By Suhel Khan

As Foreign Institutional Investors (FII’s) continue their selling spree, which has been going on for quite a few months now, investors are getting more worried about their movements. No one knows the exact reason for the ongoing exodus, but every investor is trying to save their nest egg from the wrath of stock market movements that the FII selling could cause.

Recently, two of India’s leading banks probably fell out of favour for the FII’s. The FII holding in these banks have seen a decline of as high as 10%, which is a big drop.

And this has happened in an environment where a lot of analysts and money managers believe that banks may be worth a look as a lucrative investment opportunity.

Which makes knowing about these sell offs a must.

Here are the banks that have seen a sharp decline in FII Holdings.

#1 IndusInd Bank Ltd (IBL)

IBL is the 5th largest private sector bank in India, serving over 40M customers nationwide. It is also India’s 2nd largest microfinance lender, operating through its subsidiary Bharat Financial Inclusion Limited (BFIL), serving over 13M customers.

With a current market cap of Rs 78,562 cr, the Bank is publicly held and provides a wide range of banking products and financial services to corporate and retail clients besides undertaking treasury operations.

If we look at the FII holding for the company for the last year, here is how it looks:

| FII Holding Pattern | Dec-23 | Mar-24 | Jun-24 | Sep-24 | Dec-24 |

| 42.47% | 40.25% | 38.4% | 34.11% | 27.74% |

As you can see, the FII holing in the bank has been steadily on the decline for the last year. Between the quarter ending December 2023 and the one ending December 2024, the FII holding dropped by about 35% in just one year.

As per the exchange filings made for the quarter ending December 2024, Route One Offshore Master Fund holds 1.78%, down from 2.3% from the previous quarter.

Bridge India Fund also reduced its holding from 2.47% to 2.14% between September 2024 and December 2024.

Here is something that could be the reason behind the sell off.

If we look at the financing profits, the bank recorded losses of Rs 438 cr in FY19. And in FY24, the bank recorded a financing profit of Rs 3,046 cr. In plain absolute terms, that’s a jump of almost a staggering 800% in 5 years.

But if you look at the last two quarters, the bank has reported financing losses of Rs 405 cr in September 2024 and Rs 498 cr in December 2024.

The revenues in the last 5 years grew from Rs 22,261 cr in FY19 to Rs 45,748 cr in last 5 years. That’s a compounded growth of 16%

The Net profits also grew from Rs 3,301 cr inn FY19 to Rs 8,977 in FY24, which makes it a compounded growth of 22%.

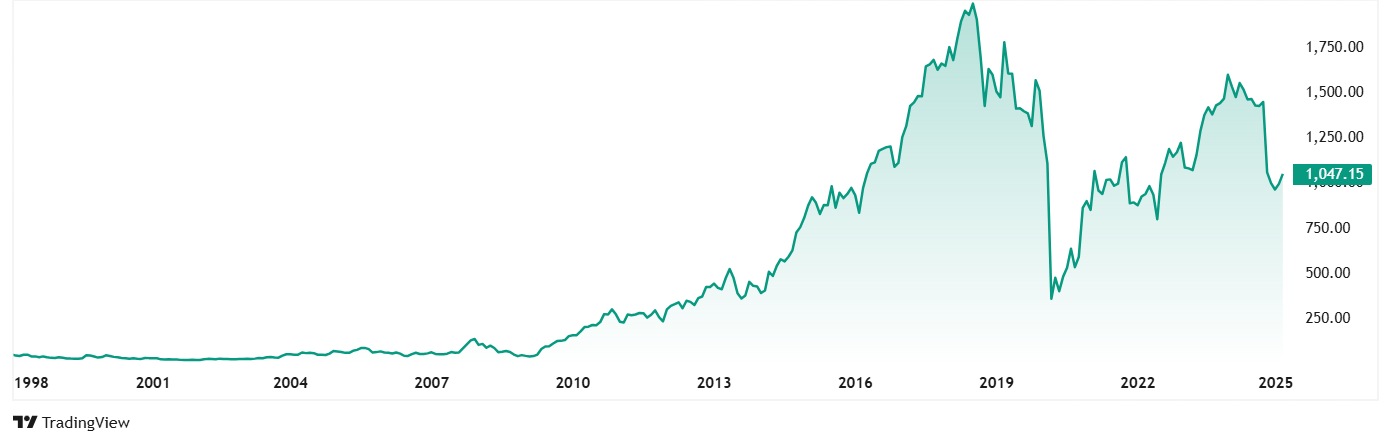

The stock prices were around Rs 1,210 in Feb 2020 to its current price of Rs 1,048 (as on 4th February 2025). This could be attributed to the fall in financing profits and the steady FII holding decline.

