Lemon Tree Hotels, once an affordable hotel brand, has transformed into a diversified player, targeting customers across economic to high-end segments. It is betting big on its premium brand, with a strong focus on asset-light expansion and non-room revenue, to drive future growth.

However, one of its key premium assets, on which it is betting big, is facing operational inefficiencies. Consequently, Lemon Tree stock has underperformed the industry, especially Indian hotels, with its valuation discount widening to over 40% from 20% earlier.

Nevertheless, the company has an aggressive expansion pipeline, with plans to scale up premium properties and improve operational efficiency. These initiatives are expected to drive growth.

With strong growth in India’s tourism sector, premiumisation, and rising per capita income, is Lemon Tree’s underperformance a temporary hurdle, or is it well-positioned for a strong comeback? We have explained this in this story.

Broad portfolio across multiple price points

Lemon Tree Hotels is the market leader in the mid-scale and economy segment, with ~10,000 operational rooms across multiple brands.

The company has a strong presence in tier-1 cities, which account for 66% of its inventory across NCR, Mumbai, Pune, Hyderabad, and Bengaluru. These are strong markets with high disposable income and high room rates, accounting for around 73% of the company’s total room revenue.

The company operates seven brands: Aurika Hotels & Resorts, Lemon Tree Premier, Lemon Tree Hotels, Red Fox, and three brands under Keys brand: Keys Select, Keys, Keys Lite, and Keys Prima.

Aurika operates in the upscale segment, Lemon Tree Premier and Keys Prima in the upper-mid-scale segment, Lemon Tree Hotels and Keys Select in the mid-scale segment, and Red Fox and Keys Lite in the economy segment.

According to Axis Capital, its market share is 15% in the mid-scale and economy segments, which is expected to increase to 16% by FY27E, as per Horwarth. It also has an 8% share in the upper-mid-scale segment.

Focus on asset-light expansion through managed hotels

The company operates on two business strategies: capital-light (managed) and capital-heavy (owned).

Over the last few years, the capital-light business model has become the go-to strategy for the hotel industry due to its operational benefits.

In this model, Lemon Tree manages properties rather than owning them and earns management fees (a fixed share of gross income) for handling these assets. Moreover, it also earns an incentive fee based on the hotel’s operating profit.

This model has high operating leverage as it generates revenue without operational costs. Increasing the number of rooms managed enhances revenue and boosts the bottom line significantly.

On the other hand, in the capital-heavy model, Lemon Tree builds and operates its hotels independently. This model is heavier on the balance sheet since hotel construction requires heavy investments and has a long payback period.

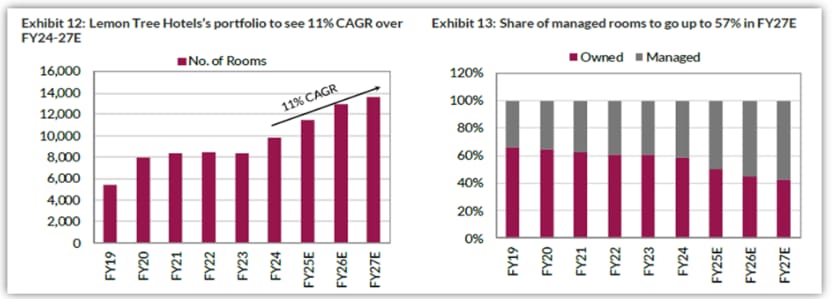

It has followed an asset-light strategy for the last five years, as its number of owned rooms increased at a 10% CAGR during 2019-24. On the other hand, the portfolio of managed rooms witnessed a 17% CAGR. As a result, the ratio of owned and managed rooms decreased from 65:35 in FY19 to 58:42 in FY24.

Share of managed room to increase as hotel portfolio increases

Source: Axis Capital (2024)

Even going ahead, the company is looking to expand through managed rooms, which are expected to grow at a 24% CAGR while the owned rooms pipeline is minimal.

Consequently, according to the company, the ratio of owned to managed rooms is expected to reduce further to 30:70 by FY28. As the portfolio’s share of more managed rooms increases, Lemon Tree’s revenue, profitability, and margins will increase due to operating leverage.

