Biggest Customer is Your Biggest Problem

Headquartered in Bangalore and backed by the Tata group, Tejas Networks has the ingredients in place to lead India’s large telecom ambitions. With an operational track-record that dates back to 2000, Tejas is now among the top 10 suppliers in the global optical aggregation and fibre broadband markets. Be it wireless or wireline or network management and monitoring, the company caters to a wide range of requirements for telecom service providers, internet service providers, critical infrastructure providers, and government entities.

Tejas reports 3% of its revenues coming from domestic government-backed entities and another 3% from exports. While this may lead one to believe that 94% of the business is driven by domestic private players, a look at the client-profile highlights the difference between letter and spirit. The company’s domestic sales are driven by pseudo-public companies like BSNL and Vodafone.

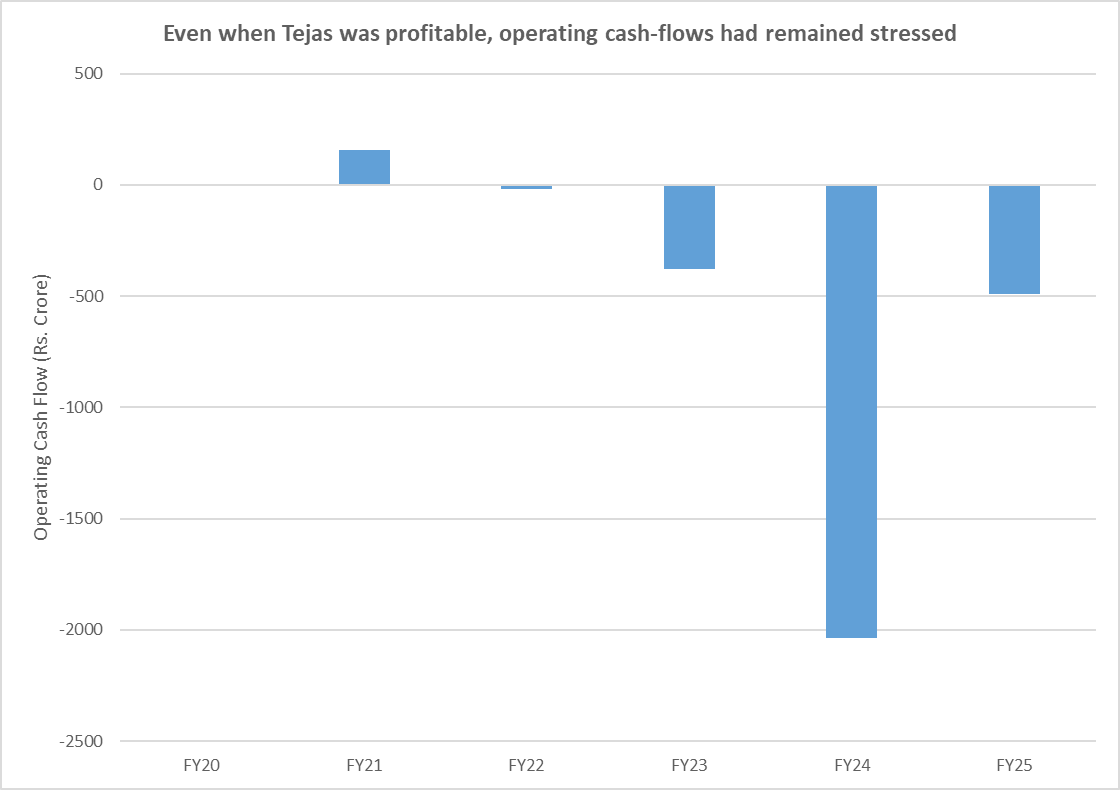

This comes with its typical set of problems – delayed receivables and patchy orders, leading to fluctuating revenues and stressed cash-conversion. To make matters worse, Tejas Networks has piled up inventory, which it has been writing off or provisioning for, due to obsolescence. This contributed to its return to losses. But even when Tejas was profitable, its operating cash-flows had remained stressed.

The Silver Lining: Can R&D and a Global Push Save the Day?

Tejas Networks holds potential. The demand for 5G is picking up massively in India, buoyed by which, Tejas’ persistence on R&D can pay off. 60% of its workforce is engaged in R&D, and the company ranks among the top three listed companies in India in terms of R&D expenses as a percentage of revenues. Along with its subsidiaries, it has filed more than 450 patents. It has also gone for inorganic expansion of its R&D capabilities.

But looking at how the company had to write off its inventory due to obsolescence, the focus on R&D needs to be met with operational efficiency. That may be difficult to achieve over the near-term, considering Tejas’ client-profile.

Furthermore, its order-book has not kept up with its topline. Against revenues of almost Rs 9,000 crore clocked in FY25, the company’s order-book stood at just about Rs1,200 crore as of the end of June 2025. This is to say that investors have done well to temper their expectations on growth going forward.

That said, the company is expected to bid for a BSNL order expected to hit the markets soon. Considering Tejas’ track-record of a successful partnership with TCS in fulfilling a BSNL order, its chances are promising. This could give Tejas’ order-book a much-needed leg up. Of course, as competition heats up, Tejas will need to up its game as well.

The company also has big plans to go global, which if executed successfully, would take the pressure off its client-profile. Additionally, its ambitions are being spearheaded by a skilled management. So, there is potential for growth, subject to execution keeping with the plans.

Moreover, following the steep correction witnessed recently, the stock is now trading at just about 50 times its earnings. This is a relief compared to its massive P/E of almost 400x a year back. But considering near-term fundamental headwinds, and a rise in speculative activity on the counter (as indicated by the falling delivery percentage), it is not expected to be a smooth ride.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ananya Roy is the founder of Credibull Capital, a SEBI-registered investment adviser. An alumnus of NIT, IIM, and a CFA charter-holder, she pens her views on the economy and stock markets.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article. However, clients of Credibull Capital may or may not own these securities.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.