Radhakishan Damani’s portfolio is up by 22% in just 3 months, according to Economic Times. For context, other mega investors are not on the same boat. While Jhunjhunwala and associates’ portfolio has appreciated by less than 2% during the quarter, Ashish Kacholia and Madhusudan Kela’s portfolios have corrected by almost 10% and 25% during the period.

While it’s not fair to draw any conclusions based on such a short period of performance, there’s no harm in catering to our curious minds occasionally. What is it that gave Damani such a huge leg up over the last quarter?

Sundaram Finance Holdings has had a significant role to play. With more than 45% return in 3 months, the stock features as the investor’s best performing pick.

In fact, Damani has also picked up a stake in Sundaram Finance. The lender has also seen FII holding expand from less than 8% to almost 19% as of June 2025. What is it about the Sundaram Finance group that has enthused Damani and foreign investors? Should you hop on to the speeding train?

Small fish, big potential?

Bajaj Finance, the industry behemoth sports more than Rs 4 trillion in assets under management (AUM). In comparison to the legendary Bajaj group’s lending arm, Sundaram’s Rs 50,000 crore AUM positions it as a small fish in the big pond of Indian NBFCs. Established in 1954, the lender finances the purchase of commercial vehicles, cars, utility vehicles, tractors, and farm equipment.

Of course, the group-level AUM for Sundaram stands at almost Rs 1.5 trillion. But that includes more than Rs 70,000 crore coming in from its mutual-fund subsidiary, and considering that in a comparison between lending businesses is hardly appropriate.

Speaking of subsidiaries, Damani’s best pick – Sundaram Finance Holdings (SFHL) – used to be a subsidiary of the group until March 2024. The company makes strategic investments across the auto component and manufacturing industries. With 18 portfolios in its kitty including Wheels India, Brakes India, IMPAL and Sundaram Dynacast, the investing company has leveraged the group’s knowledge and expertise in the sector to clock Rs 240 crore in profit on a revenue of Rs 300 crore.