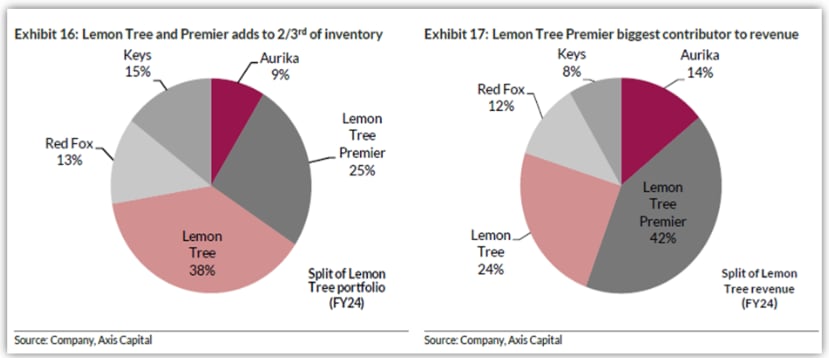

Lemon Tree and Lemon Tree Premier lead revenue growth

Lemon Tree and Lemon Tree Premier are the company’s flagship brands, contributing 63% of its total inventory. Lemon Tree Premier contributes 42% to its revenue, followed by Lemon Tree at 24%, Aurika at 14%, Red Fox at 12%, and Keys Brand at 8%.

Lemon Tree (including Premier) generates 66% of its total revenue

Source: Axis Capital (2024)

Lemon Tree brands contribute 66% cumulatively to the company’s top line and will continue to be the primary revenue driver. The focus is on expanding this brand and keys. Lemon Tree would represent 60% of the incremental room addition, with Lemon Tree Premier adding 479.

However, its more significant plays are with its new asset, Aurika, and the Keys brand. Aurika will add 311 rooms, and Keys will add 700 rooms.

Thus, cumulatively, Lemon Tree’s total number of rooms is projected to increase by over 11% compounded annual rate growth (CAGR) to 20,000 by 2028. Managed and franchised rooms would constitute 15,000+ rooms, constituting 70% of the total inventory.

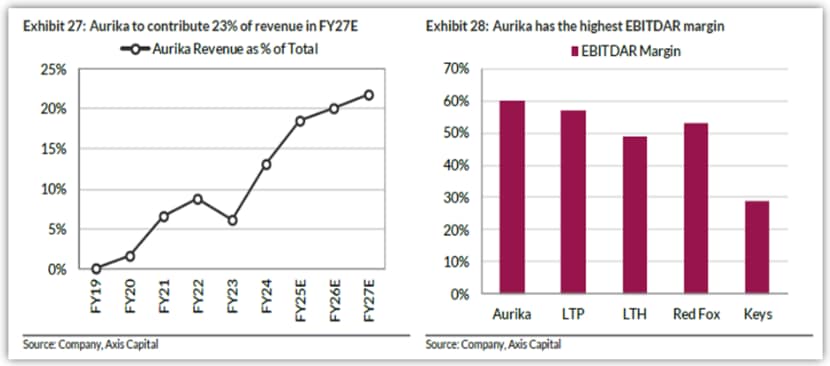

Aurika’s brand expansion plays a crucial role in future growth

Aurika Hotels and Resorts is the upscale brand of Lemon Tree Hotels, which started operations in 2019 with hotels in Coorg and Udaipur. It has another opened hotel at Mumbai airport since October 2023.

Aurika generates the highest (60%) margin

Source: Axis Capital (2024)

Currently, Aurika contributes 14% to the company’s total revenue. Moreover, despite the low occupancy rate of 53%, it generates a higher EBITDA margin of 60%—the highest for any brand in Lemon Tree’s portfolio. Lemon Tree’s other hotels earn a margin between 30% and 55%.

This makes Aurika crucial to Lemon Tree’s future growth. This asset has enormous potential, and Lemon Tree is betting on this brand for growth, but it is currently unstable.

The first reason is Aurika’s low occupancy rate, which is significantly low compared to other brands under the Lemon Tree umbrella. The occupancy rate at Aurika stands at 53%, lower than other brands that record 56-79%, dragging the overall occupancy levels of the company.