If you look at the valuations, the bank has a current PE of 11.3x while the industry average is 10.9x. The 10-year median PE for the bank 23x while the industry median for the same period is 15x.

The Price to Book Value (PBV) of the Bank is 1.3x, which is the same as the industry median valuation.

The banks NIM (Net Interest Margin) were down from 4.08% for the quarter ending September 2024 to 3.93% as of the quarter ending December 2024.

The NII (Net Interest Income) also fell from fell from Rs 5,347 cr to Rs 5,228 cr between the same two quarters.

The Net NPA (Non-Performing Assets) went up from Rs 7,639 cr to Rs 8,375 cr at the end of the December quarter, which is a 10% jump.

The bank is however still having one of the highest Dividend yields at 1.60% in comparison to industry peers.

#2 Axis bank Ltd (ABL)

ABL is the 3rd largest private sector bank in India and the 4th largest issuer of credit cards. The bank boasted of almost a 20% market share in FY24.

With a current market cap of Rs 3,08,917 cr, retail loans account for 60% of bank’s loan book and corporate 29% & SME loans 11%.

Here is how the FII holding in the bank looks like for the last year.

| FII Holding Pattern | Dec-23 | Mar-24 | Jun-24 | Sep-24 | Dec-24 |

| 54.68% | 53.84% | 53.43% | 51.78% | 47.32% |

Like the case of IndusInd bank above, the FII holding for Axis Bank Ltd also has been seeing a steady decline. Between the quarter ending December 2023 and the one ending December 2024, the FII holding dropped by almost 14% in just one year.

As per the exchange filings made for the quarter ending December 2024, Dodge and Cox International Stock Fund, Government of Singapore and Government Pension Fund Global have all reduced their stakes in the bank between the quarters ending September 2024 and December 2024 respectively.

The case here is not much different from the one of IndusInd Bank above.

In terms of financing profits, the bank recorded losses of Rs 5,860 cr in FY19 which turned into a profit of Rs 11,336 cr in FY24.

The revenues in the last 5 years grew from Rs 56, 044 cr in FY19 to Rs 112,759 cr in last 5 years. That’s a compounded growth of 15%

The Net profits also grew from Rs 5,047 cr inn FY19 to Rs 26,492 in FY24, which makes it a compounded growth of 39%.

The stock prices were around Rs 705 in Feb 2020 and as of market close for the 4th of February 2025, the price was Rs 998, which is a jump of 42% in 5 years.

The banks share is currently trading at a PE of 11x which matches the industry average of 11x. The 10-year median PE for the bank 10x which once again matches the industry medina for the same period.

When it comes to the Price to Book Value (PBV) of the Bank, it is at 2.0x. This is at a premium to the industry median valuation of 1.3x.

The banks NIM (Net Interest Margin) were down from 3.99% for the quarter ending September 2024 to 3.93% as of the quarter ending December 2024.

The NII (Net Interest Income) grew from Rs 13,483 cr in the previous quarter to Rs 13,606 cr as of the quarter ending December 2024 making it a 1% growth.

The Net NPA (Non-Performing Assets) saw a flat tend it moved from 0.34% to 0.35% between the quarter ending September 2024 and the one ending December 2024.

To Bank or Not to Bank!

FII holdings in IndusInd Bank and Axis Bank have seen a notable decline in the past year, despite their strong growth in revenues and profits. Key investors like Route One Offshore Master Fund and Dodge & Cox International Stock Fund have reduced their stakes, likely due to challenges in financing profits, rising NPAs, and shrinking interest margins.

However, both banks maintain strong fundamentals – Axis Bank’s stock has gained 41.56% over five years, while IndusInd Bank offers one of the sector’s highest dividend yields. For retail investors, while this FII exodus warrants attention, it could present buying opportunities if the banks successfully address their operational challenges.

The next few quarters will be crucial in determining if these banks can regain foreign institutional investor confidence. In the meanwhile, adding these stocks to your watchlist would not be such a bad idea.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.