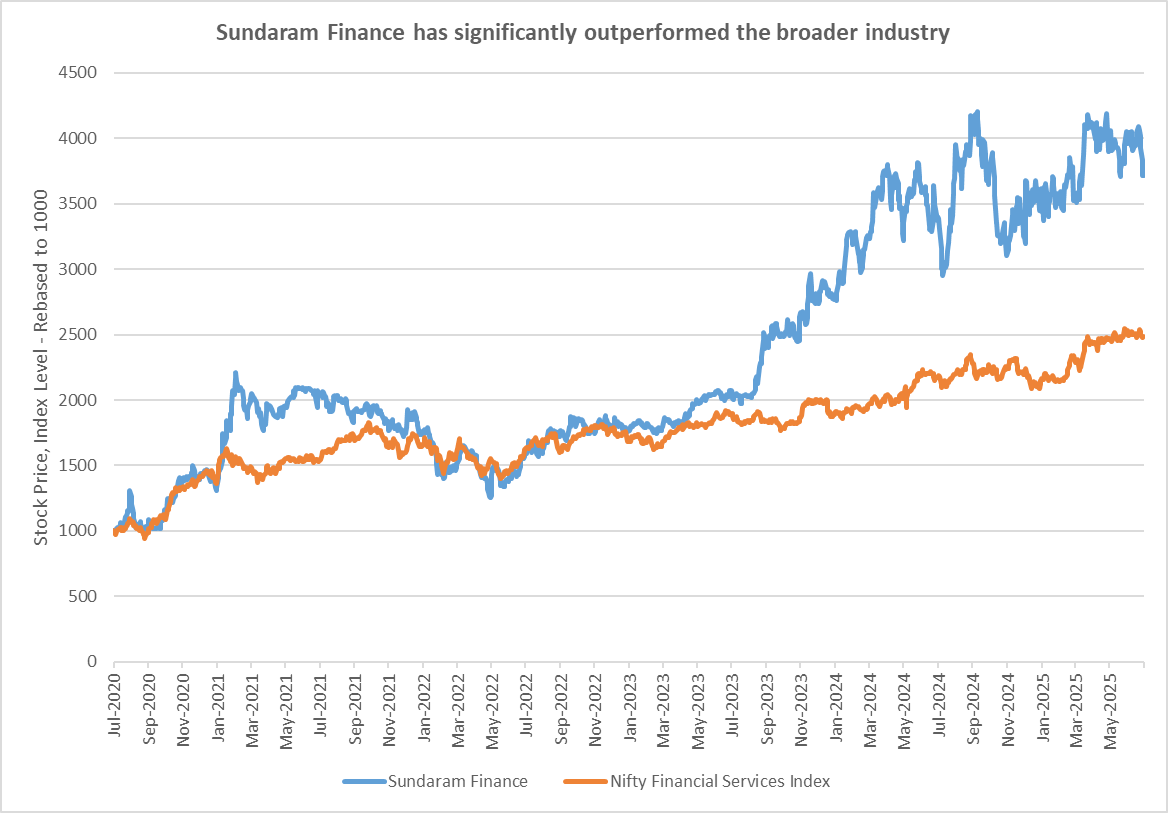

This explains the 63% CAGR return delivered by SHFL over the last 5 years. Sundaram Finance, on the other hand, has had a performance more in line with the NBFC industry. With a 30% CAGR since July 2020, Sundaram Finance has significantly outperformed the Nifty Financial Services Index’s 20% CAGR during the period.

Getting into Sundaram’s trenches

With a 70-year heritage and a legacy of deep-deposit customer connect across the group, Sundaram has grown from strength to strength over the years. It boasts of more than 700 branches, and caters to over 6 lakh customers.

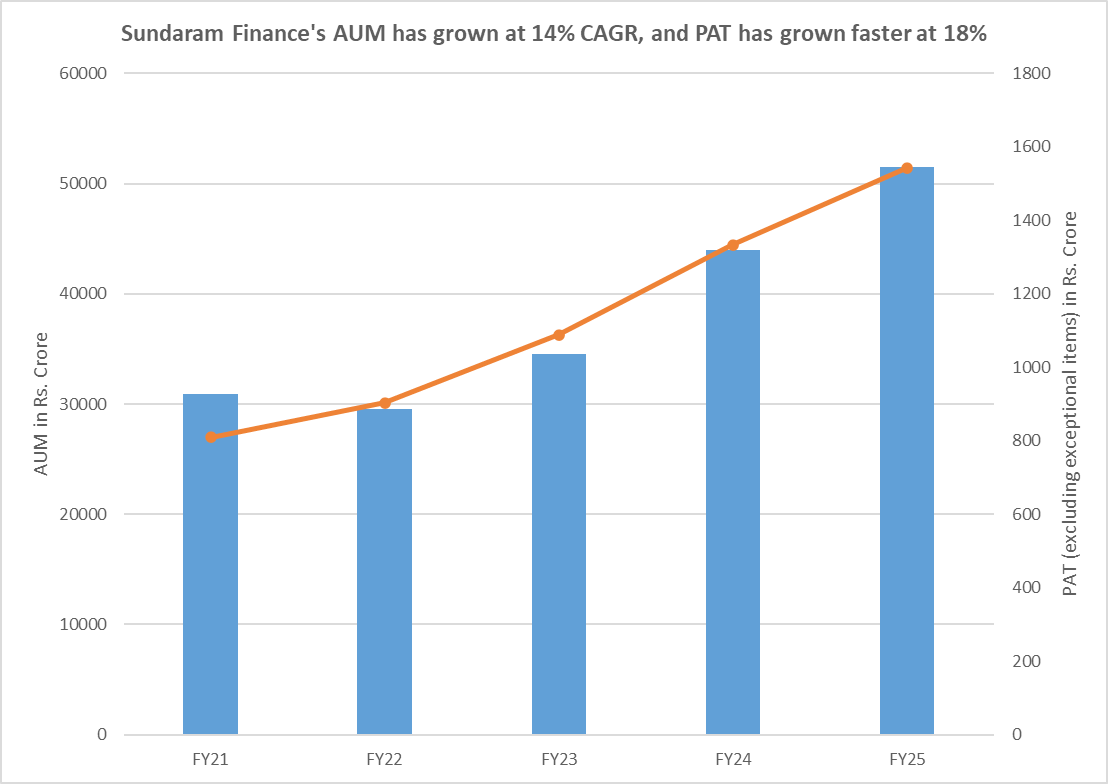

Since FY21, the lender’s AUM has expanded from just about Rs 30,000 crore to more than Rs 50,000 crore. Its PAT has increased even faster, registering an 18% CAGR growth from Rs 800 crore in FY21 to more than Rs 1,500 crore in FY25. In FY25, PAT grew by only about 6%. But excluding an exceptional gain of Rs 120 crore from the redemption of non-convertible preference shares of TVS holdings in FY24, PAT-growth was more respectable at 16%.

