Dolly Khanna, is widely known and followed by many for her strategic stock portfolio spread across diverse range of companies across various sectors, focussing on long-term value creation. And that too after extensive research and analysis.

However, this time she has shocked her fellow Warren Buffetts of India and the whole investor community on the whole with her latest stock pick. A company that has been in the news for all the wrong reasons in the past few years. Plus, the company hasn’t seen any profits in the last 5 years.

Khanna definitely has some rationale behind this risky pick, but it is only known to her. But its has sent the investor circles into a circle of questions and doubts. Let us try to find out if this could be the next big thing or a disaster hiding in plain sight.

Coffee Day Enterprises Ltd

Incorporated in 1996, Coffee Day Enterprises Ltd is in the business of Coffee and related business, Integrated multimodal logistics, Financial services, Leasing of commercial office space, Hospitality services and Investment and other corporate functions.

With a market cap of Rs 842 cr, the company is also engaged in the trading of coffee beans. The company through its subsidiaries, associates and joint venture companies, is engaged in business in multiple sectors such as Coffee-retail and exports, Leasing of commercial office space, Hospitality and Information Technology (IT) / Information Technology Enabled Services (ITeS).

Dolly Khanna, a Warren Buffett of India, who currently has about 17 stocks in her portfolio worth Rs 484 crores, just bought a 1.6% stake in the company worth Rs 13 cr. And this has the rumour mills working overtime.

Coffee Day Enterprises Ltd has been in the news for a few years now after its founder, V G Siddhartha died by suicide in 2019. An unfortunate event, which got a lot of media and agency scrutiny to the company, which was already under immense financial stress.

The Big Fall…

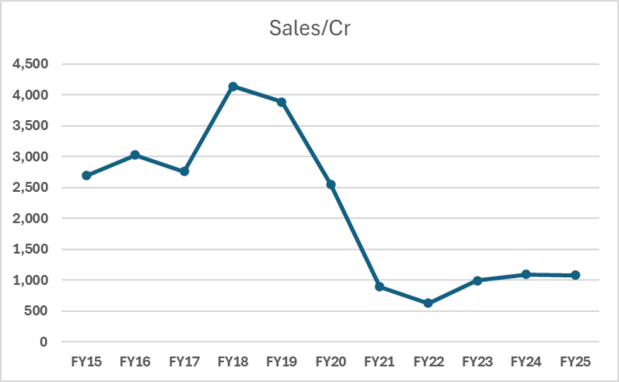

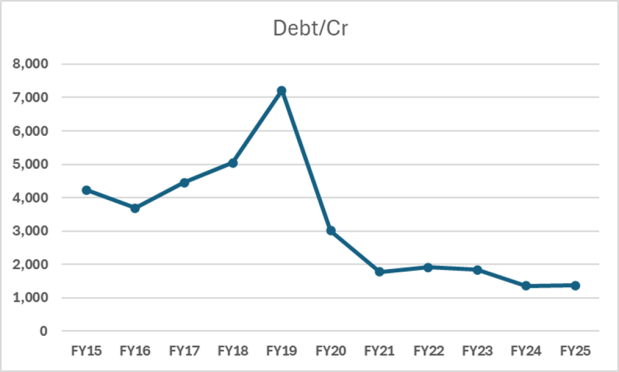

The company’s sales figures saw a roller coaster of a ride in the last decade.

For obvious reasons, the company’s sales dropped after 2019 post the passing of Siddhartha. The company saw the biggest drop between FY19 and FY22.

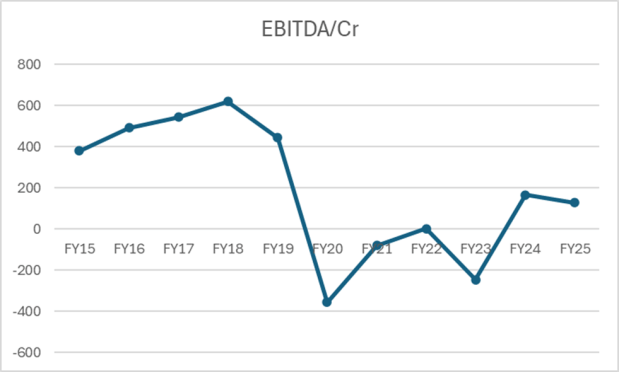

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) also went through the same stress post 2019.

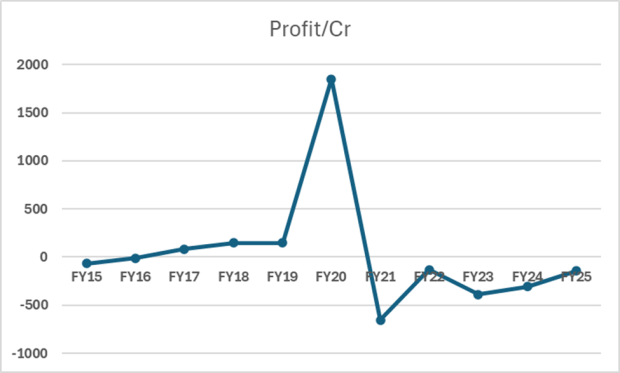

No wonder the company faced and is still facing liquidity issues, which it has been trying to solve. This had a direct impact on the net profits. Having said that, the company showed some solid growth up until Siddhartha’s demise.