According to Axis Capita, the other issue is increasing competition, as 2,000 rooms will go live near the same locality in the next 12 months. Thus, it may face pricing pressure, which could limit its average room rent (ARR) to about Rs 10,000.

Notably, Aurika’s average daily rate decreased 27% to ₹10,643 in FY24. In the December quarter, it remained stagnant at Rs 10,457. Moreover, its revenue per available room rent stood at Rs 6,984 in Q4FY24, which has increased to Rs 7,442 in the recent quarter. It was up 66% over the corresponding quarter last year.

Nevertheless, Axis says Aurika’s occupancy rates could improve to 60% by FY27. Even with a stable ARR, this will boost Lemon Tree’s growth and be a key revenue driver. It is expected to contribute 23% to Lemon Tree’s revenue by FY27.

Furthermore, hotels under the Keys brand are being renovated and are expected to be completed by FY26. Key has an occupancy rate of around 56% and generates an ARR of around Rs 4,000. While this will not help improve Lemon’s ARR, it can play a key role in revenue growth once operations resume.

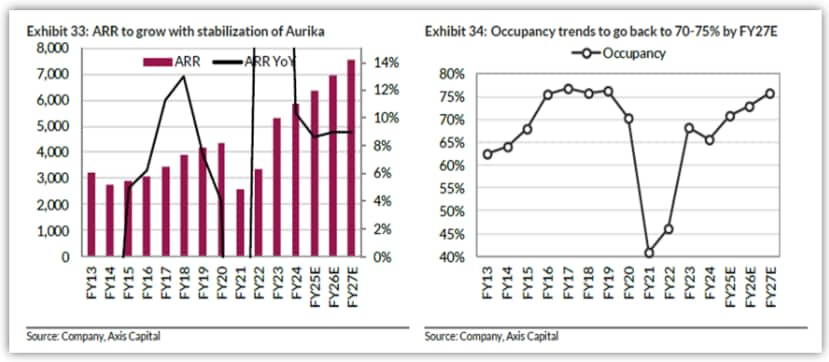

Aurika holds the key to drive average room rate and EBITDA margin

Lemon Tree’s ARR grew at an industry-leading rate of 8% CAGR between FY16-24, from about Rs 3,000 to Rs 6,000, against industry growth of 2% and ~3% for Indian Hotels, driven by a higher occupancy ratio of 75%.

This growth was driven by the portfolio shift towards premium brands such as Lemon Tree Premium, which generate higher ARR than economical brands. However, unlike its competitors, Lemon Tree’s occupancy is still below the pre-pandemic 75% mark.

Aurika operational efficiency will boost Lemon Tree to pre-pandemic levels

Source: Axis Capital (2024)

This is due to low occupancy at its new hotel Addition, especially at Aurika. Thus, increasing Aurika’s occupancy is key to boosting Lemon Tree’s ARR, which is expected to grow at a 9% CAGR till FY27

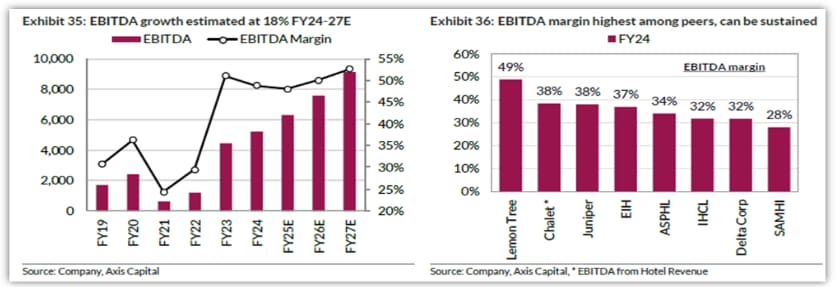

Lemon Tree leads with highest margin among peers

Source: Axis Capital (2024)

Not only this, but the higher margins Aurika offers will substantially boost Lemon Tree’s margins (49%), which are the highest in the industry. However, the possibility of margins going much higher is less as its margins are already high.