Sundaram clocked a 17% growth in its AUM in FY25 over the previous fiscal. But in a subdued auto market, disbursements increased slower at 9% year-on-year. The cautious demand environment during the year was exacerbated by a scorching summer, disruptions due to elections, and geopolitical uncertainty. Given that 45% of Sundaram’s AUM is concentrated in commercial vehicles and another 25% in car financing, the lender has been vulnerable to the slowdown in the automobile market.

That said, PAT-growth has been supported by improving scale, an expansion in net-interest-margin (NIM) and a moderation in cost-to-income ratio from 35% to 31% during the fiscal.

Regulatory tailwinds

After holding rates high for more than 2 years, the RBI commenced monetary easing this year. It has already slashed rates by 100 bps (1%) in 2025 so far. Monetary easing will help Sundaram Finance more than diversified NBFC players, given Sundaram’s focus on fixed-rate vehicle financing. As rates trend lower, Sundaram’s source of funds will be repriced faster than its application of funds, thus helping its margins.

Following the higher-than-expected 50-bps cut delivered in June, the RBI has now switched to a neutral stance. Of course, inflation has moved steadily lower and concerns around growth have picked up pace since then. This could make a case for more rate-cuts. But inflation is expected to resume upwards once the favorable base effect wears off in October.

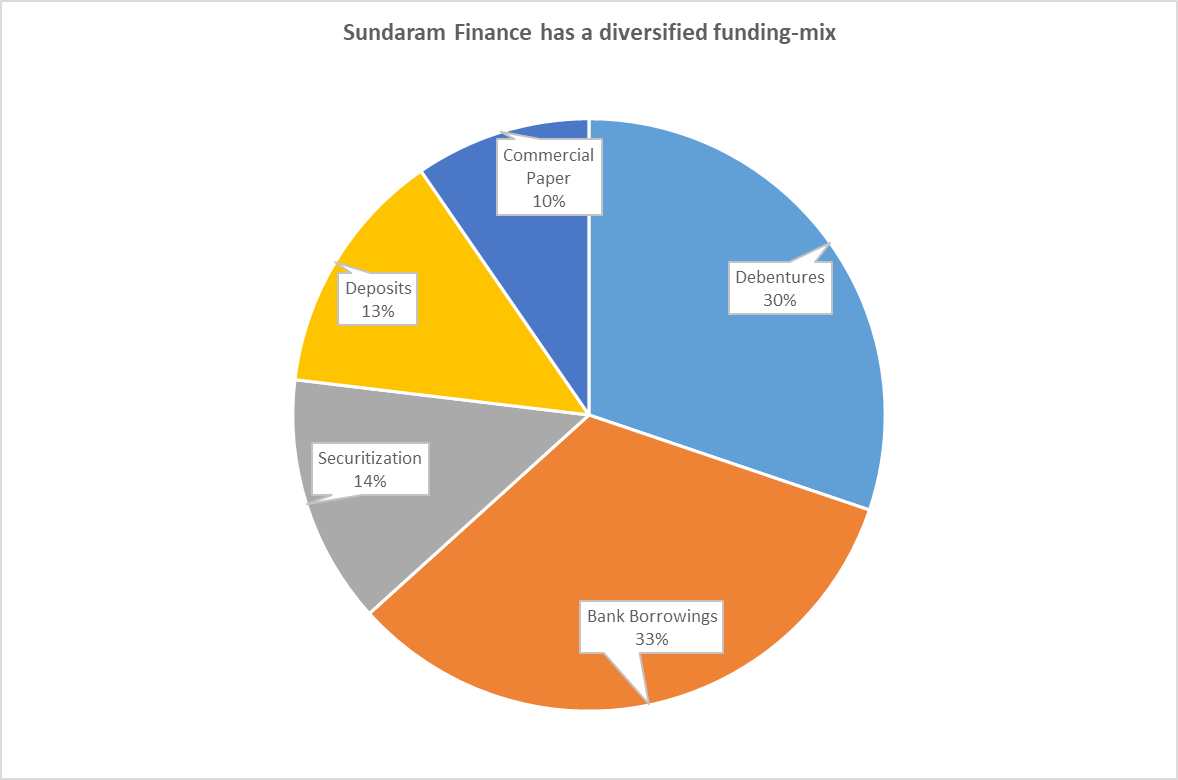

While Sundaram’s funding-mix is diversified, 33% comes from bank borrowings. So, yet another regulatory tailwind for the NBFC’s margins has been the RBI’s reversal of higher risk-weights for banks’ lending to NBFCs.

