India is a country which is almost always in the global headlines. Our stock market is known to be one roller coaster ride the world around. Navigating our markets is a tough job and there are some investors who do a great job of it. These super investors or as we call them, the Warren Buffetts of India, have massive following and their moves create ripples across board.

Two of these warren Buffets of India, Sunil Singhania (Holds 16 stocks word Rs 2,990 cr) and Madhusudan Kela (Holds 21 stocks worth Rs 2,627 cr) just made some big changes to their portfolio. They just sold off 2 stocks, one an energy company and the other a luxury retailer.

So, as the markets goes abuzz with speculation about their exit from these 2 stocks, let us dive and see if we can find what is it that triggered this sell decision.

Waaree Energies Ltd

Incorporated in 1990, Waaree Energies Ltd is an Indian manufacturer of solar PV modules with an aggregate installed capacity of 12 GW. The company has five solar module manufacturing facilities in India, with international presence

With a market cap of Rs 90,249 cr, Waaree Energies is India’s largest manufacturer and exporter of solar modules with a 21% share of the domestic market for solar modules and 44% share in India’s solar module exports.

Madhusudan Kela held a 1.2% stake in the company which as per the exchange filings made by the company for the quarter ending June 2025 has gone below 1% indicating a substantial or complete exit.

Now this sell decision has raised a lot of questions, given that the company has logged in some solid financials in the last few years.

The sales of the company grew at a compounded growth rate of 49% from Rs 1,996 cr in FY20 to Rs 14,444 cr in FY25. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) went from Rs 93 cr in FY20 to Rs 2,722 cr in FY25, logging in a CAGR of 97%.

Net profits jumped from Rs 39 cr in FY20 to Rs 1,928 cr in FY25, which is a compounded growth of a whopping 117% in just 5 years.

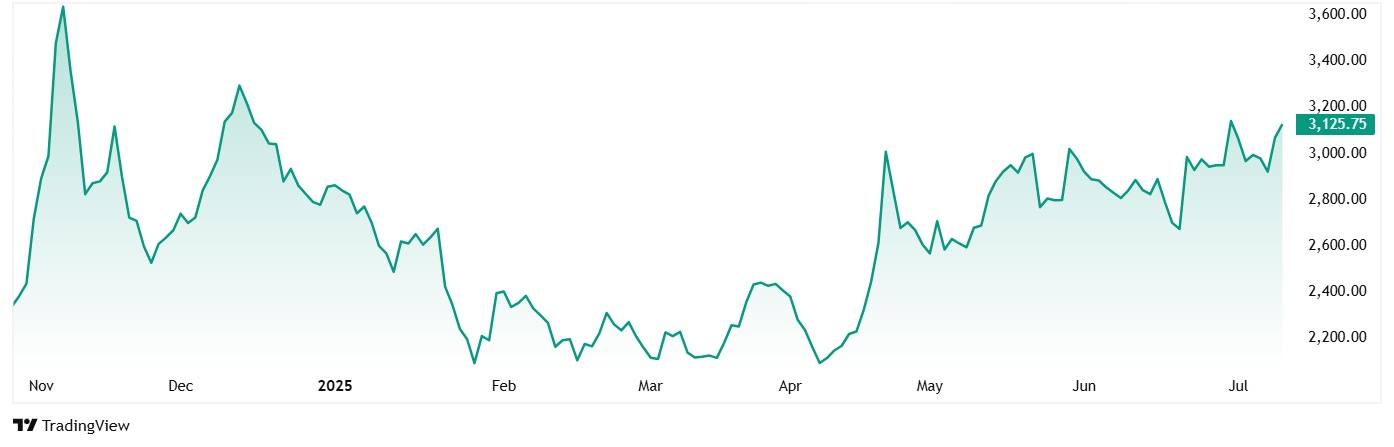

The share price of Waaree Energies was around Rs 2,340 when it was listed in October 2024, which has jumped to Rs 3,141 as of 9th July 2025. That’s a growth of 34% in hardly a year.

The stock is trading at a PE of 48x, while the industry median of 44x. long term median PE for Waaree will be too soon to look at, but 10-year industry median is 25x.

Despite new US tariff uncertainty, Waaree Energies’ management is confident due to their strong order book, received advances, and flexible manufacturing locations. While recognizing supply chain and operational risks, their focus remains on EBITDA as a key control. To counter declining module prices, they plan to cut raw material costs faster than selling price drops, leveraging scale and integration. The company anticipates robust demand in India and globally, driven by policy support and sectors like AI, expecting no slowdown through FY26/27.