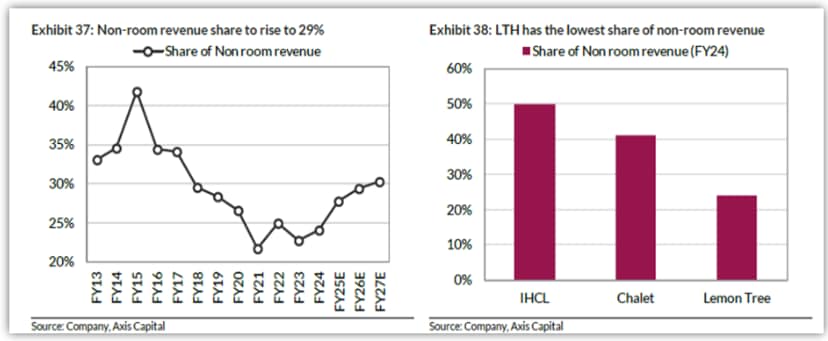

Non-room revenue expected to see strong growth

Lemon Tree’s non-room revenue contributes only 24% to its total revenue, much lower than 50% for Indian Hotels and 41% for Chalet Hotels. This is due to the higher share of mid-scale hotels in Lemon Tree’s portfolio, which lacks diverse F&B offerings and premium services.

Lemon Tree lags peers in non-room revenue

Source: Axis Capital (2024)

This could change going forward as the share of premium hotels (like Aurika and Keys Prime) increases. An increase in revenue from management contracts will further support this. As a result, management expects the non-room revenue share to rise to 30% by FY27E, making it a significant revenue and profitability driver.

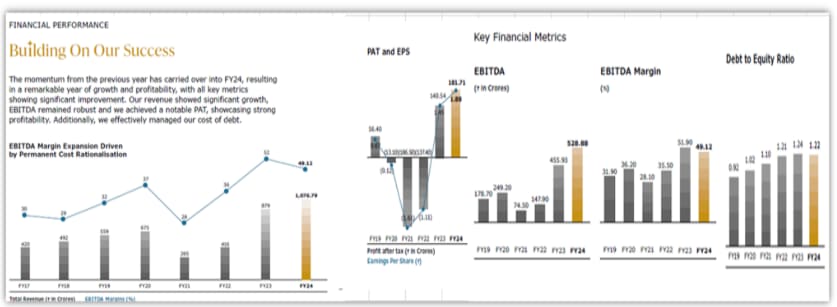

Financials to improve as growth kicks in

The company believes Aurika will help it generate enough cash flow from internal accruals to fund its expansion plan. The company’s debt peaked in FY24, with the Debt-to-equity (D/E) level at 1.22, as most capital deployment has been done.

The company’s average cost of borrowing is 8.8%, contributing to finance costs of ₹2.1 billion in FY24 (14% higher than last year) on revenue of ₹10.1 billion (22% higher).

Its profit grew 29% to ₹1.8 billion (29% higher). Notably, The company turned profitable in FY23 after having experienced losses since FY20.

Lemon Tree turned profitable in FY23, driven by strong demand

Source: Lemon Tree 2024 Annual Report

Thus, reducing debt levels, which are expected to come down to zero by 2028, will help it save finance costs. The company’s focus on increasing the share of hotels under management contracts will help it deleverage.

Along with the ongoing expansion, this is expected to lead to strong growth in Lemon Tree’s revenue and profitability. Improving operational metrics and profit growth will help improve return on equity (ROE) from 15% to 20%.

The company also aims to have a return on capital employed of 20% by 2028 (from 12.3% in FY24), driving a higher share of management contracts and reducing the need for capital investment.

Lemon Tree trades at an EV/EBITDA multiple of 20x, 40% lower than its 5-year median EV/EBITDA multiple of 27x. Relatively, it trades at a 46% discount to Indian Hotels’ multiple of 37x and a 13% discount to Chalet Hotels’ valuation of 23x.

Nonetheless, Axis Capital believes Aurika will see improvement starting in FY26, and until then, the stock can remain an underperformer. ICICI Securities expects Lemon Tree’s share price to trade at ₹173 per share, about 40% higher than the current market price on 23x Dec’26 EV/EBITDA basis.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Madhvendra has been following the equity markets for over seven years, turning his passion for investing into insightful financial writing that simplifies complex market trends. He enjoys offering honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, he brings fresh narratives that make finance more accessible and engaging.

You can connect with Madhvendra on LinkedIn to explore his insights more and engage in meaningful discussions.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.