Management upbeat on the outlook, but risks loom

Sundaram’s management has been counting on a recovery in rural demand to support its growth aspirations. It also expected the government’s persistent capex spending and income-tax benefits announced last budget to drive up urban demand. It also hopes for private capex to join in, thereby kicking off the virtuous cycle of rising employment and rising demand.

With healthy monsoons this year, the rural demand piece is likely to fall into place. But owing to persistent geopolitical uncertainty and languishing IT wages, urban demand is still patchy. The automobile market is still in the slow lane.

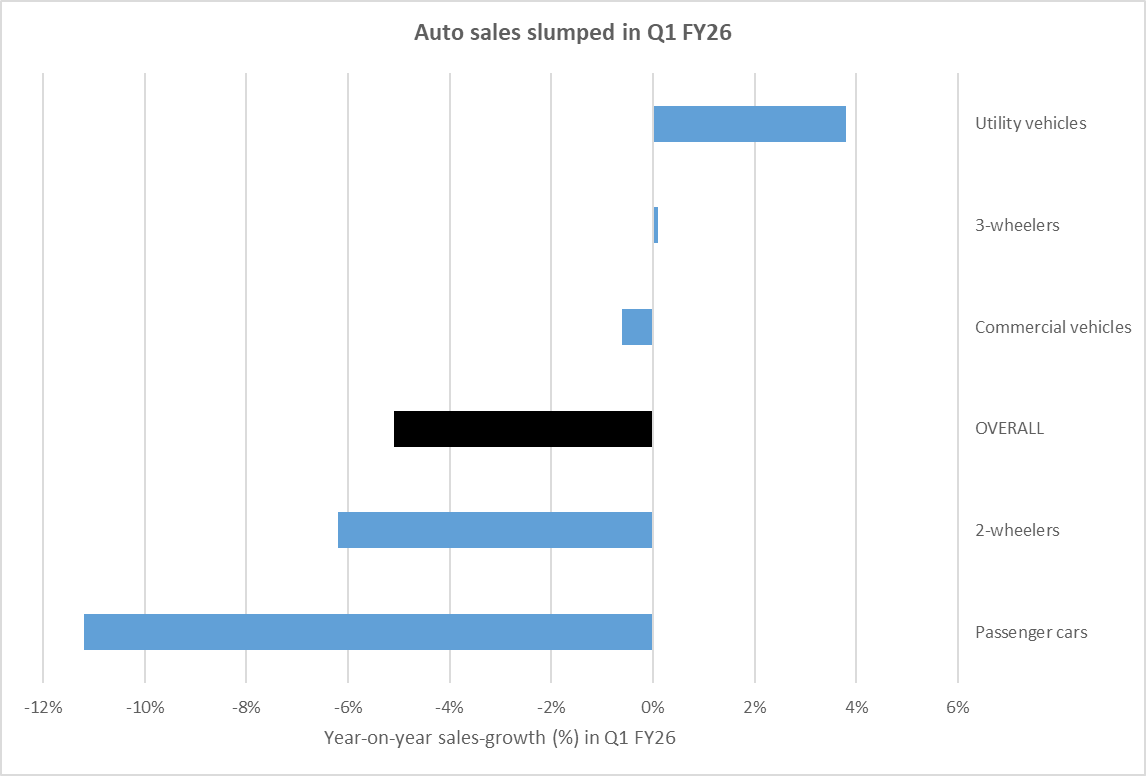

According to SIAM data, despite support from utility vehicles, passenger vehicle exports, and 3-wheelers, overall auto sales dropped by 5.1% year-on-year in Q1 FY26. Passenger car sales saw the steepest dip. Considering that a quarter of Sundaram’s lending is towards car-financing, the lender’s growth is likely to have been affected.

Furthermore, Sundaram has not been immune to industry-wide stress. Its gross NPA expanded from 1.98% to 2.17%, and net NPA also worsened to 1.38%. While the company claims best-in-class asset-quality, the rising stress on its books still raises concerns. Still above the regulatory requirement, but the lender’s capital-adequacy has declined from 24.4% as of March 2022 to 20.4% as of the latest fiscal-end.

The stock is trading at more than 28 times its earnings, significantly pricier than its 5-year median of 23x P/E. While the valuation has moderated in the last one year, brokerages have pegged its target-price at Rs 4,410 apiece. This reflects a 7% downside over current levels.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ananya Roy is the founder of Credibull Capital, a SEBI-registered investment adviser. An alumnus of NIT, IIM, and a CFA charter-holder, she pens her views on the economy and stock markets.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.