The sharp drop in the profits after 2019 was a strong shock to investors across the board.

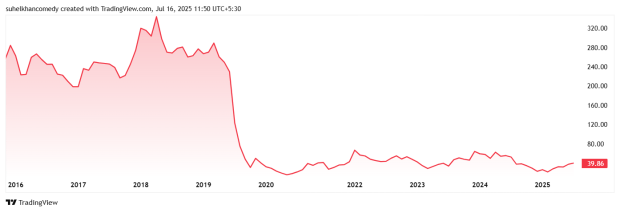

The share prices of Coffee Day Enterprises Ltd bore the brunt of these falling financials. The company saw its all-time high price of Rs 375 in around January 2018 and was trading at about Rs 240 when the news of Siddhartha’s death by suicide flashed on news channels.

It was then a downward spiral, which the company is still trying to contain.

Currently as on 16th July 2025, the share price is at Rs 40.

The company’s share is trading at a negative PE due to consistent losses in the last few years. The 10-Year median PE for the company is 59x while the industry median for the same period is 91x.

As we can see, things went from bad to worse quite quickly after Siddhartha’s untimely passing.

The Worthy Successor

In December 2020, Siddhartha’s wife, Malavika Siddhartha Hegde, took the reigns in her hands as the CEO of the company. She had a complex and challenging situation at hand when she took over. The company was not only struggling with huge financial liabilities to a consortium of 13 lenders, but also with the void left by its founder. Creditors were closing in, and the operational stability of brand, which included the core coffee business, logistics, financial services, and real estate was in danger.

In short, the Coffee Day Enterprises was on the brink of unavoidable collapse, with debts of over Rs 7,000 cr mounting. And of course there was a crisis of confidence. But Malavika, despite being in an emotional turmoil, was methodical, patient, and transparent. Her primary objective: deleverage the company and restore the trust of employees, shareholders, and creditors.

Here are the steps she had to and did take:

- Strategically divesting non-core assets to get down its huge debt.

- Sold off the company’s stake in Sical Logistics

- Sold off stake in the technology park, Global Village Tech Park

- Shut down unprofitable Café Coffee Day outlets.

Her approach was direct and transparent. In a letter to the company’s 25,000 employees shortly after taking charge, she expressed her commitment to the company’s future and acknowledged the immense challenges ahead. This transparency helped rebuild morale and garner support from all stakeholders.

And things changed for the better in terms of debt.

From a debt of over Rs 7,000 cr to Rs 1,373 cr in FY25, the company’s debt came down by over 80% in just 5 years.

Dolly Khanna’s investment in Coffee Day Enterprises cannot just be regarded as a strategic move.

With Dolly Khanna’s track record of picking future multibaggers and Malavika’s proven leadership skills, investors are very positive about the outcome of this new stake by Khanna.

The Risks Are Still Not Small

The company has been consistently defaulting on its loan and interest repayments to banks, financial institutions, and unlisted debt securities (NCDs and NCRPS) due to a severe liquidity crisis. An issue that has been repeatedly disclosed over several quarters in investor presentations.

In January 2023, SEBI had imposed a total penalty of INR 26 crore on Coffee Day Enterprises Limited (CDEL) for violations related to the transfer of funds by its subsidiaries to Mysore Amalgamated Coffee Estates Limited (MACEL). SEBI directed Coffee Day Enterprises to recover the entire dues from MACEL and its related entities along with interest and to appoint an independent law firm for this purpose.

In all, Coffee Day Enterprises Ltd is facing severe financial distress marked by continuous debt defaults, a significant portion of its assets being highly questionable receivables from related parties, and auditors expressing a fundamental uncertainty about its ability to continue operations. The recurring nature and the long-standing period of these audit qualifications (six times on several issues) indicate deeply embedded governance and financial control issues.

Follow Dolly Khanna’s Decision?

While we have seen the positives and the red flags for Coffee Day Enterprises, whether to follow Dolly Khanna in buying this stock is still a personal decision. The company has shown some good turnaround under Malavika Siddhartha Hegde’s leadership, but not without financial and governance issues.

Operating and Net Profits, Sales and other financial metrics for the last decade have shown that the company can deliver results that can grab investor attention, but due to the circumstances it has seen the last few years, the trust of investors is shaken.

At such a time, a stake by an investor like Dolly Khanna raises some valid questions. How the stock and its performance work for Khanna and its ither investors will be a great ride to watch. Add this stock to your watchlist now and keep an eye on it.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, he was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.