Ethos Ltd

Ethos Limited (“Ethos”) was incorporated in 2007 and promoted by KDDL Limited. Ethos is India’s largest luxury and premium watch retail player.

With a market cap of Rs 7,223 cr Ethos is India’s largest luxury and premium watch retail player having 13% share of the total retail sales in premium and luxury segment and 20% share when seen in the exclusive luxury segment.

Sunil Singhania’s Abakkus Asset Management held a stake in the company through Abakkus Growth Fund, which has dropped below 1% as per filings made for the quarter ending June 2025.

Let’s look at the financials for Ethos to try and gather the reason behind this sell off.

The sales of the company grew at a compounded growth rate of 22% from Rs 458 cr in FY20 to Rs 1,252 cr in FY25. EBITDA grew from Rs 56 cr in FY20 to Rs 188 cr in FY25, logging in a compound growth of 28%.

As for the Net Profits, the company saw a big turnaround as it went from losses of Rs 1 cr in FY20 to profits of Rs 96 cr in FY25, which is a compounded growth of 120% in just 5 years.

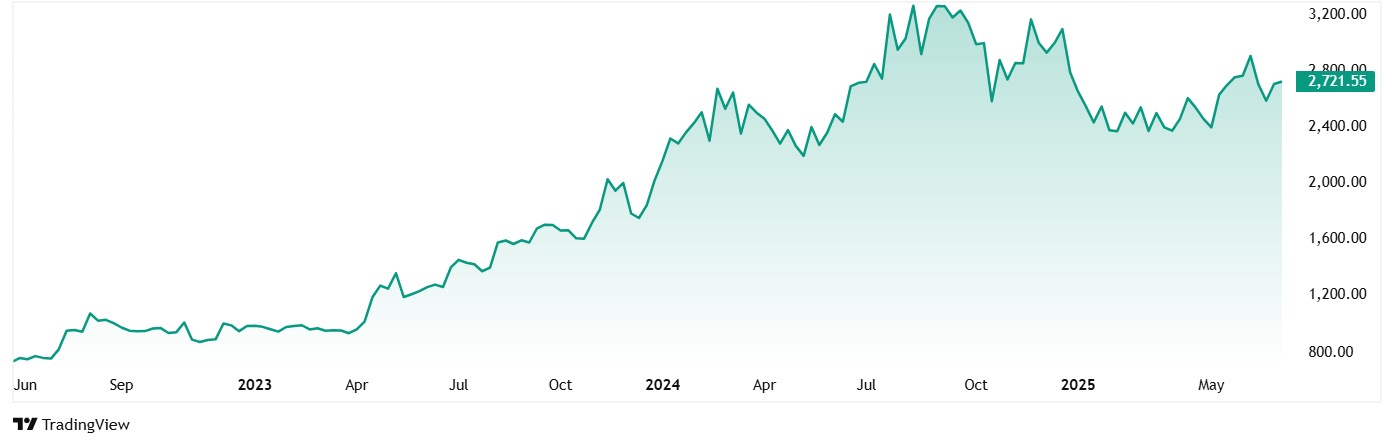

The share price of Ethos Ltd was around Rs 720 when it was listed in June 2022 and as of 9th July 2025, the price was Rs 2,699, which is a jump of almost 275% since listing.

The company’s stock is trading at a PE of 75, while the industry median is 32x. The 10-year industry median PE is 29x.

The company has recently established Ficus Trading LLC as a wholly owned subsidiary in the UAE. It will focus on areas including pre-owned watches (leveraging the large Indian diaspora and thriving pre-owned market in Dubai), aftersales service for Indian customers, and retailing Favre Leuba in the region.

Ethos sees no visible demand slowdown in India and reiterates its vision to grow revenue 10x in 10 years, as stated at IPO. Management is confident in the structural growth of luxury retail in India, ongoing premiumization, and Ethos’ ability to set benchmarks and attract global brands.

Strategic Exit or Time to be Careful?

Madhusudan Kela and Sunil Singhania’s exit from Waaree Energies and Ethos respectively raises some valid questions. Despite of strong financials and future plans, what is it that prompted these 2 Warren Buffetts of India to exit these stocks?

Is it something strategic exit or a hint at something bigger that the everyday investor does not know about? One this is for sure that when super investors like Kela and Singhania make such moves, it is not an impulsive or emotional decision, but a well calculated one.

How these two stocks will do in the months and years to come will now be something to look at. A good idea will be to add them to your watchlist and keep a close eye on them.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.